All New Goods and Service Tax (GST) Reforms

Contents

What is GST

From when is this effective

Who will be impacted / exempt

Why Streamline-

What is the need?

What are the benefits

How will the same be streamlined

How will it impact sectors and Govt revenues

Benefits to the economy

Industry specific benefits / demerits

Stakeholders/ consumers benefits / demerits

How GST fits in the Big Picture

What is GST

Goods and Service Tax is a comprehensive tax levy on manufacture ,sale and consumption of goods and service at a national level under which no distinction is made between goods and services for levying of tax. It will mostly substitute all indirect taxes levied on goods and services by the Central Govt of India.

GST is a tax on goods & services under which every person is liable to pay tax on his output and is entitled to get input tax credit ( ITC ) on tax paid on its input . ( a tax on value addition only ) and ultimately the final consumer shall bear the tax.

France was the first country to introduce GST in 1954. Worldwide , thereafter , almost 150 countries have introduced GST after that.

Indirect taxes in India have driven businesses to restructure and model their supply chain and systems owing to multiplicity of taxes and costs involved. Once GST will see the light of the day, the way India does business will change, forever.

GST will convert the country into unified market, replacing most indirect taxes with one tax. It would have a dual structure – a Central component levied and collected by the Centre and a state component administered by states.

At the Central level, it will subsume Central excise duty, service tax and additional customs duties while at the state level it will include value-added tax, entertainment tax, luxury tax, lottery taxes and electricity duty. Central sales tax (CST) will be completely phased out. Entry tax or octroi would be subsumed from the start. But state taxes on petroleum products will continue for a few years after GST is introduced, as per the deal brokered between the Centre and states on Monday. State taxes on alcohol and tobacco, too, would remain.

As with VAT, the tax will be charged on each stage of value addition. At each stage, a supplier can off-set the levy through a tax credit mechanism. This means, the consumer pays GST added on by only the last dealer in the supply chain.

Salient Features of GST

(i) The GST would be applicable on the supply of goods or services as against the present concept of tax on the manufacture and sale of goods or provision of services. It would be a destination based consumption tax.

(ii) It would be a dual GST with the Centre and States simultaneously levying it on a common tax base. The GST to be levied by the Centre on intra- State supply of goods and / or services would be called Central GST (CGST) and that to be levied by the States would be called State GST

(iii) The GST would apply to all goods other than alcoholic liquor for human consumption and five petroleum products, viz. petroleum crude, motor spirit (petrol), high speed diesel, natural gas and aviation turbine fuel. It would apply to all services barring a few to be specified.

(iv) Tobacco and tobacco products would be subject to GST. In addition, the Centre could levy Central Excise duty on these products.

(v) The GST would replace the following taxes currently levied and collected by the Centre:

- Central Excise duty

- Duties of Excise (Medicinal and Toilet Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

(vi) State taxes that would be subsumed under the GST are:

a . State VAT

- Central Sales Tax

- Luxury Tax

- Entry Tax in lieu of octroi

- Entertainment Tax (not levied by the local bodies)

- Taxes on advertisements

- Purchase Tax

- Taxes on lotteries, betting and gambling

- State cesses and surcharges insofar as they relate to supply of goods and services

(vii) An Integrated GST (IGST) would be levied and collected by the Centre on inter-State supply of goods and services. Accounts would be settled periodically between the Centre and the States to ensure that the SGST portion of IGST is transferred to the destination State where the goods or services are eventually consumed.

(viii) Tax payers shall be allowed to take credit of taxes paid on inputs (input tax credit) and utilize the same for payment of output tax.However, no input tax credit on account of CGST shall be utilized towards payment of SGST and vice versa. The credit of IGST would be permitted to be

utilized for payment of IGST, CGST and SGST in that order.

(ix) HSN (Harmonised System of Nomenclature) code shall be used for classifying the goods under the GST regime. Taxpayers whose turnover is above Rs. 1.5 crores but below Rs. 5 crores shall use 2 digit code and the taxpayers whose turnover isRs. 5 crores and above shall use 4 digit code.

(x) Exports shall be treated as zero-rated supply. No tax is payable on export goods but credit of the input tax related to the supply shall be admissible to exporters.

(xi) Import of goods and services would be treated as inter-State supplies and would be subject to IGST in addition to the applicable customs duties.

(xii) The laws, regulations and procedures for levy and collection of CGST and SGST would be harmonized to the extent possible.

From when is this effective

The Model GST Act ,2016 is now available but final enactment will take time at center and state level , so April 1st 2017 is the more realistic date for GST implementation.

Who will be impacted / exempt

Besides simplifying the indirect tax structure, GST should also help to create ‘One India’ by eliminating geographical fragmentation. It will remove the current cascading of taxes by ensuring the seamless flow of input credit across the value chain of both goods and services,” suggests a report from Nomura.

Which sectors and companies will gain the most if GST gets implemented?

Morgan Stanley analysts say four of the ten sectors they have evaluated would benefit from GST implementation. Consumption (warehousing consolidation), logistics (more movement of heavy vehicles), house building materials (lower duties), and industrial manufacturing would likely experience a positive impact; oil & gas could see a negative impact, while cigarettes could see a negative impact only if overall tax incidence goes up, which may be a low-probability event. The remaining sectors would likely see a neutral impact.

Exemptions under GST are :

- Petroleum products2. Entertainment and amusement tax levied and collected by panchayat /municipality/district council3. Tax on alcohol/liquor consumption

4. Stamp duty, customs duty

5. Tax on consumption and sale of electricity

Source http://economictimes.indiatimes.com/markets/stocks/news/gst-will-change-the-way-india-does-business-who-will-win-who-will-lose/articleshow/53517955.cms

Why Streamline

Presently, the Constitution empowers the Central Government to levy excise duty on manufacturing and service tax on the supply of services. Further, it empowers the State Governments to levy sales tax or value added tax (VAT) on the sale of goods. This exclusive division of fiscal powers has led to a multiplicity of indirect taxes in the country. In addition, central sales tax (CST) is levied on inter-State sale of goods by the Central Government, but collected and retained by the exporting States. Further, many States levy an entry tax on the entry of goods in local areas.

This multiplicity of taxes at the State and Central levels has resulted in a complex indirect tax structure in the country that is ridden with hidden costs for the trade and industry. Firstly, there is no uniformity of tax rates and structure across States. Secondly, there is cascading of taxes due to ‘tax on tax’. No credit of excise duty and service tax paid at the stage of manufacture is available to the traders while paying the State level sales tax or VAT, and vice-versa. Further, no credit of State taxes paid in one State can be availed in other States. Hence, the prices of goods and services get artificially inflated to the extent of this ‘tax on tax’.

There is lot of streamlining and simplicity: imports and inter-state movement of goods or services will be subject to IGST (integrated GST), while all local “supplies” will suffer CGST (central GST) + SGST (state GST) or IGST (which is effectively the total of CGST and SGST). All of these are subject to only minimal exemptions.

Imports of goods will remain chargeable to BCD as before.

When selling goods or services, our manufacturer would also charge IGST, or CGST + SGST.

Therefore, VAT, CST, entry tax, central excise duty, service tax, CVD, SAD, and various other cesses are all going to be subsumed within the folds of GST.

How will it impact sectors and Govt revenues

Under the proposed GST, effective tax rate on goods (comprising around 70-75 per cent of the CPI basket) will decline.

A significant proportion (35-40 per cent) of goods (majorly agriculture products) are not subject to tax and we expect a status quo in future.

At present, services-oriented components constitute ~25-30 per cent of the CPI basket with a major share belonging to housing, transport and communication sector . Service tax is not imposed on certain ( 12 per cent of the CPI basket) services and these services are expected remain exempt under GST regime. A hike in tax rate on services is unlikely to have any material direct impact on CPI.

Thus, the overall transition to GST will not have a significant impact on inflation

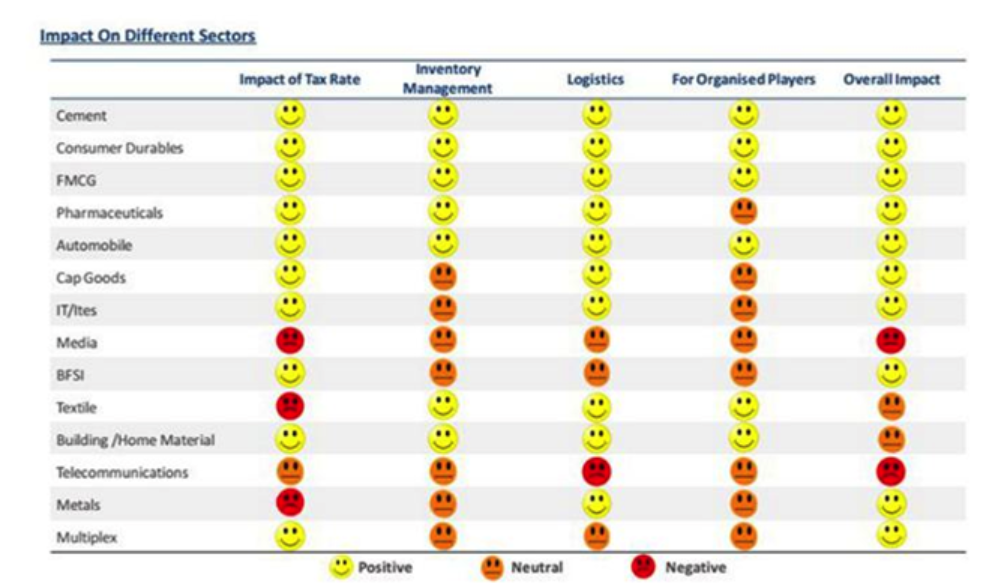

Sector wise impact of GST:-

Automobiles: The effective tax rate in the sector currently ranges between 30 per cent and 47 per cent.

Highlights:-

► On implementation of GST the tax rate is expected to oscillate between 20-22 per cent.

► It is expected to drive overall demand and reduce cost for the end user by about 10 per cent.

► The transportation time and the overall cost will be reduced as the goods will be transferred from one state to another by easily surpassing various octroi and check points.

► In addition to this, the cost for the logistics and supply chain inventory will be curtailed by almost 30-40 per cent.

Impact: In a long run, GST is expected to remain positive for automobile sector.

Consumer durables : The current tax rate for the sector ranges between 7 per cent and 30 per cent.

Highlights:-

► The implementation of GST will essentially benefit companies, which have not availed tax exemptions in the past.

► It will lead to the reduction of the price gap between the organised and unorganised sector.

► The warehouse/logistics costs across the operational and non-operational segments will be curtailed. This will improve the operational profitability by almost 300-400 bps.

► The 7th Pay Commission is also expected to boost demand and fund inflow in the consumer durables sector by the end of the year.

Impact: The impact may remain neutral or negative, specifically for companies which either enjoy tax exemptions or fall under the concessional tax bracket.

FMCG

Impact: The impact may remain neutral or negative, specifically for companies which either enjoy tax exemptions or fall under the concessional tax bracket.

Furnishing and home decor

Impact: Currently, the effective tax rate for the sector ranges above 20 per cent.

Highlights:-

► After the implementation of GST, paints and other construction chemicals companies will benefit from lower tax rate.

► At present, the market share for the organised sector is about 65-70 per cent. Effective tax correction practices under the GST regime will ensure that the price difference amongst the unorganised sector and the organised sector is narrowed. This will improve opportunities for the organised sector.

► The overall cost and competitiveness in products such as like ceramic tiles, faucets, sanitary ware and plywood & laminates manufacturer will be curbed.

Impact: – Implementation of GST is expected to bring the unorganised sector under a uniform tax base and improve growth opportunities for the organise ..

Logistics

Highlights: The implementation of GST will lead to lower transit time and thereby generate higher truck utilisation.

This will boost demand for high tonnage trucks and lead to overall reduction in transportation costs.

It will facilitate seamless inter-state flow of goods, which is expected to directly accelerate demand for logistics services.

IMPACT : The logistics sector is largely fragmented and comprises many unorganized players. Several players in the unorganised sector avoid tax which generates a cost gap between them and the organized players.

With the GST coming into picture, we expect an overall positive impact, with a reduction in the cost competitiveness as all the players will be brought under a uniform tax base, thereby improving growth opportunities for the organized players.

Cement

Currently, the tax on cement ranges between 27 per cent and 32 per cent.

Highlights:-

► The tax rate for the cement sector is expected to decline to 18-20 per cent under the GST regime.

► This is expected to lead to savings in the transportation cost, which currently comprises up to 20-25 per cent of total revenue.

► Thereby, overall realisations of cement companies will substantially improve post GST rollout.

Impact: The impact of GST will be positive, as the companies will also be able to save on their logistic costs, due to rationalisation of warehouses and lower transportation costs (due to decline transit time).

Entertainment

We have divided in two main categories i.e. Multiplexes and Media. We expect a significant impact on both the sectors after implementation of GST.

Multiplexes: This category attracts different taxes such as service tax, entertainment tax and VAT among others. Currently, the effective tax ranges between 22-24 per cent.

Highlights:

► It is expected GST tax rate will trickle down to 18-20% ..

► Reduction in taxes will lead to an increase in average ticket price (ATP) and higher revenue.

► There exist several challenges pertaining to:

► Availability of limited credit for service tax paid on lease rentals, maintenance cost, advertisements, security charges.

► No credit is available on the taxes paid on capital expenditure.

► The VAT credit on available on the purchase of F&B can be offset against VAT liability on F&B sales.

► Entertainment tax rate on box office collections ranges between 22-24 per cent and the same is not cenvatable against any input taxes.

These will be addressed after the implementation of GST.

Impact: The overall impact is expected to be positive and the Ebitda margins of the players are expected to increase by 250-350 bps.

Textiles/garments

The effective tax rate for the sector currently ranges between 6-7 per cent

Highlights:-

► Under the GST regime, there is no clarity whether a lower rate will continue for the readymade garments.

► Companies may be negatively impacted in case the output tax rate is high.

► Going forward, several export companies may also avail duty drawback benefits. Though we await more clarity on the impact of these benefits.

Pharma

Currently, the sector enjoys various location-based tax incentives. The effective tax rate (excise duty) for most companies is much below the statutory tax rate (6 per cent).

Highlights:-

► The concessional tax bracket for the sector is expected to continue.

► The existing tax exemptions will continue until expiry of the tax exemption period. Going forward it will be difficult to bring forth the new exemptions.

► GST is also expected to address inverted duty structure and lower logistic costs for the sector.

Impact: It is expected remain neutral for the pharmaceutical sector.

IT & ITeS

Currently, the IT industry is subject to an effective tax rate of 14 per cent.

Highlights:-

► The tax rate under GST is expected to increase to 18-20 per cent.

► The industry earns a large part of its revenue from exports, which will continue to be exempt under GST.

► Litigation around taxability of canned software will probably end under GST regime as there will be no distinction between goods and services.

Impact: It is expected to range from being neutral to slightly negative.

Telecom

Currently, telecommunication services are subject to service tax of 14 per cent.

Highlights:-

► The tax rate is expected to increase to 18 per cent under GST.

► It is expected that the telecom companies may pass the increased tax burden on postpaid subscribers.

► Availability of input tax credit will lower the sector’s capex cost.

Impact: Increase in effective tax rate may be marginally negative for the sector. The telecommunication companies may not be able to pass on all the increase in taxes to all the end consumers, especially the ones in the lower prepaid sections.

Metal

Currently, the effective tax rate for base metal products is 19-21 per cent:

► VAT ranges from 4-5% depending on the state

► Excise 12.5%, CST 2% and entry taxes in respective states.

Impact: Under GST, it is not known whether metal products will attract a special rate that is lower than the standard GST rate.

Banking and financial services

Currently the effective tax rate is 14 per cent, which is levied only on fee component (and not interest) of the transaction.

Highlights:-

► Under GST, effective tax rate on fee-based transactions is expected to increase to 18-20%.

► As the taxes on the input services will increase, operating expenses (comprising of rent, legal & professional fee, advertisement, insurance, telecommunication and other expenses) will also increase marginally.

Impact: With the implementation of GST a moderate increase in the cost of financial services such as loan processing fees, debit/credit card charges, insurance premiums, etc. is expected.

How GST fits in the Big Picture

So why is the market so fascinated about the GST? Will it really be a game changer? More importantly, how will it impact listed companies?

Morgan Stanley has come out with an explainer stating that implementation of GST will be one of the most significant reforms affecting all factors of production and economics. The implementation of a unified GST in India is viewed as one of the most far-reaching indirect tax reforms that the country will see, says Morgan Stanley.

Broking firm Nomura points explains that currently under the constitution, while the Union government is constrained from levying taxes on goods beyond the point of manufacturing, state governments cannot levy taxes on services. Thus, to simplify and unify the current indirect tax structure, an amendment to the current constitution is needed. The implementation of a unified and simplified GST through constitutional amendment could overhaul the current indirect tax system of India.

GST is a consumption tax that is collected on sale of manufactured goods and services. Since it is a consumption tax it is passed on until the last stage, wherein the customer bears the tax, just like excise duty is imposed currently.

What makes GST an important tax reform is it simplifies the tax structure, increases tax compliance, increases government revenue and integrates states. Morgan Stanley says that the current taxation system creates borders within borders in the country, as the system is unable to provide tax credits for interstate transactions, and this leads to distortions in the allocation of resources. In this context, one of the most important benefits of implementing the GST is that it would integrate the economy and provide for a common national market. Corporate sectors’ decisions to set up production operations would be influenced not by tax benefits but on core business efficiency.

What will be the impact of GST on the economy? Analysts say that after an initial increase in inflation, which will be transitory in nature, growth should kick in. Broking firm Nomura estimates that the GST would drive up headline CPI inflation by 20-70 basis points in the first year due to higher prices of electricity, clothing & footwear, health/medicine, and education after accounting for input taxes and potential asymmetric pricing behaviour by firms where tax increases may be quickly passed on to output prices, while firms refrain from fully passing-on tax savings to consumers. However, in the long term, lower tax and logistic costs, productivity gains and higher investments under the GST should structurally reduce inflation.

Market is betting on growth that GST is expected to bring in. Morgan Stanley points out that the overall impact of better allocation of resources, improving efficiency of domestic production and exports is likely to improve overall growth.

As per estimates from the National Council of Applied Economic Research (NCAER), growth could increase by 0.9% to 1.7%.

What is the expectation of the GST rate to be :

India can also start with low GST rates. The lower rate would mean lesser incentive for tax evasion and encourage better compliance. It will also help widen the tax base. As the structure of GST envisages use of PAN number and linking with NSDL database, compliance for direct taxes will also enhance. Just like Malaysia, India’s GST revenue can surprise on the positive side as there are huge leakages in the system, especially at local octroi and tax collection machinery at state levels.

On the other hand, a high GST rate may arouse popular sentiment against it and compliance may not start on a good note.

Another important factor to watch will be GST’s impact on inflation. Low GST rates will not stoke inflation and will boost growth and employment. However, in the wake of such high decibel debate on government and RBI stance on rate cuts and inflation, any rise in inflation will be a huge deterrent for the new RBI governor to cut rates. Higher incidence on services may not get fully captured in the CPI- inflation index but will hurt a much larger part of the population, being provider or consumer of services.

The low rates will encourage many new enterprises to expand, put in new investments and attract new capacity at micro and small level. With India becoming one market, a lot of possibilities will open up for small as well as large enterprises. Entrepreneur’s investment is always driven by sentiment or expectation about future profit and not actual profits as actual profits are known only with hindsight long after the investment is made. A low GST rate will create positive sentiments all around and boost investments ..

India was never better placed to take the risk of some revenue loss in short term. The government is sitting on a huge bounty from lower oil prices of the last two years. Politically also, lower rates will be difficult to be opposed and will garner public support — so essential for any path-breaking reform.

The implementation of GST will bring huge long-term benefits to the country. It will help superior and more optimal resource allocation, increase competitiveness in domestic production and exports, reduce, simplify tax structure and enhance ease of doing business and boost GDP growth by anywhere between 80 to 150 bps. It is therefore very important that the process runs smoothly and does not fall prey to negative public sentiment.

A simple courageous call on keeping rates surprisingly low for instance 8% for essential, 16% standard and 32% for luxury items can be the real game-changer.

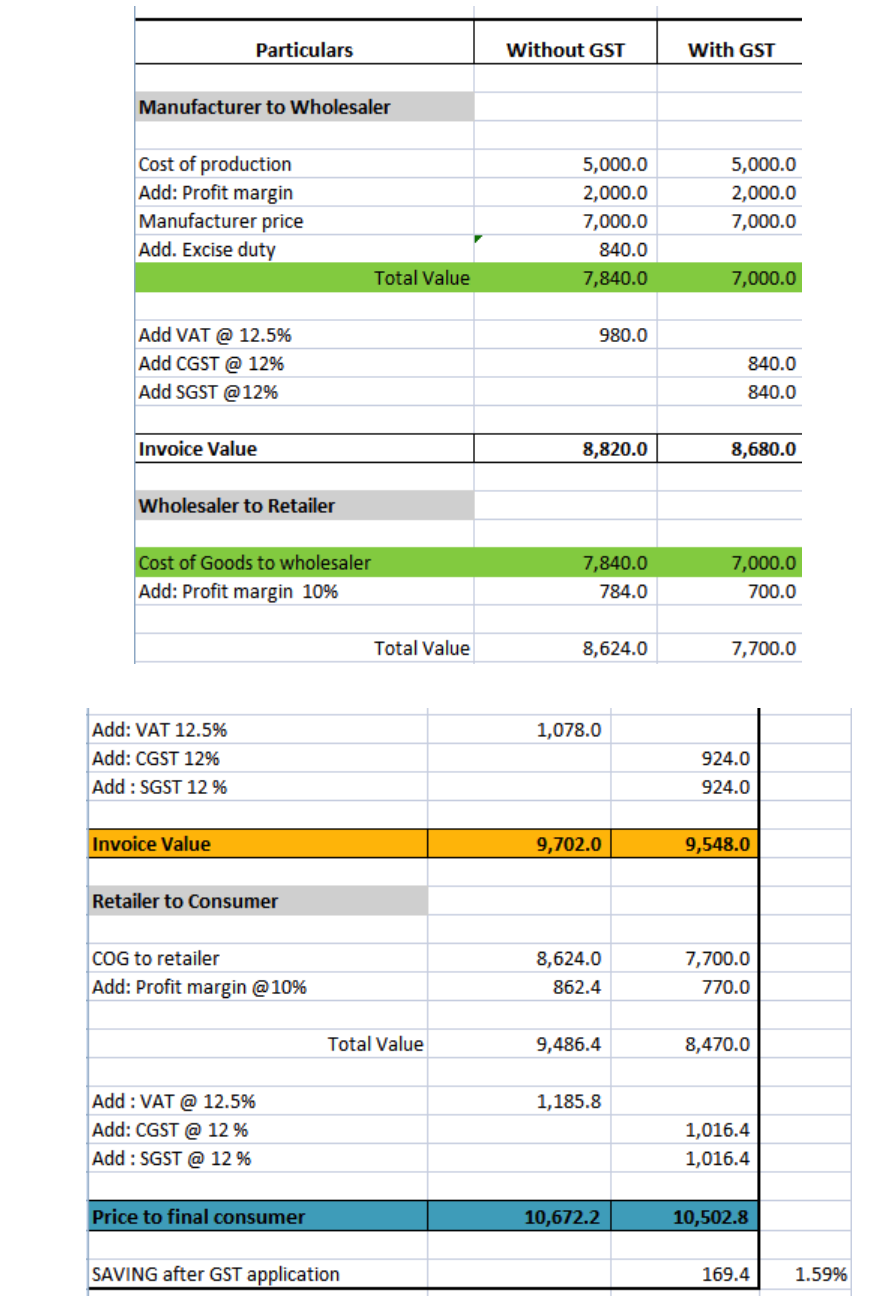

GST Example Highlighting the Streamline process at Manufacture, Wholesaler and Customer Level

Sneha Ramamurthy

Research Desk- Dilzer Consultants Pvt Ltd

http://economictimes.indiatimes.com/markets/stocks/news/gst-will-change-the-way-india-does-business-who-will-win-who-will-lose/articleshow/53517955.cms

http://www.gstindia.com/goods-and-service-tax-a-detailed-explanation-with-examples-2/

http://indianexpress.com/article/business/business-others/what-is-gst-295138/

http://www.business-standard.com/article/economy-policy/gst-bill-who-will-it-benefit-the-most-116080100301_1.html

http://economictimes.indiatimes.com/markets/expert-view/lower-than-expected-gst-rate-can-be-the-real-game-changer/articleshow/53704432.cms

22 August 2016