Budgeting to save better

Budgeting is the key towards building wealth. Budgets are more than just paying bills on time. It determines how much one should spend, and on what. By preventing from overspending on less important items, a budget helps to channel resources to areas that should be given priority.

How to Budget Your Money: The 50/20/30 Guideline – How does budgeting help one save more

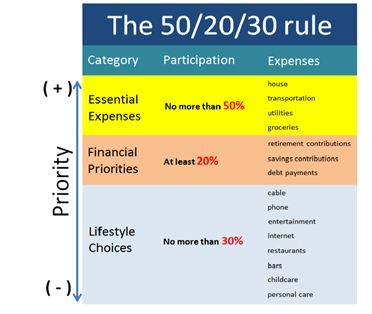

The 50/20/30 rule, also called the 50/30/20 budget, is one approach that can help a person to keep spending in alignment with the savings goals.

What is the 50-20-30 budget?

At its basic level, the 50-20-30 budget divides the after-tax, take-home pay into three buckets.

1. 50% OF INCOME – ESSENTIALS

Under this bucket, no more than half of the taxable income should be set aside for the absolute necessities or rather essential expenses in life. Essential expenses are those one certainly have to pay and include housing, food, transportation costs and utility bills. They also include minimum possible payments needed to pay debts eg. payments on car loan,credit cards, student loans etc.

Essential expenses are more about the total sum than individual costs. For instance, some people may live in high-rent areas near their work place, but may not have to commute to work. Many others may enjoy much lower housing costs, but transportation is far more expensive.

1. 20% OF INCOME – SAVINGS

The next step is to dedicate 20 percent of the take-home pay toward savings. This includes savings plans, extra debt payments (if one is trying to become debt-free) and rainy-day funds. This category of expenses should only be paid after the essentials (50 % of Income) are taken care of and before one thinks about the last category of personal spending ( remaining 30 % of Income).

While 50 percent (or less) of the income should be the goal for essentials as per this rule, 20 percent—or more should be the goal in this category of savings as far as obligations are concerned. One should pay off debt quicker and would make more significant strides towards savings by devoting more of the income towards this category. The advantage of starting early with savings by adhering to this strategy is that a person will earn compounding interest the longer he/she lets this fund grow.

2. 30% OF INCOME – PERSONAL

The 30% of the bucket is for lifestyle expenditure. The reason that this category accounts for a larger percentage than savings is because too many things come under it.

IT INCLUDES THINGS LIKE VACATIONS, ENTERTAINMENT, GYM FEES, HOBBIES, PETS, EATING OUT, CELL-PHONE PLANS, CABLE BILLS ETC. THIS IS THE CATEGORY WHICH CAN MAKE THE MOST DIFFERENCE IN THE BUDGET, GIVEN THAT IT IS COMPLETELY DISCRETIONARY AND CAN BE AVOIDED TO SOME EXTENT.

Similar to how no more than 50 percent of the income should go toward essential expenses, 30 percent is the maximum amount one should spend on personal choices as per this rule. The fewer costs in this category, the more progress a person should make towards paying off debts and make savings thus securing the future.

Is the 50/20/30 Rule the Best Way to Budget Money?

To sum it up, with this budgeting rule, one puts away 50% of money for necessities, 20% for long-term savings and debt payments, and 30% for lifestyle choices and non-necessities.

However, this plan provides a basic framework for one to work upon budgeting and need not be adhered to very strictly. Income and expenses, essentials, savings etc may vary across individual and financial circumstances. One should find out their own expense allocation to know where they stand and then use and tweak these basic guidelines for budgeting purpose.

The way in which we at Dilzer Suggest an allocation is First Save then spend. Therefore Out of total Net Income Set aside 33% towards Savings 33%towards Expenses and 33% or LEss towards Loan payments (only in required)

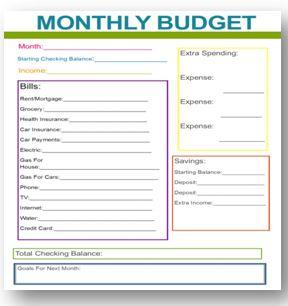

Steps towards a good budget

Writing it down

- Writing down the various sources of income which includes salary, rent, interest on deposits, dividends, etc.

- Making a list of expenses incurred in a month and allocate money to each of these heads. Expenses should include grocery bills , payment to maid, fuel expenses , EMI of the car, school fee or insurance premium (monthly figure).

- Flexibility in budgeting

The budgets for the household should be flexible. If one has money left over in one category, it should be used for expenses in categories where there is a shortfall. However the money earmarked for investing should not be used for such purposes. As a rule, this money should not be used for any other category except in case of an extreme emergency. This will ensure that overspending does not impact the financial goals.

Debalina Roy Chowdhury

Dilzer Consultants

Sources

https://www.doughroller.net/budgeting/is-the-50-20-30-budget-a-good-rule-of-thumb/

https://blog.mint.com/saving/the-minimalist-guide-to-budgeting-in-your-20s-072016/