FD vs FMP and MCLR Rates being offered by banks on loans and deposits

Agenda

– Changes in the banking industry and current scenario

– What is the impact on you ?

– What Investment options do regular investors have –

– Choice of FD Vs FMP ( bank wise rate descriptions )

– Choice of FMP ( MF schemes description )

– Tax implications

General trend of declining interest rates

– Future of your savings and market linked rates is the new theme

Changes in the banking industry and current scenario

From April this year, RBI has asked banks to move to the new marginal cost-based lending rate (MCLR). All new flexible rate or floating rate loans will get linked to MCLR, which is linked to actual deposit rates. Each bank has multiple MCLRs depending on the different tenures. The new methodology has come into effect from 1 April 2016 and is expected to curtail banks’ ability to hold on to higher base rates despite the RBI slashing rates.

How it works

So far, banks followed diverse methodologies for computing the minimum rate at which they could lend—the base rate. Now, the RBI has asked all banks to follow the marginal cost of funds method to arrive at their benchmark lending rate. MCLR will be calculated after factoring in banks’ marginal cost of funds (largely, the interest at which banks borrow money), return on equity (a measure of banks’ profitability), negative carry on account of cash reserve ratio.

How is MCLR calculated? (Components of MCLR calculation)

Let us first understand as to how banks make money or profit. The primary function of a bank is to lend money and to accept deposits from the public. The difference between advances and deposits is the income earned by the banks. So, how is the base rate or Standard Lending Rate calculated by the banks?

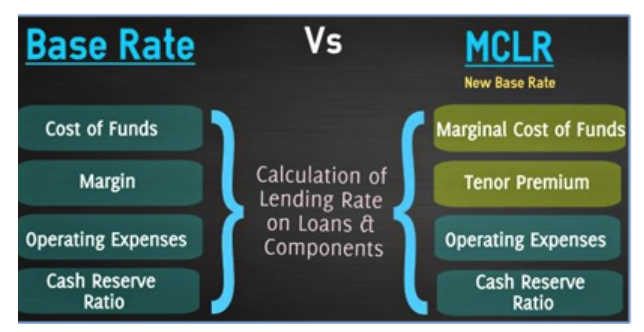

The main components of base rate system are;

- Cost of funds (interest rates offered by banks on deposits)

- Operating expenses to run the bank.

- Minimum Rate of return ie margin or profit

- Cost of maintaining CRR (Cash Reserve Ratio).

- As you can see, the banks do not consider ‘repo rate’ in their calculations. They primarily depend on the composition of CASA (Current accounts & Savings Accounts) and deposits to calculate the lending rate. Most of the banks are currently following average cost of fund calculation. So, any cut or increase in rates (especially key rate like Repo Rate) by the RBI is not getting transmitted to the bank customers immediately.

As per the RBI’s new guidelines, it is mandatory for the banks to consider the repo rate while calculating MCLR with effective from 1st April, 2016. The new method — Marginal Cost of funds based Lending Rate (MCLR) will replace the present base rate system.

The main components of MCLR calculation are:

- Operating Expenses

- Cost of maintaining CRR

- Marginal Cost of funds ( After considering interest rates offered on savings / current / term deposit accounts. Based on cost of borrowings i.e., short term borrowing rate which is repo rate & also on long-term borrowing rates).

- Return on Net-worth

- Tenor Premium (an additional slab of interest over the base rate, based on the loan tenure & commitments).

The main differences between the two calculations are i) marginal cost of funds & ii) tenor premium. The marginal cost of funds will have high weight-age while calculating MCLR. So, any change in key rates (increase or decrease) like repo rate brings changes in marginal cost of funds and hence the MCLR should also be changed by the banks immediately.

(In economics sense, marginal means the additional or changed situation. While calculating the lending rate, banks have to consider the changed cost conditions or the marginal cost conditions.)

RBI’s key guidelines on MCLR

All loans sanctioned and credit limits renewed w.e.f April 1, 2016 will be priced based on the Marginal Cost of Funds based Lending Rate.

- MCLR will be a tenor-based benchmark instead of a single rate. This allows banks to more efficiently price loans at different tenors based on different MCLRs, according to their funding composition and strategies.

- Banks have to review and publish their MCLR of different maturities every month on a pre-announced date.

- The final lending rates offered by the banks will be based on by adding the ‘spread’ to the MCLR rate.

- Banks may specify interest reset dates on their floating rate loans. They will have the option to offer loans with reset dates linked either to the date of sanction of the loan/credit limits or to the date of review of MCLR.

- The periodicity of reset can be one year or lower.

- The MCLR prevailing on the day the loan is sanctioned will be applicable till the next reset date (irrespective of changes in the benchmark rates during the interim period). For example, if the bank has given you a one-year reset period in your loan agreement, and your base rate at the beginning of the year is say 10%, even if the interest rate comes to 9% in the middle of the year, you will continue at 10% till the reset date. Same will be the case even if the interest rate increases above 10%.

- Existing borrowers with loans linked to Base Rate can continue with base rate system till repayment of loan (maturity). An option to switch to new MCLR system will also be provided to the existing borrowers.

- Once a borrower of loan opts for MCLR, switching back to base rate system is not allowed.

- Loans covered by government schemes, where banks have to charge interest rates as per the scheme are exempted from being linked to MCLR.

- Like base rate, banks are not allowed to lend below MCLR, except for few categories like loans against deposits, loans to bank’s own employees.

- Fixed Rate home loans, personal loans, auto loans etc., will not be linked to MCLR.

- MCLR is applicable for Banks only. Hence this is irrelevant to home loans offered by NBFCs (Non-Banking Financial Companies) like LIC Housing Finance, Dewan Housing(DHFL), HDFC, Indiabulls etc.,

How MCLR Works? (Example)

For instance, for salaried individuals, ICICI Bank has set a floating rate home loan at one-year MCLR of 9.20% with a spread of 25 bps for loans of up to Rs.5 crore. So, the interest rate will be 9.45% (9.20% +0.25%). This interest rate is valid till 30th April, 2016 (as given in the bank’s website). ICICI Bank has decided to set one-year MCLR as the benchmark rate for their home loans.

Though the MCLR is reviewed monthly, your home loan will be reset every year automatically, depending on the agreement with the bank.

So, if you take a Rs.50-lakh home loan on 10th April,2016, your home loan interest rate would be 9.45% . You have to pay EMI installments at this rate of interest for the next 12 months.

Let’s say one-year MCLR gets revised to 9% in April, 2017 and the spread remains the same then your home loan interest rate will be reset at 9.25% (MCLR of 9% plus spread of 25 bps).

How to Switch from Base Rate to MCLR?

This primarily involves two steps;

If you would like to switch to MCLR system then you have to request your banker to link your loan rate with MCLR instead of Base Rate.

Once your loan is linked with new MCLR rate, you can request your banker to reduce the quantum of ‘spread’. Your Banker may charge you one-time fee (conversion fee) for reduction in Spread. Henceforth, you will get the new Rate of Interest (ROI) which is linked with MCLR.

What is the impact for you

MCLR is more transparent.

If the RBI cuts repo rates and cost of borrowing in the system goes down, you can expect reduction in your EMI much sooner.

The only issue is that you will have to wait till the next interest reset date before you get the benefit of lower interest rate. In such cases, you may consider refinancing your loan from another lender.

Since the MCLR has to be published every month, banks cannot hide their borrowing cost from the customers.

Do note MCLR is a double edged sword. Just as you expect interest rate cuts to be passed quickly, you must also expect interest rate hikes to be passed soon.

Depending on what conditions (fee etc) your bank is offering you for switch. You will not be able to switch back to Base Rate Regime. Additionally, consider the spread that the bank is offering under MCLR regime.

With housing loans, you can always refinance your loan from a lender offering lower interest without prepayment penalty; hence the MCLR regime adds only limited value.

What options do regular investors have

Fixed Deposit Rates offered by banks as on July 2016:

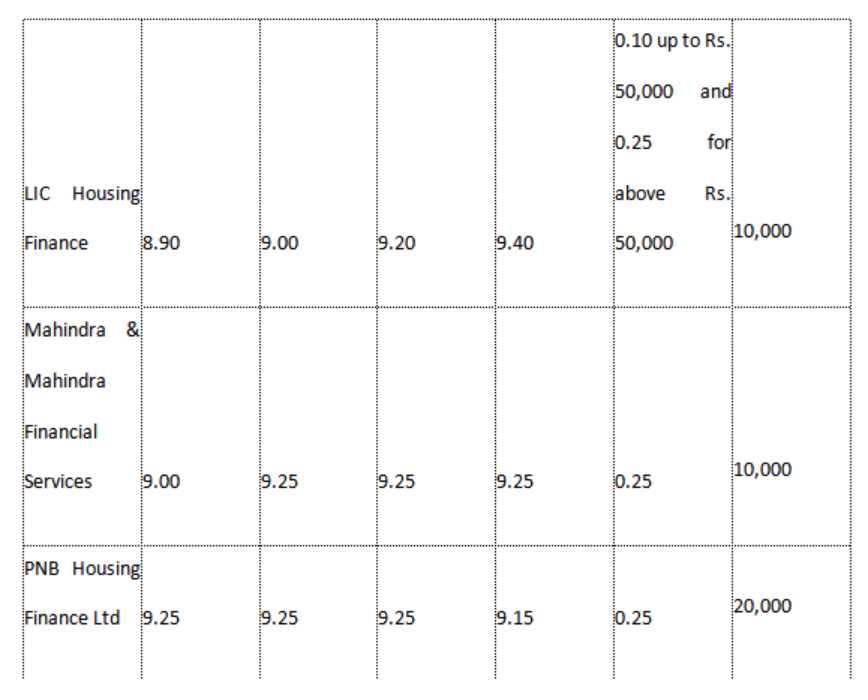

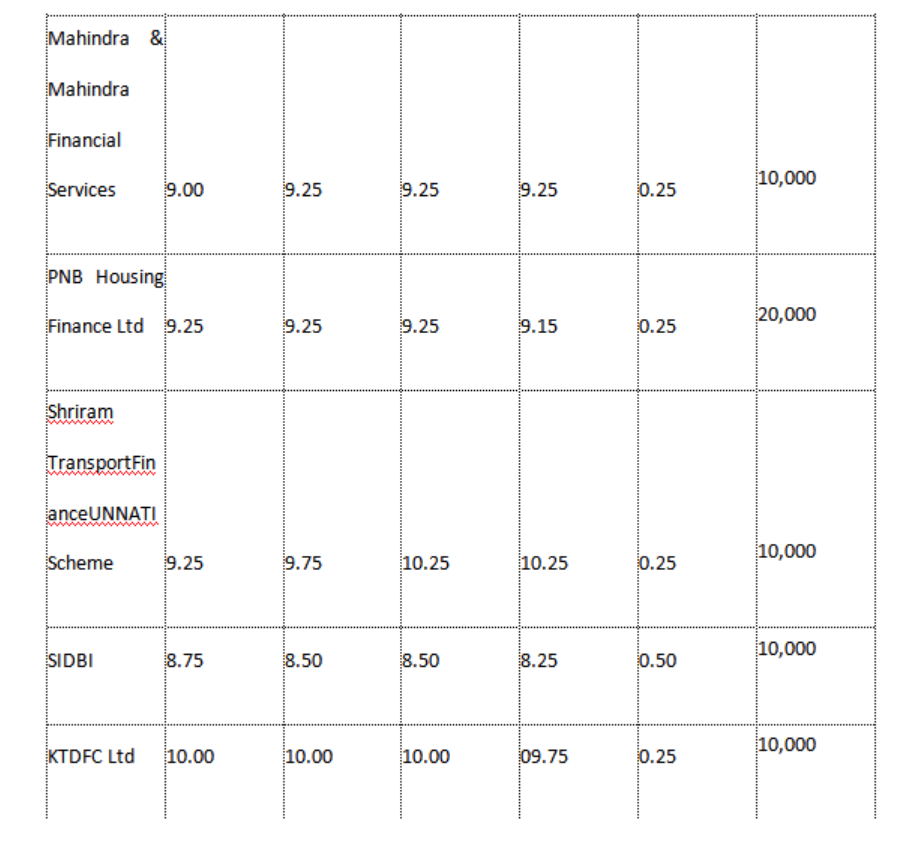

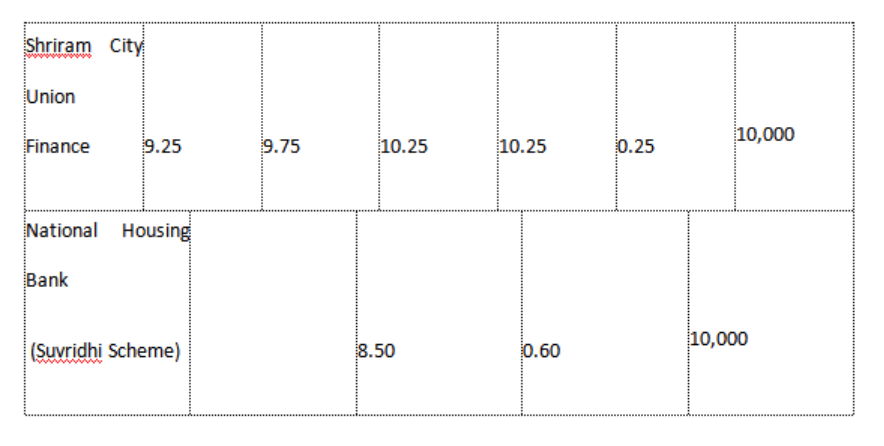

Company FDs:

Deposits in Companies which earn a “fixed rate of return” over a period of time are called Company Fixed Deposits. Financial Institutions and Non-Banking Finance Companies (NBFCs) accept such deposits. These deposits typically offer 1-2% higher rates of interest than bank FDs. The reason: they are riskier since they depend on the well being of the business of the underlying company.

Company FDs are unsecured i.e. not secured by assets. The investors need to be careful in choosing these FDs as lucrative interest rates should not be the only criteria. Even if the returns are lower, it would be better to go with schemes that have a good rating (given by credit research houses like CRISIL, CARE) and a solid track-record.

That said, a smart investor who invests in such corporate FDs will keep an eye on the share price of the company which indicates how well the company is doing. In case the share price starts falling beyond a point, it may well be a good time to sell these bonds before things go from bad to worse

Company Fixed Deposit Interest Rates as on July 2016

Corporate bonds/Non Convertible Debentures (NCDs)

These are debt securities issued by public and private companies to supplement their funding requirements. Corporate bonds typically offer higher interest rate in comparison to fixed deposits.

Example of NCDs: In July 2014, Shriram Transport Finance had raised about Rs 3,000 Cr. through a primary issuance of NCDs. The interest coupon offered to individual investors was 10.7-11.5%, depending on the payout option and tenure of the bond.

When the companies issues shares, you become a shareholder and when it issue bonds/NCDs, you become a lender.

Note: Investors should satisfy themselves about the ability of the borrower to repay back the funds at the time of maturity. Senior citizens and conservative investors should choose highly rated and strong institutions.

Company Fixed Deposits (FDs) vs. Non Convertible Debentures (NCDs) – Difference

Safety: NCDs are secured instruments where lenders can claim if the company fails to repay whereas Company FDs are unsecured and more risky.

Liquidity: NCDs are traded on exchanges. NCDs give investors the option to sell their units back to the issuer after a specific period. On the other hand, Company FDs are not traded on exchanges.

Find a list of Corporate Bond Listed on the Exchange

Tax Considerations

Interest earned from fixed deposits and corporate bonds and deposits is not tax-free and is taxed as per the an investor’s tax slab. Some banks offer “Tax-saver Fixed Deposit” in which money invested is locked-in for at least 5 years. This is the minimum time-requirement to qualify for the deduction. The maximum amount allowed as deduction is Rs.1.5 lakhs.

The government at times allow some companies to issue tax-free bonds for retail investors. This is mostly when the proceeds are being utilized for some purpose of national interest like building infrastructure (infra-bonds) etc.

Public Provident Fund (PPF):

Public provident funds can be opened with any post office or a bank. PPF investment offers an 8.70 % return, and has a maturity of 15 years. The maximum that can be invested in a year being Rs 1.5 lakh, that counts for tax deduction under 80 (C). Not only the money you invest in PPF is exempt from tax, the interest you earn on the PPF investment is also exempt from tax. IF YOU ARE LOOKING AT YOUR FIRST FIXED INCOME INVESTMENT. THIS IS THE BEST PLACE WHERE YOU SHOULD START INVESTING.

National Savings Certificates (NSC):

National Savings Certificates are issued by the department of Posts and are available at all post office counters in the country and provide an interest rate of 8.5 % for 5 years and 8.8 % for 10 years. The maximum that can be invested in a year is Rs 1 lakh, that counts for tax deduction under 80 (C).

Fixed Maturity Plans – (FMPs)

For an investor spooked by the debt market, low-risk opportunities such as Fixed maturity Plans (FMP) could prove to be good choices now.

A number of fund houses have launched fixed maturity plans (FMP) to make the best of the high yields prevalent in the debt market today. What exactly are FMPs and when should one invest in them?

FMPs are close-ended debt schemes with a fixed maturity horizon. That means they are open for investment for a few days during launch and then closed until maturity, which may be just a month away or as long as five years.

FMPs invest in money market instruments, bonds and government securities. Their fixed tenure often makes them comparable to fixed deposits.

However, unlike fixed deposits, FMPs do not guarantee returns. Still, they are considered low risk, especially when compared with open-end debt funds, for a few reasons.

First, FMPs choose instruments in such a way that the tenure of the underlying investment coincides with that of the FMP. For instance a 1-year FMP will invest in debt instruments that also have the same maturity. By doing so, the fund will ensure that it gets the interest income (called accrual) on these instruments when the FMP matures. This strategy ensures that returns are positive if held to maturity, unlike open-end funds that may slip in to negative returns once a while.

This way, the investments are not affected by the varying prices of the instruments in the debt market, till they mature.

Two, as FMPs are locked in (although they have an exit option through the stock exchange route, they are thinly traded and hence, not liquid), it does not face pressure of redemption and hence, it does have to churn its portfolio to meet exits. This also provides stability to FMPs.

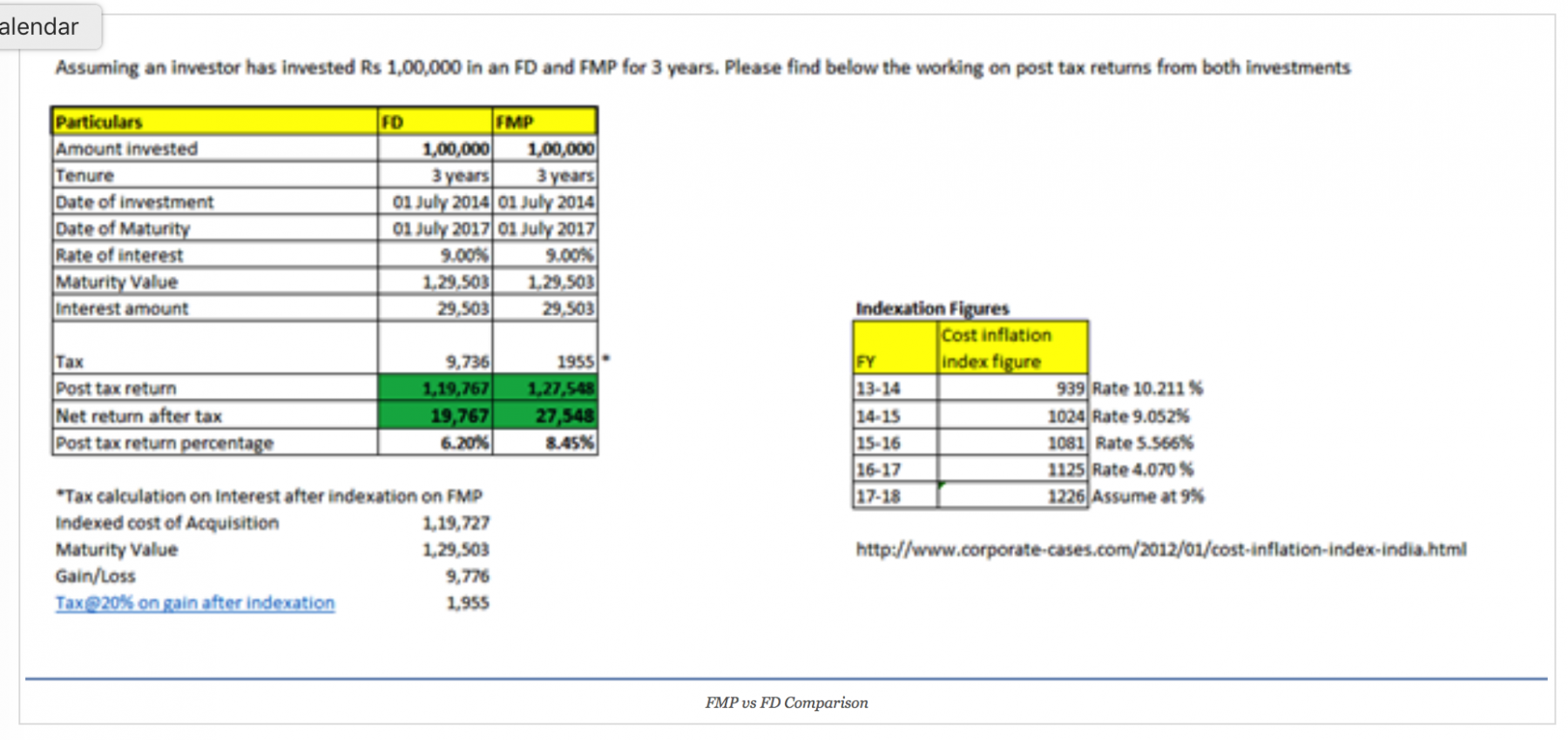

Tax efficient

On the return front too, FMPs held for over one year can deliver superior post-tax returns, when compared with fixed deposits, as a result of indexation benefit. Unlike fixed deposits, FMPs (and all debt funds) enjoy capital gain indexation benefit if held for more than a year. Interest on fixed deposits, on the other hand, will be taxed at your regular income slab rate.

Although the dividends are taxed at the fund’s end at 28.32% (as dividend distribution tax), the growth option in an FMP provides leeway to index cost and, sometimes, enjoy nil capital gains tax in periods of high inflation (as the indexation will be done in line with inflation).

The way FMPs are structured also makes the indexation benefit more attractive. Often times during the end of a financial year, the tenure of an FMP would be a year and a few days or 2-3 years and a few days. For example, an FMP launched in end March 2013 for 380 days will mature in April 2014. But for indexation the investment will be considered to be made for 2 years – that is from FY 2012-13 to FY 2014-15, thus providing higher indexation of cost.

You may note that FMPs of less than one year will be taxed at your income tax rate.

Hence, if you are in the high tax bracket, short-term FMPs may not make for great post-tax products for you.

The yields of the underlying instruments (such as CDs, commercial papers, bonds) at the time of offer is either mentioned in the offer document or can be checked in public websites.

For instance, 1- year FMP can fetch anywhere between 9-10 per cent currently (depending on the proportion of investment in CDs and commercial papers), as most of them seek to invest in certificates of deposits and commercial papers.

You will also do well to know if the FMP promises to invest in top-rated instruments and whether it takes any credit risk by going for instruments with mediocre credit rating.

General trend of declining interest rates

When reference is made to the Indian interest rate this often refers to the repo rate, also called the key short term lending rate. If banks are short of funds they can borrow rupees from the Reserve Bank of India (RBI) at the repo rate, the interest rate with a 1 day maturity. If the central bank of India wants to put more money into circulation, then the RBI will lower the repo rate.

The reverse repo rate is the interest rate that banks receive if they deposit money with the central bank. This reverse repo rate is always lower than the repo rate. Increases or decreases in the repo and reverse repo rate have an effect on the interest rate on banking products such as loans, mortgages and savings.

A big increase in wages and pensions of government employees later this year and a hike in service tax rates are expected to stoke price pressures, but subdued rural demand, coupled with prospects of good summer rains, could provide a buffer. That should allow room for another 25 basis point rate cut. A recent Reuters poll predicted the RBI would deliver one more rate cut towards the end of this year.

—Sneha Ramamurthy

Research Analyst- Dilzer Consultants Pvt Ltd

https://www.relakhs.com/mclr-new-lending-rate-bank-loans-w-e-f-apr-2016-details-components-review/

http://www.personalfinanceplan.in/opinion/decoding-mclr-should-you-switch-from-base-rate-to-mclr/

http://www.blog.sanasecurities.com/best-fixed-income-investment-options-in-india/

http://in.reuters.com/article/india-economy-retail-inflation-idINKCN0Y4

3 August 2016