How does increase or decrease of interest rates on loans affect me

Owning a house is everybody’s dream. That is why buying a house always makes it way to one’s goals when we do financial planning. Buying a house has become a Herculean task these days owing to the mounting real-estate prices. A home loan is an easy way to fund your house purchase as it is not wise to burn your entire savings to buy a land or a house. Banks and other housing finance establishments offer different types of home loans these days. The demand for home loan has increased manifold in recent years and people have different expectations when it comes to a home loan. Borrowing a loan requires careful planning and analysis. And when it comes to home loan, this becomes all the more important, since the commitment is for a long term.

There are two types of interest payment when it comes to home loan – fixed rate and floating rate. Both have their own pros and cons. In a fixed rate loan, the interest rate does not vary till the end of the loan, whereas in floating rate, the interest rate varies depending up on the market interest. For floating rate model, the interest rates keep changing depending on the lending rate declaration by the RBI and the cost of the funds to the bank. Every rate variation affects the borrower, here we will look at how these increase and decrease affect the finance of a borrower. But, at first, we will look at how the interest is calculated in the floating rate model.

How the interest is calculated?

Each bank has its own interest rate which can vary based on the customer’s credit profile. The interest rate is calculated using a simple formula:

Base rate/Marginal Cost of funds based Lending Rate (MCLR) + Loan interest spread = Home loan interest

The base rate/MCLR rate is fixed by the bank time-to-time depending up on the market interest rate and the cost of lending. This will be a floating rate which will change depending on the circular issued by the banks depending on RBI’s lending rate or cost of funds to the bank. The 1 year MCLR is the commonly used lending rate for home loan. Which may vary from Bank to Bank depending on the cost of lending. The interest rate spread is a fixed rate which is setup by the bank on the initial stages of the loan. This rate will not change throughout the tenure of the loan and this will be communicated to the borrower on the loan document. For Eg: if the one year MCLR rate is 8.25 and the loan spread is 50bps.Then the loan interest is as follows.

8.25%+.5%=8.75%

If the interest rate decreases by 25bps then the interest rate is

8.00%+ .5%= 8.5%

So, each change in the home loan will not affect the loan interest rate spread of the borrower. So, it is advisable to have a competitive interest spread at the beginning of the loan.

The effect of increase and decrease of home loan interest on your finance

The increase and decrease in the interest rate will have a huge impact on the house hold finance of the borrower. It not only increases the cost, but also increases the EMI burden for the borrower which has an immediate effect on his house hold finance. Let’s look upon how the increase and decrease of interest rate effect a home loan borrower.

The effect of increase in home loan interest

It will increase the total cost of the loan

Each time there is an increase in the interest rate of the loan the cost of borrowings to the borrower increases. A small change of 50bps on the loan interest rate can have a huge impact on the cost of borrowings as the home loans are taken for a longer term. The timing of the interest also influences the cost of borrowings, the changes of interest on the earlier stages will have a higher impact on the cost of the loan rather than at the end of the term. This can be clearly understood from the below example:

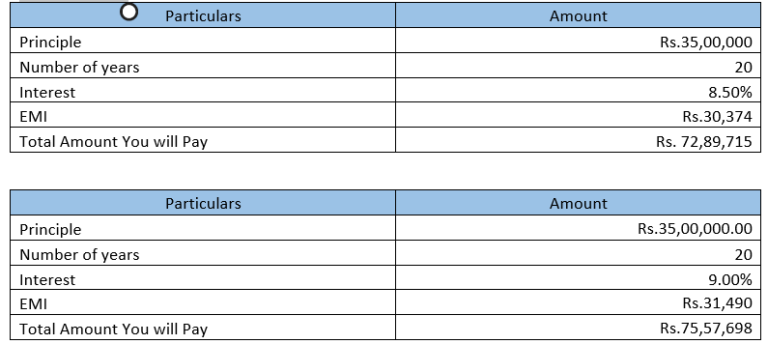

Mr. Ragav has taken a home loan of Rs 35,00,000 from his bank for a tenure of 20 years. His loan interest rate was 8.50% when he took the loan, recently the bank has increased the lending rate by 50bps. When he calculated the cost of borrowings, it has increased by Rs. 2,68,000. The calculations are as follows

This is the case when the interest rate increases in the beginning stage of the loan, if this increase was on the 10th year then the increase in the cost of capital could have been Rs.30,374.

Increase in every month EMI

This is the sudden impact that will affect the home loan buyer. The increase in the interest rate will either increase the monthly EMI or the tenure of the loan. If we look at the above example, by an increase of 50bps on the interest, the Monthly EMI has increased by Rs.1117 which will have a high influence on the buyer’s house hold finance. The same will be applicable when the interest rate decreases. But the impact of reduction is less when compared to the increase. If the interest rate reduces by 50bps, then the EMI will be reduced only to an extend of Rs. 1099.

Increase in the tenure of the loan

If the home loan buyer is not ready to increase his monthly EMI, the other option which is available for the bank/ lender is to increase his home loan tenure. In the above example of Mr. Ragav, if the interest on the home loan increases by 50 bps on the end of one year, he has to extend his loan tenure by 24 months more. The same will be applicable when the interest rate reduces, the tenure of the loan will decrease. In the above case, if the interest reduces by 50bps after one year then the loan tenure will reduce by 18 months.

Increases the tax benefit on interest

The home loan not only helps the borrower to purchase property, but also helps him to reduce his tax burden. The borrower can avail tax benefit on both interest as well as the principal repayment done on that Financial Year (FY). He can avail the tax benefit up to Rs.2 lakhs on the interest paid U/S 24 and up to Rs. 1,50,0000 on the principle contribution U/S 80C for that FY. In case of a joint home loan, both the parties can avail this maximum limit individually. So, as the interest rate increases, the contribution towards the loan interest increases which will increase the tax deduction for the borrower for that particular year. This will be only applicable when the borrower increases his EMI in-lieu with the increase in loan interest. An increase of 50bps on loan interest of Mr. Ragav’s home loan at the beginning of second year will create an increase of Rs. 17734 in his interest payment for that FY.

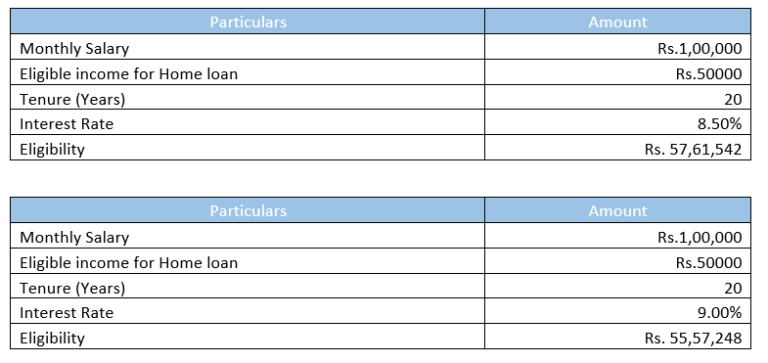

Decreases the maximum loan eligibility

The increase in the home loan interest in the market can reduce the maximum loan eligibility of an individual. The following illustration will give more clarification on the above point.

So as the market interest rate for loan increases, the maximum eligibility limit of the loan decreases.

The effect of decrease in home loan interest

Increase in the contribution to the principle

Each decrease in the interest rate on home loan will fetch more contribution towards the principal, if you are not reducing the monthly EMI. This will result in the earlier closure of your home loan than its existing tenure.

Increases the tax benefit on principal repayment

The reduction of interest increases the principal contribution, which directly increases the tax benefit of principal repayment for that FY. A reduction of 50bpsin the beginning of second year on the above example will contribute Rs.17652 more into the principal in that FY which will increase the tax deduction for the same value on that FY.

Conclusion

The changing interest rate and the optimistic thought that the interest rate will fall in future (which does not happen all the times), are the main reasons why a borrower opt for the floating rate interest. When it comes to home loan, the changes in the interest rate will not affect those who have taken the loans recently. The interest rate is fixed for the first year and start fluctuating only from the second year only. Sometimes the lender (Bank / Housing Finance establishment) will forget to inform the borrowers on interest reduction. So, make sure that you have proper tracking of the interest rate when it comes to your home loanDilzer Consultants Pvt Ltd.

Ranjith

Dilzer Consultants Pvt Ltd