How to Insure your home

A house is made of walls and beams; a home is made with love and dreams.”

There is no such place like home in the entire Universe. After all, it is a place where you and your loved ones can rejoice, weave thousands of memories that last for a lifetime. While we put our life’s savings into buying or constructing a home but we rarely realize that our home needs a protection in the form of insurance too.

Your home is your biggest and most valuable asset. Also place where you live and centre to your life and lifestyle. If you lost your home due to an accidental fire , earth quake or law suit your whole life could be disrupted. The frequency of natural calamities is a cause for concern. The destruction it brings with it leaves a big hole in the pockets of those affected. However, with a little care, you can avoid this financial setback.

An insurance policy is a legal contract of the promise that an insurance company gives you to pay for losses outlined in your policy in return for premiums that you pay to the insurance company. Insurance is not a bank account where your premiums are stored, but rather is a promise that the insurance company will pay for the costs of any covered risks that impact your covered property during the policy period.

The insurance you buy to cover your home provides protection for a specific period or term of time, usually for a one-year period. If your coverage is not renewed, the insurance company will not cover losses occurring after the end of the policy period.

What is home insurance

There are two types of home insurance policies —

- Basic fire insurance policy &

- Comprehensive policy/ householder’s package policy (HPP).

Fire insurance policy covers your house against fire and other allied perils including lightening, storm, flood and riot. However, some insurers may ask you to pay an extra premium in order to cover disasters such as earthquake and landslides. You can also insure your house and contents against terrorism by buying an add-on cover.

Key points to note :

- Home insurance will only pay the cost of the building and not for the land

- Get the reconstruction cost of your house either from a broker or civil contractor before buying or renewing your policy

- Market value of a building will factor the depreciation , so opt for the cost of reinstatement than the market value.

- Keep proof of your insured items in the office/ locker / or another place than your home as the insurer will need them to settle your claims

- The insurer may decline your claim if the construction is poor or unauthorised.

The basic cover bifurcates into two: one covers the structure of the building against fire and other allied perils and the second covers the contents of the house. Tenants can just opt for cover for just the contents. A HPP also offers optional covers that insure contents of your house against burglary, damage, mechanical or electrical breakdown.

How do you choose the sum insured?

The value of your house has three components: land, building and locality costs. Insurance will cover only the building cost. For example, if the market value of your house is Rs 1 crore, of which the building cost is Rs 30 lakh, your policy will insure only Rs 30 lakh.

But, what happens when the entire house is brought down, like it happened recently in Uttarakhand where rows of houses got flushed away? If the land is yours, you should be able to rebuild the house. But if you have an apartment, you alone can’t reinstate the house. Therefore it’s recommended for housing societies to buy insurance for entire premises.

There are two ways of buying home insurance: one is on the market value basis or depreciated cost basis and the other on the reinstatement basis. Don’t confuse market value for resale value. When you re-sell your house, you get the value of land and the locality as well. In insurance, market value is akin to the value of your house after factoring in depreciation. Insurer will depreciate the market value by 2% per annum going up to 100% in 50 years .

Reinstatement on the other hand is the value of reconstructing the house. The insurer in this case will not deduct depreciation. Opt for reinstatement cover even in case of the contents of the house. But keep in mind that the insurer will settle the claim only after the house is reconstructed. Some insurers may make partial payments to help you reconstruct the house.

What is the cost?

Insuring the house and its contents is not very expensive. For instance, for a sum insured of Rs. 30 lakh for the building and Rs. 5 lakh for the contents a pure fire insurance cover that covers against fire and other allied perils along with a terrorism cover would come to about Rs. 2,000 for a year. Pack in burglary and theft cover for a sum insured of Rs. 5 lakh and the premium will be Rs 3,155. Add additional cover for breakdown domestic appliances for a sum insured of Rs 4 lakh, the policy will come for about Rs 5,600 for a year. If you own a house you should buy home insurance as soon as possible. If you are a tenant you could insure just the contents.

Inclusions in Home And Property Insurance

Home insurance covers losses to the structure and content of your home due to natural and man-made calamities.

- Fire and perils cover-

- Aircraft damage

- Fire

- Lightning

- Riot, strike

- Storm, cyclone, flood

- Missile testing operations

- Earthquake Cover

-

The policy offers coverage against loss or damage to any of the insured property. However, many policies do not cover flood or overflow of the sea, rivers and lakes due to earthquake.

-

Burglary and Theft Cover

-

The contents of home are also covered against burglary or theft. The coverage will also be extended to silver articles, jewellery, precious stones and other valuable items, provided these are kept in a locked safe within your home premises.

Exclusions in Home Insurance

Loss or damage caused by wear & tear and depreciation

Loss of cash

Loss or damage caused by war, invasion, act of foreign country

Loss or damage caused by nuclear war

Loss, destruction or damage caused to any electronic equipment due to over-running or excessive pressure

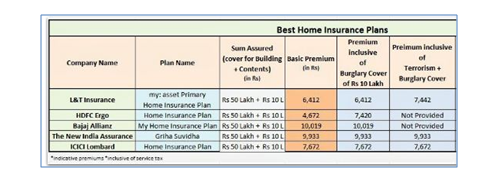

Comparison of rate offered by various Insurance companies:

- New India Assurance’s Griha Suvidha is one of the most comprehensive home insurance plans. By default this house insurance policy provides burglary, terrorism & jewellery (up to Rs 4 Lakh) covers at a very competitive premium rate. It has one of the cheapest premium rates.

- L&T insurance provides ‘third party liability cover’ by charging additional premium.

- Except in HDFC Ergo‘s plan, Burglary cover is included by default in all the other standard policies.

- Terrorism cover is not offered by HDFC.

- HDFC Ergo home insurance plan’s premium is very low for a basic and standard cover.

-

ICICI Lombard‘s Home insurance plans also offers all types of cover except the ‘third party liability cover’. This plan offers basic, burglary, terrorism & Jewellary covers (up to 25% of content Sum assured) at very competitive premium rates.

How to claim home insurance

In case of an accident, ensure your safety and the safety of the home first. If you can, take all possible steps to avert the damage.

- Contact your insurance provider through the helpline number, fax or mail and explain the damage caused.

-

If possible, take snaps of the damaged parts of your property. Also ensure that you keep the bills and receipts of the services that you have availed after the accident.

-

Depending on the nature of accident and extent of damage, your insurer will ask for supporting documents. Make sure you submit all necessary documents along will duly filled claims form.

-

A surveyor may be appointed by the insurer to assess the damage.

- After the claim is validated, you will be offered a suitable reimbursement by the insurer.

Documents Required for Filing a Home Insurance Claim

- Having all the necessary documents in place will ensure a quick claims process. Below are some of the necessary documents for filing a home insurance claims .

- Duly filled claims form signed by the insurer and the insurer’s legal representative

-

Evidence of the event, extent of loss and nature of accident – some of the valid independence evidence reports include First Information Report (FIR), rent agreement, court summons, repair bills, legal opinion if applicable, fire brigade report, invoices of owned belongings, hospital bills, bills of suppliers for replacement etc.

-

Depending on the nature of claims made, additional documents may be asked for. Also, keep a copy of the policy, policy number, identity and address proof to be shown if required.

When you file for a home insurance claim, the insurance firm will send you an evaluator to decide the degree of the harm occurred and the ideal way to solve it. The evaluator will estimate a value based on usual factors like trending expenses and upper limit of what the company offersWhen it comes to insuring your most valuable asset, give no room for myths, misconceptions or vagueness. Reading the fine print may seem painstaking, but is better in the end as you know what you are signing up for.

As mentioned above, not all risks and dangers can be covered and hence take regular maintenance of your house seriously.

Sneha Ramamurthy

Content Strategist

Dilzer Consultants Pvt Ltd