The importance of knowing your net worth

Nowadays, the lifestyle of most of the working class has improved drastically, thanks to the abun-dance of high-paid jobs and the increase in household income. The improved disposable income has led to an increase in the savings habit and asset accumulation. At the same time, this also increased the habit of borrowing among the people for acquiring those assets. With the recent reforms in banking sector (formalization of credit system with the introduction of CIBIL rating for availing loans) and improved financial literacy, people started realizing the importance of knowing their net worth to fully understand where they stand financially.

What is net worth?

The net worth provides a snapshot of an individual’s financial situation at any point in time. It is the amount by which one’s assets exceed one’s liabilities. In simple terms, net worth is the difference between what you own and what you owe.

In its simplest form, net worth is the difference between your assets and your liabilities. In mathe-matical terms it is

Assets – Liabilities = Net Worth

If your assets exceed your liabilities, you have a positive net worth. Conversely, if your liabilities are greater than your assets, you have a negative net worth. If the figure is negative, it means you owe more than you own. If the number is positive, you own more than you owe. A negative net worth does not necessarily indicate that you are financially irresponsible, it just means that – right now – you have more debt than assets.

How is it calculated?

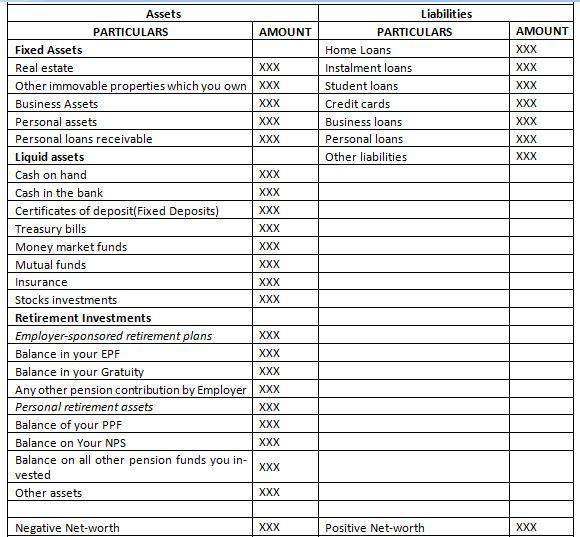

While preparing a financial plan for a client, the net worth calculations is one of the first step used to analyse his current financial position. The net worth clearly indicates what he owns and owes, a clear picture of his financial strength at this point of time. In mathematical sense, net worth is calculated by adding all your assets and deducting all your labilities from it:-

Net worth = Assets – liabilities

In accounting terms the net-worth is calculated as follows

Fixed investments are all those immovable assets which you own

Real estate. This includes the market value of your primary residence, as well as any other property which you own, either for investment or for renting. This can also include the land which you hold in your name, your portion of inherent property etc. Keep in mind real estate prices can fluctuate from one year to the next. It is generally best to be at least somewhat conservative in your estimates.

Business assets. If you are a business owner, you can include the net worth of your business, or any significant business assets you have in to your net worth. But keep in mind that, business equity and assets aren’t always readily convertible into cash.

Personal assets. These can be cars, furniture, jewellery and other personal effects etc. Many people do not include these in their net worth calculation, because they have no intention of selling them ever.

Personal loans receivable. These are loans you have made to your family, friends, or business associates. Include them only if there is a reasonable likelihood of collection.

Once you have tallied up the complete numbers for both your assets and liabilities, subtract your liabilities from your assets, and the balancing figure will be your net worth.

What should be my minimum Net-worth?

There is no clear cut definition for a minimum net worth of an individual. The net worth is like a stock in the market, it will fluctuate. However, like the stock in the market, it is the overall trend that is important. Ideally, your net worth continues to grow as you age – as you pay down debt, build equity in your home, acquire more assets, and so forth.

The commonly followed principles for minimum net worth are as follows.

Net Worth = [Your Age – 25] X [Gross Annual Income ÷ 5]

The other commonly used principle is

If you are employed, net worth should be

{(Age*Annual Household Income)/10} – Inheritances

If you are not employed or a student or just started working, your net worth should be

{((Age-27)*Annual Household Income)/10} – Inheritances

The importance of knowing your net worth

The net worth provides a snapshot of your financial situation at this point in time. If you calculate the net worth today, you will see the end result of everything you’ve earned and everything you’ve spent up until right now, while this figure is helpful to provide you a wake-up call, if you are completely off track, or gives a confidence that you are doing well. Reviewing your net worth statements over time can help you determine 1) where you are, and 2) how to get where you want to be.

Though many people never bother to calculate their net worth, everyone really needs to. There are many reasons why knowing your net worth is important.

1) It is the accurate measure of your wealth

Net worth is the most accurate measure of your wealth. Wealth is what is left over after all of your bills are paid — and that’s precisely what net worth is all about. You really don’t know your precise financial situation until you know your net worth.

2) It helps to track your financial progress

As net worth is a specific number, you will be able to be tracked with precision. This enables you to measure your financial progress from one month or year to the next. While calculating the net worth, there are many things to consider, which depends on your overall financial situation. From the past experience it has been proved that people who work with an advisor and who know their net worth seem to have a better grasp of their financial situation than those people who don’t.

A growing net worth is the best sign you’re moving forward, a decline in net worth means you have more work to do.

3) Moving the financial focus beyond income alone

The concepts of wealth and prosperity are often grouped by income levels. While this measure has some value, it doesn’t take into account expenses, taxes, or other specifics. Even if your income is growing, if your net worth is flat or declining, your financial situation may not be improving at all.

We usually come across a lot of couples who get paid more than Rs 7.5 million a year and would like to retire. Perhaps between their retirement accounts and investments they can even count, they have 20 cr. in assets.

But some of these same clients also have 10-12cr in debt in different names be it their home loan, Property loan and other loans. While at a glance, that 20 cr. looks appealing, many of our retired clients understand that if your EMI is around Rs. 50,000 a month it is all too well, it is lot tougher to pay once you’re no longer earning that Rs.7.5 million. So, in that sense the net worth has nothing to do with your salary. It’s what you’d have left over today if you had to cash everything out and pay all your obligations.

4) Avoids over-emphasis on asset value alone

It is a common that people focus almost exclusively on the value of their assets as a measure of their personal wealth. For example, they may proudly proclaim Rs. 250 million in assets, while ignoring Rs.150 million in debt. It is not the size of either number that counts, but rather the difference between the two.

5) Helps to reduce the debt

Regular reviewing of your net worth may help you to develop a plan for paying down debt. A large debt number can seem scary, but if it is more than offset by a large asset position, it’s not nearly as bad as it looks. For instance, you might be earning 5% interest in a money market instrument while at the same time your car loan is costing you 10% interest. You may find that using the cash to pay off the car loan might make sense in the long run.

6) Motivates you to save and invest

You may be more motivated to save and invest your money by keeping track of your net worth. If your net worth shows that you are on track – that’s fantastic. It can encourage you to continue what you’re doing. If not, it can provide that extra incentive to start being more proactive about saving and investing.

Conclusion

So, now we know that knowing your net worth is very crucial in understanding your financial wellbeing, so more emphasis should be given to improve its current position in a long term. The net worth can be improved in two ways – by increasing your assets or decreasing your liabilities or both together. This can be easily attained by proper planning and keeping a discipline in your spending. The other option is to take the help of a financial planner who is professionally trained for this.

Ranjith

Dilzer Consultants Pvt Ltd

Reference:-

https://www.investopedia.com/articles/pf/13/importance-of-knowing-your-net-worth.asp

https://www.huffingtonpost.com/david-a-dedman/why-you-need-to-know-your_b_7161058.html

https://www.themoneyprinciple.co.uk/knowing-your-net-worth-is-important/