Things to consider before you borrow

Things to consider before you borrow

The most important factor in deciding whether to borrow money is YOU. Is it a Need or greed? This refers to the intention for which you are applying for the loan.

Loans are made available for genuine needs like marriage, hospitalization, education, relocation, repairs and renovations, building you own house or buying a new property.

But if you wish to obtain the amount and invest it in stocks or commodities to generate higher returns by speculating, then it is not recommended.

Once the reason for raising money has been established, then it’s important to carefully consider your options before taking the leap.

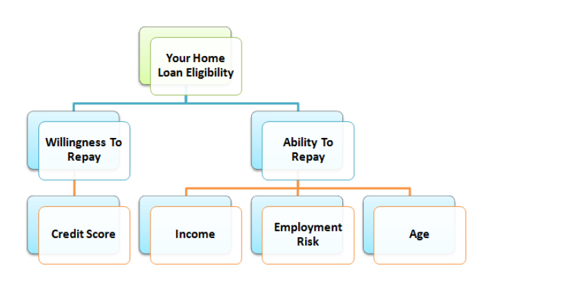

Eligibility Criteria –

A crude way to calculate your loan eligibility is by calculating the EMI. Banks usually limit the installments at 40-50% of the borrower’s salary for salaried people, that is, basic plus dearness allowance. Reimbursements and allowances are not considered for this. Also, if you have existing liabilities, say another loan, the eligibility goes down further. Some banks are sensitive about the number of dependents you have. Higher number of dependents implies lower repayment capacity.

Credit Score (CIBIL Score)

CIBIL score or credit score is a score assigned to you on the basis of your credit history. Regularity in repaying loans, credit behavior and type of credit taken are some of the factors which affect your CIBIL score. CIBIL score is assigned on a scale of 300 to 900: 300 is the lowest and 900 is a perfect credit score. To have a hassle-free experience while borrowing a home loan, you should maintain a minimum CIBIL score of 700 or above.

There are many people who believe that since they have never taken a credit card or borrowed money from a lender, they will easily get a higher loan eligibility as it shows responsible spending on their part.

For instance, people with a stable source of income find it relatively easier to get loan than say a self-employed with erratic earnings. Your age defines how many earning years you have and therefore your re-payment capacity vis-à-vis the tenure of the loan. Usually, loan tenures do not go beyond your retirement age, unless you’ve a younger co-applicant.

Also, having a co-applicant allows you to get a higher loan as the income of the co-borrower is clubbed while considering the eligibility. The value of the property is also considered before sanctioning the loan. Banks usually cap the loan amount at 70-80% value of the property.

1. Type of Loans –

- Personal Loans, wherein you can take a – Secured loan: Personal property is offered as collateral and may be granted to individuals with poor or no credit history or an unsecured loan: Based on credit scores; no collateral is necessary.

- Business Loans, wherein there are many choices based on the type of business and its working requirements –

- Term loans: General purpose loans that are paid back over a set period of time.

- Short-term loans: Smaller loans that are taken for periods of less than one year and paid back in one lump sum.

Equipment financing: Loans granted for purchasing equipment; equipment is used as collateral.

- Lines of credit: Specific loan amounts are granted per year on an as-needed basis; these loans usually need to be repaid quickly.

- Small Business Administration (SBA) loans: Loans offered by banks or financial institutions that are guaranteed by the SBA. For more information about the different types of SBA loans and loan requirements, visit the SBA website for more details

- Student Loans, wherein the money required to fund the entire studies locally or abroad can be raised to be repaid on completion of the course.

- Home loans, wherein the rate can be floating or linked to MCLR and term can be varying

- Auto Loans, wherein a small down payment can be made before procuring a vehicle on loan / EMI

It is important to be acquainted with how loans work to avoid any nasty surprises later. Here are some important things you should know before signing on the dotted line.

2. The Fine Print–

A loan agreement is a legal document and therefore often incomprehensible. However, there can be quite a few devils hiding in the details.

You may think a ‘default’ is only if you do not pay the EMI. However, there are some banks who define default as when the borrower expires, gets a divorce (in case of joint-loans), or the borrower is/are involved in any civil litigation or criminal offence.

Some banks have a security clause that makes that entitles the bank to demand additional security along with your loan amount in case property prices fall. If you fail to pay up, you’ll be marked as a defaulter.

Be careful about the add-on charges and penalties. It’s not just the interest that you pay. There are additional charges such as administrative and service charges or processing fees. Also, there are penalties like on pre-payment of the loan. Consider these when comparing the deals offered by various lenders.

Negotiating for the right rate –

Have a clean record in your credit history for payments done on time.

Use it to negotiate loan amount and the rate. Every bank wants good business and a high credit score gives you bargaining power.

Try to purchase the loan at the end of the month. Banks have their monthly targets and may be more flexible as they do not want to lose business.

3. Beware! Longer tenure means costlier loan:

Any increase in the base rates means the banks have also been increasing their floating home loan rates. For the borrower it means a higher EMI. Many can’t afford such rise and often request the bank to re-adjust (increase) the loan tenure to bring down the monthly outgo. While it can be a temporary relief if you are in a desperate situation, in the long term you end up paying more.

Example: a situation where you’ve taken a loan of Rs.30 lakh at 10.5% for tenure of 20 years. Your EMI will come at Rs. 29,951 and the total interest you’ll have to pay on it will be Rs.41,88,240. In a home loan of long tenures, you usually pay more interest than your principle amount.

Say after two years of paying the EMI the bank increases the rate by 0.5% to 11%. Since the interest component is very high in the initial years you would have paid Rs 6,20,460 by the end of first two years while the principle would have reduced by Rs 98,373 only leaving you with an outstanding balance of Rs 29,01,627. At 11% for the remaining 18 years the EMI comes at Rs 30,904. But you decide to extend the tenure by two years and bring the EMI back to Rs 29,950. The total interest now payable on the re-adjusted loan will be Rs 42,86,373, that is, Rs 98,153 more than the initial interest payable.

Plus, you have already paid Rs 6,20,460 interest. So, the long-term effect is that you end up paying Rs 7,18, 613 more (Rs 6,20,460+ Rs 98,153 ).

Switch lenders:

Taking a loan from a bank doesn’t mean you are stuck with it forever. In extreme situations or in case you are getting a significantly better deal from another lender, you can always switch. Most banks don’t have any pre-payment penalty anymore on floating rate loans. Therefore, processing fee is the only additional cost you have to bear. Try negotiating on this as well or at least ask for a reduction if not a full waiver.

If you are thinking of taking a loan in the future, then it is a good idea to start working on improving your eligibility from today itself. The moral we learned in our childhood rings true for home loans as well:

“The seeds that you plant today will decide the fruit you get tomorrow”

Sneha Ramamurthy

Dilzer Consultants Pvt Ltd

CREDITS

https://www.allbusiness.com/top-5-things-to-consider-before-applying-for-a-loan-93874-1.html