Which Loan should we pay off first?

Day to Day living and running of the family for the common man entails paying off a lot of loans ,the burden of which is rather overwhelming.

Loans are a common way to improve one’s standard of living and lead a better lifestyle. One must be careful not to go over-board on loan’s taken and the burden of repayment that comes with it.

Credit card debts, home loans, student loans, vehicle loans, medical bills – the list is endless. But the solution lies in proper understanding of your debts and paying them off in an appropriate manner which does not tax your pocket and wisely!

One needs to prioritise their money and choose a method to pay off their debts.

When settling on a debt repayment plan there are two main methods one needs to choose from.

A. The avalanche method

One school of thought is that you should pay of the debts with highest rates and proceed to the lower rates and then the lowest in the course of time. This will help reduce the interest burden

B. The Snowball method

Another school of thought is that one should pay off the loans of small amount and proceed to the one’s with the higher amount.

We will provide a brief overview of the above two methods

A. Method of Paying of the loans with higher interest rates – The avalanche method

Priority 1 Personal Loans

Personal loans form the major chunk of one’s loan amount. These are unsecured loans lent out to people based on their creditworthiness, previous track record of repayment of loans ie the ability of repayment based on income level. Personal loans are given at a very high interest rate. Higher interest implies higher EMI repayment schemes.

Examples of unsecured loans are Credit Card debt, Overdraft etc.

It is always better to pay of the high interest rate debt first, like credit card bill and then move on to other lower interest burden payments..

Step/Priority 2 ; Unproductive loans

Examples of unproductive loans are

- loans against property,

- loans against fixed deposits and insurance policies,

- Gold loans

- loans against Provident Fund and

- Auto Loans.

Such loans should be paid off next depending on the interest rates. T he interest rate on gold loans and loan against property are dependent on margin between pledged value and loan amount. If an individual opts for 50 per cent of the value of the gold as loan then he or she is expected to get a better rate compared to opting for 80 – 90 per cent of the value as loan. These loans hold a lesser interest rate compared to personal loans. Loans against fixed deposits, insurance and PF attract lower interest rate than the gold loans and loans against property.

Also such loans do not attract any tax benefits and hence it is better to repay these first.

Priority 3: Educational loan

The increasing costs of education are being met by educational loans. Many cannot afford the high costs of education and therefore they take Educational loans. One can get tax benefits from educational loans. Individuals can claim tax benefit on the interest payments being made towards educational loan availed from approved financial institutions. Interest payments can be offset by the tax benefit and hence one is advised to pay off educational debt only after paying off other debts.

Priority 4: Home loan

Home loans are the most common form of debt and it usually makes sense to pay it last over a large number of years.. Home Loans come with hightax benefits.

Tax benefits are available on both principal repayment and interest payments on the home loan under Sec 24(1) and Sec 80 C of the Income Tax Act.

The exit strategy for home loan also differs based on the tenure and type of house. Generally in the initial years, majority of the EMI payments account for interest payments and during the last few years of loan tenure they account for principal repayments. It is advisable to consider prepayment during the first half of the loan tenure. If an individual has two existing home loans, one for self occupied property and one for let out property, tax benefits can be claimed only one one property depending on place of residence and nature of work

B. Method of paying off loans worth smaller amount first – Snowball Method

Another method is paying off your smallest debts first. You can clear up a lot of smaller monthly payments/installments and then move on to pay the higher amounts/installments.. It is an easier way to repay one’s debts but one actually might end up paying more interests and losing some tax benefits in the long run.

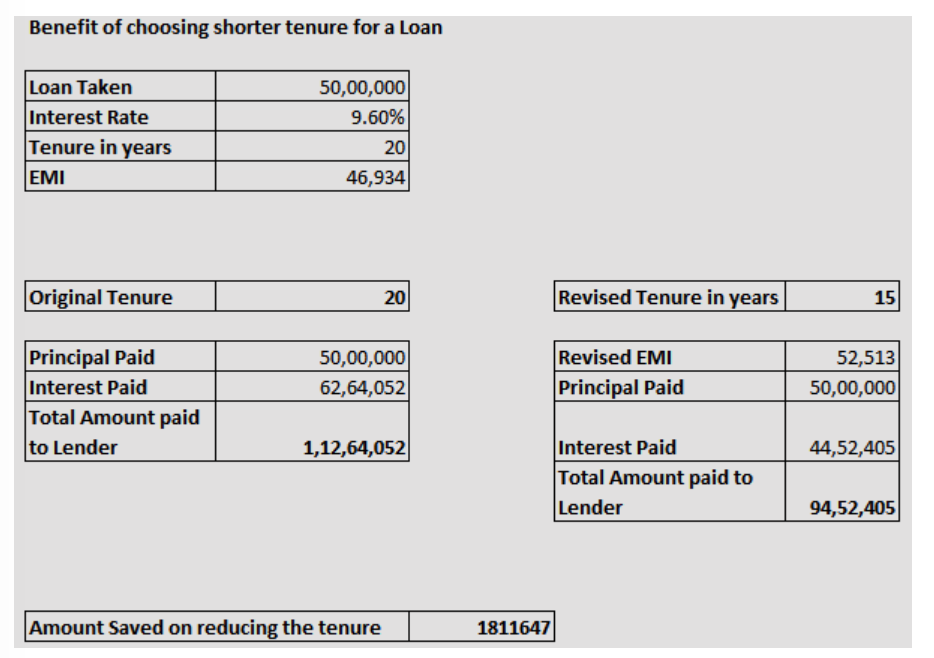

Below is an illustration showing how by reducing the tenure of the loan, one can save on interest and pay less to the bank-

However the most successful debt repayment plan will be a mix of these above two methods.

For more information on which loans to pre pay and sound investment advice, do contact us here

Debalina

Content Writer- Dilzer Consultants Pvt Ltd

11 December, 2015