Without a regular income, should I prepay my existing loan or invest?

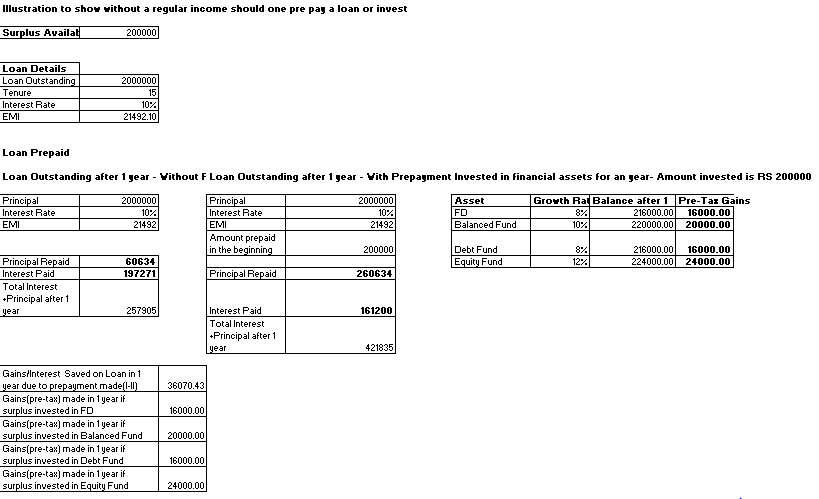

To prepay existing loan or invest are the two financial options available to a person without a regular income. To make things clearer, suppose a person has started a business on his own or has taken voluntary retirement or retired from his job, what should be his priorities? Prepaying all his or her existing loans or invest?

Here are a few step by step suggestions from our end.

Closing the Employee Provident Fund, Gratuity, Super Annuation.

Logically speaking it is advisable for them to gather money from all available resources like Employee Provident Fund, Gratuity, Super Annuation by closing them and then decide whether to invest or prepay the money.

Prepayment of Home loan with highest interest cost should be considered first, such as home loan.

- Home loans offer tax benefits for interest payments and for principal repayments, however, if the loan is taken recently, the interest outgo is high and therefore it makes sense to pre-pay the interest, by increasing EMI or making lumpsum payment.

-

If a person is a first time purchaser of an, home he or she gets an additional tax benefit of Rs 2 lakhs on the interest paid on the home loan. Loan owners often presume that because they have already paid a substantial number of EMIs, the interest component is much lower, and it hence makes little sense for them to prepay the loan amount.

The truth, however, is that the borrower pays the same interest for the unpaid principal amount, since the interest is calculated using the reducing balance method. When considering prepayment, borrowers should hence consider the prevailing interest rate, rather than the loan tenure.

Whether or not to prepay the loan depends on the stage the loan payment one is at, the interest rate, and the prepayment charges. An analysis of these elements is a must before one decides to prepay.

Car loan Unlike a home loan, a car loan does not help build an asset that will appreciate in value. A car depreciates in value with use. Car loans are expensive too. It would be a good idea to pay off the car loan since the interest amount is higher compared to an home loan.

Investing the balance after clearing one’s loans and liabilities, is a good option.

It is always important to create a nest egg or savings for the future.This balance money should be invested taking into account one’s risk-taking capacity and tolerance. All loans are not bad. If a loan helps one to appreciate one’s asset and offers tax breaks on capital repayments and interest payments, it’s worth continuing with that loan. However, its makes sense, to first repay loans that are high cost with no tax breaks Analysis of one’s financial situation holistically is a must before making a decision.

One can always follow the middle path – invest some, prepay some.”

Example 1

- Vinita is a 30 year old person with a 2 year old daughter –

She just left her job and started her own business

Gross annual income ~ 15.4 Lakhs. Annual growth 10% • Monthly expenses ~ Rs. 40,000; Inflation 8% • Home loan (self-occupied): 60 Lakhs; Rate: 10%; Tenure 20 year; EMI: Rs. 57,901 • Daughter’s education 16 years away • Daughters marriage 23 years away • Section 80C limit: 1 Lakh (home loan principle is assumed to be not part of deduction) • Section 24(b) limit (home loan interest deduction): Rs. 200000.

Vinita has now received a lumpsum amount of Rs. 3 lakh. Should she invest it or use it for pre-paying? If the lump sum is used to prepay, Vinita will fall short of the corpus required for financial independence. Investing the lump sum is better because today’s money saved will grow much faster with compounding effect. It will be a good thing for her to invest in some market linked educational insurance plan preferably single premium,or a short term product say three years which will take care of the educational expenses of her daughter. She can claim tax benefit here under Sec 80 C and create a savings pool for her daughter’s education.

Example 2

In the year 2010 Shyam took Rs 20,00,000 as housing loan. Now 5 years later he is easily paying Rs 23,000 EMI every month. He can think of increasing the EMI amount by Rs 10,000 but will that be a good option?

Let us look at the pros and cons of the options repaying the loan.

Most of the Indian middle class consider loan as a burden, so they prefer to repay quickly. What happens if Shyam invests for retirement instead?

If he puts this money in an ELSS, it means he will build an all equity portfolio for the next 15 years. Equities, historically, over 15 year term should give one about 6-7 cent real returns (nominal interest rate minus inflation).

Mr Singh has decided to take voluntary retirement at the age of 56 and is in the process of receiving his retirement benefits . He can utilise this amount to build or add to his retirement corpus savings to live post retirement years, stress free.

For more information on which is the best way to pre-pay or invest a lumpsum you receive, do contact us here

Debalina Bose Content Writer – Dilzer Consultants Pvt Ltd

Sources