We Promise to help you plan better.

Fill up this simple form to speak to a certified financial planner.

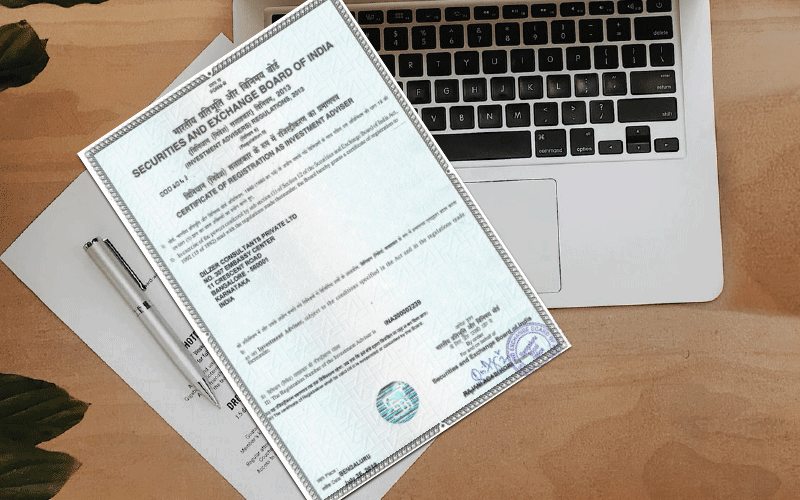

Dilzer Consultants Private Limited is a SEBI Registered Investment Advisor. License No: INA 200002239.

We firmly believe that true financial security fosters happiness across mental, emotional, and spiritual dimensions. Our mission is to empower our clients to achieve their goals by offering personalized financial guidance in an environment built on trust. We are committed to helping our clients preserve their wealth, accumulate assets strategically, and consistently outperform benchmarks to ensure long-term financial success. By maintaining the highest standards of integrity and business ethics, we create a foundation for close, interactive engagement, making our clients feel valued, understood, and confident in their financial journey.

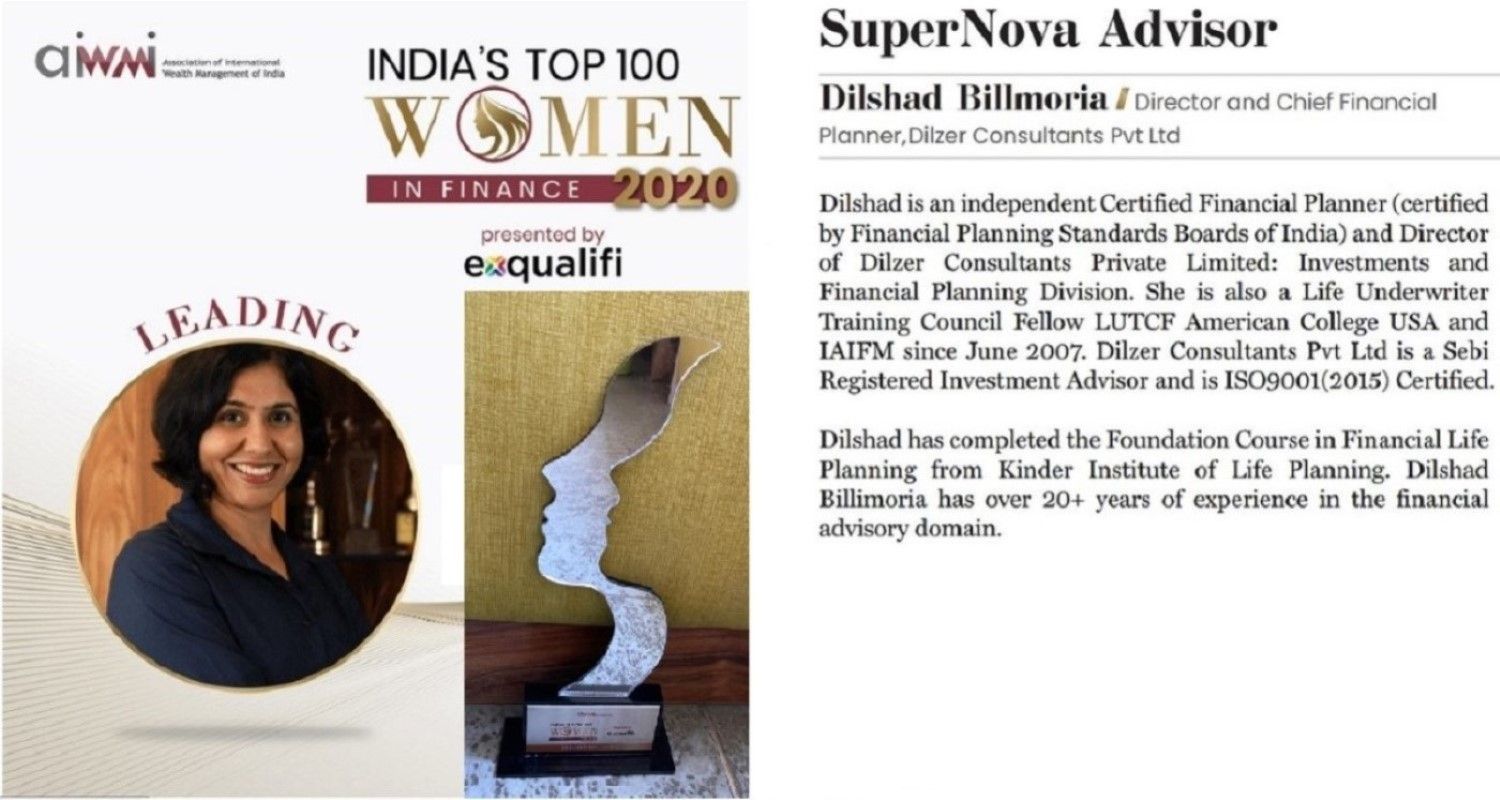

Dilshad Billimoria CFPCM is a Certified Financial Planner, Managing Director, and Principal Officer Dilzer Consultants Private Limited:

She is also a Life Underwriter Training Council Fellow LUTCF American College USA and IAIFM since June 2007.

Dilzer Consultants Pvt Ltd is a Sebi Registered Investment Advisor, since 2014.

Dilshad completed the Foundation Course in Financial Life Planning from Kinder Institute of Life Planning”

The organization provides Professional Investment Advisory and Financial Planning Services for a fee.

Dilshad Billimoria has over 23+ years of experience in the financial advisory domain.

With over 300 families and Assets Under Management of over 200 crores, we have created financial peace and independence in the lives of many people and helped them realise their financial goals.

Our clients are from India and all over the world, including UK, USA, New Zealand, Brazil, Dubai, Abu Dhabi, and Singapore.

We offer a progressive planning practice that differentiates itself by being disciplined, well researched and profitable. Our processes and practices start at grassroots, ensuring all angles are covered in the decision-making process.

It is our belief that by providing a personalized and consistent service experience, we ensure long and fruitful relationships with our clients.

The Financial Planning Division, prepares financial plans for clients following a detailed process of Initial Discussion, Data Gathering, Financial Plan preparation, Implementation and Review.

Their Investment Advisory service is in the area of Mutual Funds, Risk Management, Investment Planning, Wealth Management, Tax Planning, WILLs, Estate Planning and Retirement Planning.

Financial Planning has always amazed and intrigued her. There is always more to Personal Finance, like behavioral finance, people’s attitude to money, savings, childhood encounters, that affect decision making and therefore investment planning.

The greatest satisfaction is in creating and implementing a Financial Plan for people, and seeing it take shape!

She says: “It is our belief that by providing personalized and consistent service, and quality advice, which is always in the interest of the client, we ensure long and fruitful relationships with them.

In the true spirit of our commitment, we conduct open discussions to seek first to understand what is important to the client and then to be understood when finding solutions to their financial position.”

Deputy CEO

Keshav Kothari is a CFA level 3 Holder working with Dilzer Consultants Pvt Ltd since 2019. He is the Research Head at Dilzer Consultants Pvt Ltd.

Amarnath CN joined Dilzer Consultants Pvt Ltd in 2022. He is a Certified Financial Planner and Para Planner at Dilzer Consultants Pvt Ltd

Kamni Maskara

Raghavendra

Planning and Advisory

Gaurav Taneja

Gourav Roy

Planning and Advisory

Research and Client Connect

Research and Client Connect

Planning and Advisory

Junior Planner Advisory

Junior Planner Advisory

Junior Planner Advisory

Junior Planner Advisory

Planner Research and Client Connect

Haseena Begum holds a B.Com degree. She has been working for Dilzer as Relationship Manager Operations since January 2018. Haseena is responsible for handling operations related to work and implementation at Dilzer Consultants Pvt. Ltd. for its clients, besides handling tax-related matters.

Saraswathi holds a B.Com degree . She has been working as relationship manager operations at Dilzer since November 2011. Saraswathi is responsible for handling operations related work and implementation at Dilzer Consultants Pvt Ltd for our High Net worth Clients.

Mala is a BCom by qualification. She has been working as relationship manager operations since July 2011. Mala is responsible for handling operations related work and implementation at Dilzer Consultants Pvt Ltd for for its clients, besides handling tax related matters

Ayesha Tabassum has a Bachelor of Commerce Degree in May 2010. She is NISM VA Certified and has been with Dilzer since 2022

Relationship Manager Operations

Bhargav Venkata Sai

Relationship Manager Operations

Software engineer with 7+ years experience working in the complete product development life cycle of successfully launched applications. Highly accomplished in manipulating visual hierarchy. A regular contributor to system enhancement. A trainer who successfully motivated a group of young developers into getting highest accolades for their recent endeavors.

Monica is a People Operations professional with 20 years in the field. Her work has spanned creating and heading People Operations functions for organisations, designing and facilitating life skills workshops, coaching, and writing. In the last two years, she has channelled her energy towards growing organisations and entrepreneurs of start-ups, advising them on their people strategy.

Amit has more than 21 years of industry experience in multiple domains, including finance.

He is also one of the directors of Gigamodules Software Services LLP (2011).

Gigamodules has been a technical partner to Dilzer Consultants Pvt. Ltd. since 2014, and have been working with us for Web Hosting, Securing our website, as well as Custom Development work in PHP.

.

-

-

Human Resource Head

We value our clients and put their interest in the forefront. Their integrity and fiduciary capacity are of paramount importance to us. We cut the jargon and deliver what we promise.

We walk our talk and practice what we preach. We are transparent about our services, fees, what we can deliver and what we cannot. Hear what our clients have to say.

We are more about being solution centric than product centric. Our strategies are practical, realistic and timebound. Our methods and processes follow SEBI RIA guidelines.

We recommend solutions after an in-depth analysis of investment options based on scientific data. Every recommendation that we make is backed by research and data, helping us suggest options that are cognizant of our client’s risk tolerance.

Our Reporting and Financial Plan Platform thrives on technology making risk profiling accurate to enable better decision making, with robust, comprehensive and up-to-date reporting.

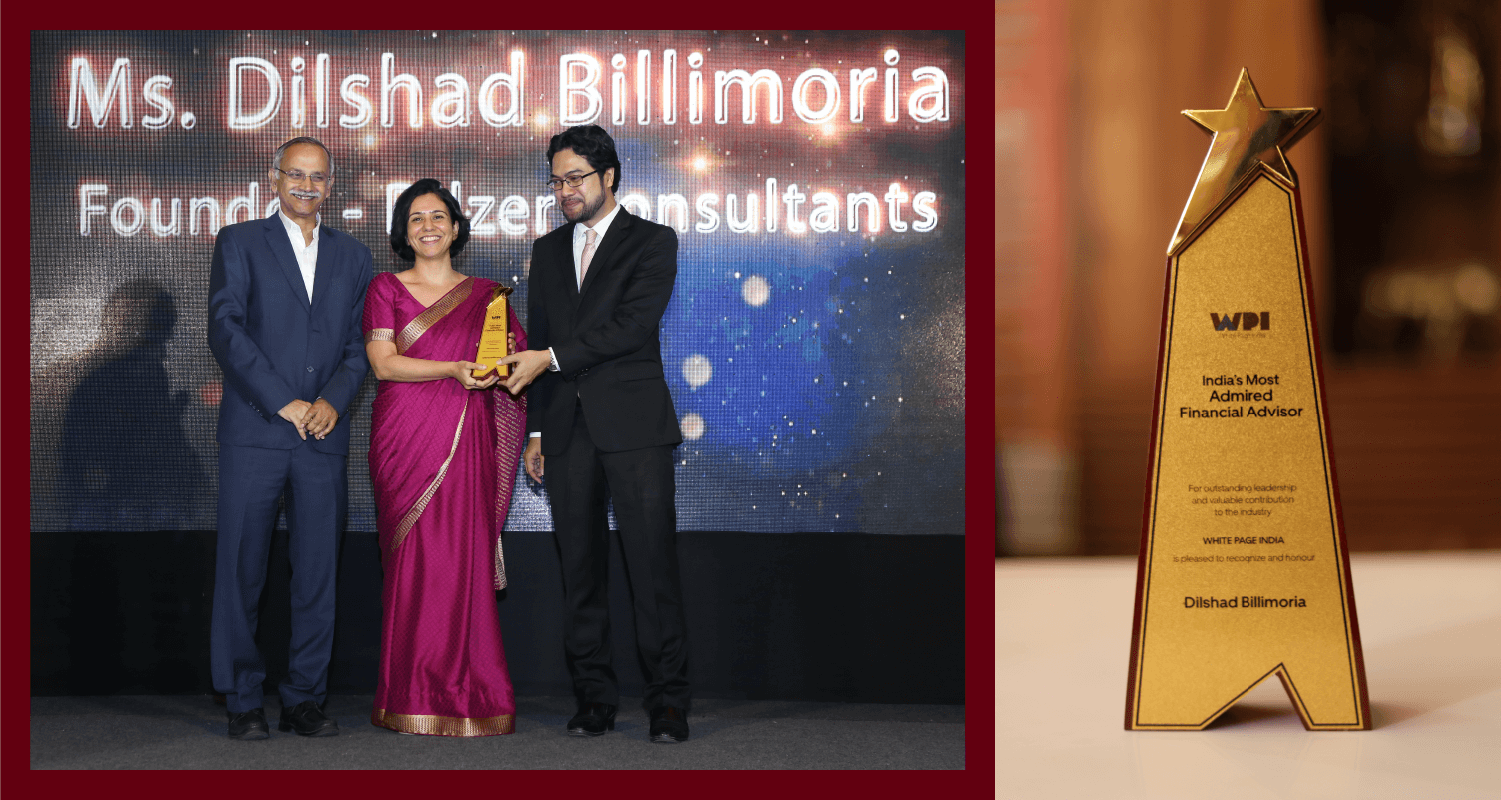

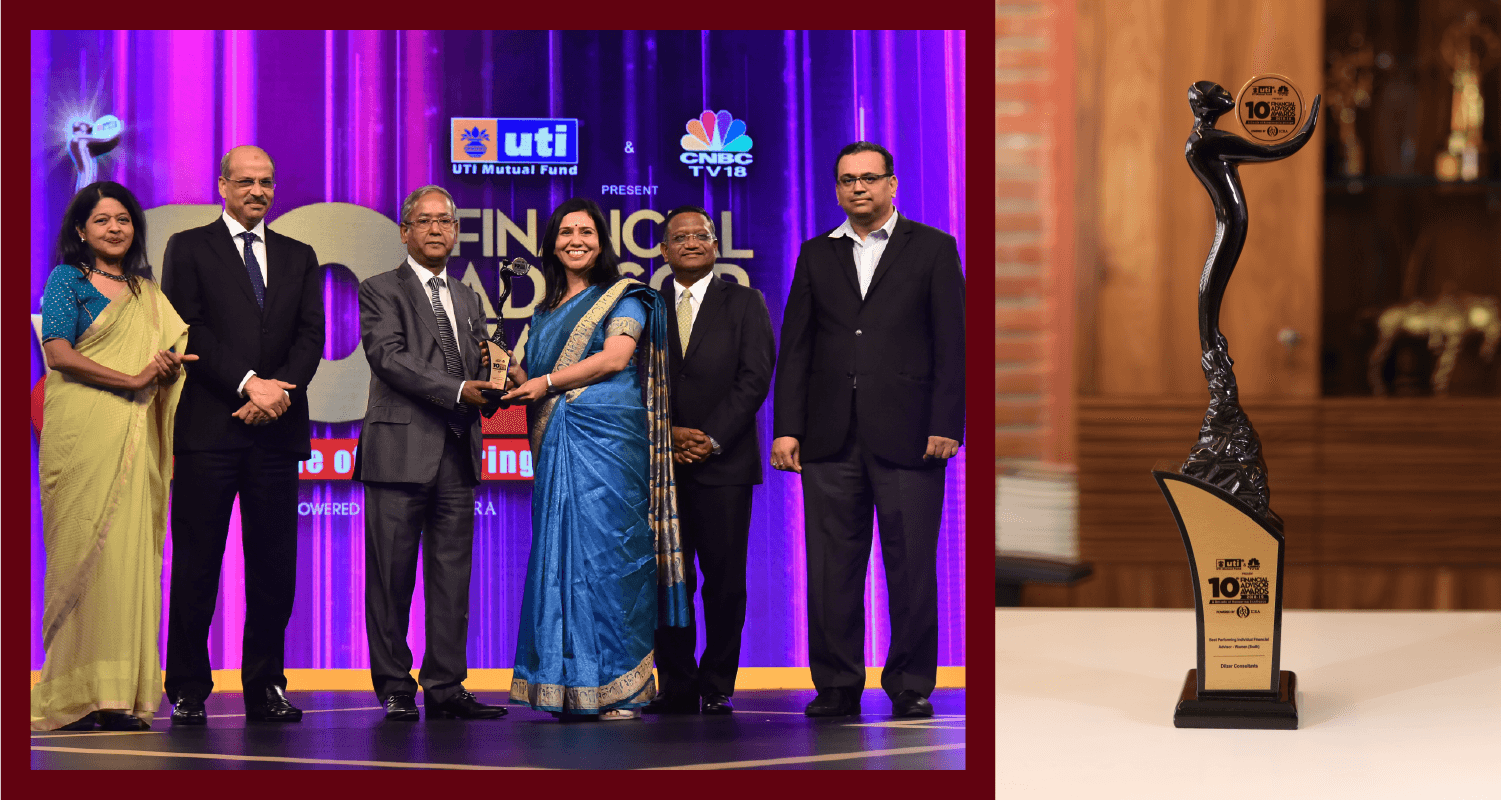

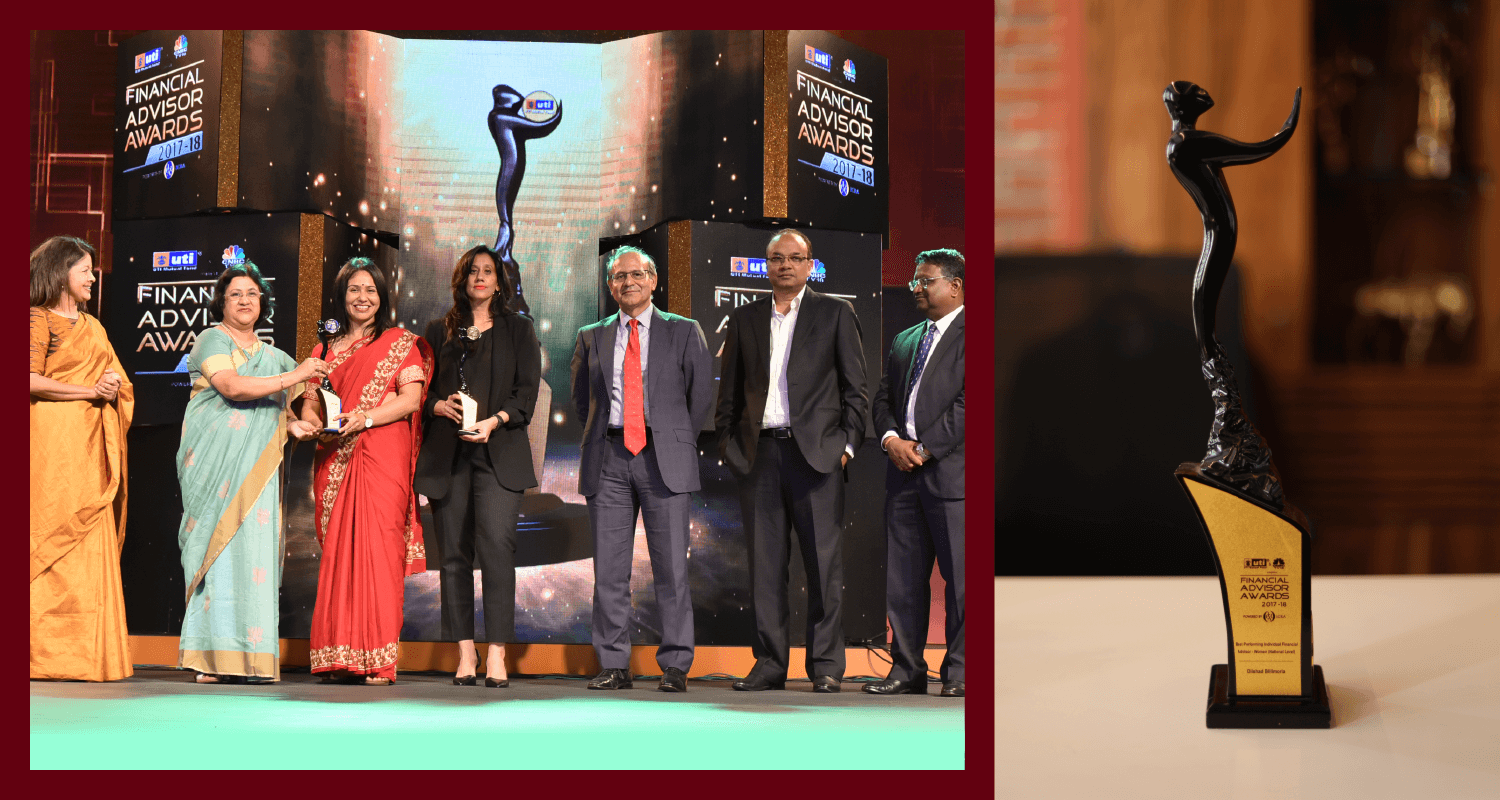

There is no shortcut to success. Our credibility comes with our Director, Dilshad Bilmoria ,who is a panel member of Outlook Money. She has also won the Best Woman Financial Advisory Award 2018 and 2019 - All India. She is a regular columnist at MINT, Outlook Money, Financial Planning Journal, myiris.com and has authored many articles on her blog.