Child Education Plan and Retirement Pension Plan – Insurance Company Analysis

| Child Plan | ||||||||||||

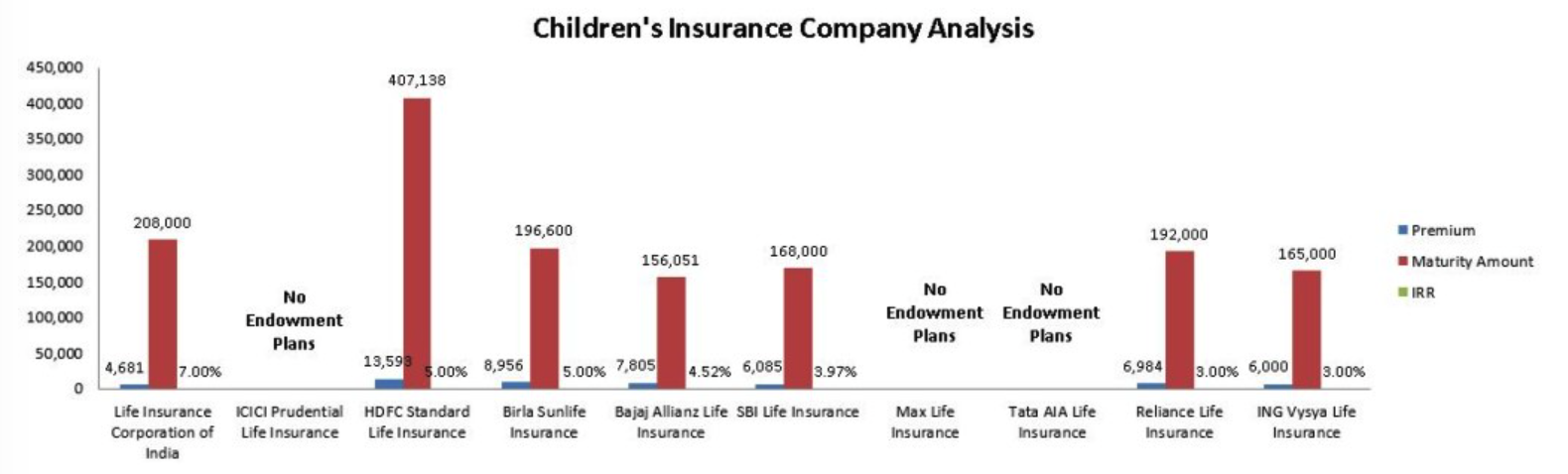

| Children’s Insurance Company Analysis | ||||||||||||

| PLANS | Life Insurance Corporation of India | ICICI Prudential Life Insurance | HDFC Standard Life Insurance | Birla Sunlife Insurance | Bajaj Allianz Life Insurance | SBI Life Insurance | Max Life Insurance | Tata AIA Life Insurance | Reliance Life Insurance | ING Vysya Life Insurance | ||

| Parameters | Policy Name | Child ULIPs | NA | Smart Kid Solution | Youngstar Super Premium | NA | Future Gain | Smart Scholar | Shikhsha Plus Super | Super Achiever | Education Plan | Wealth Maxima Child |

| Child Endowment Plan | MoneyBack | NA | Youngstar Udaan | Vision Star Plan | Invest Assure Policy | Smart Champ Insurance | NA | NA | Child Plan | Mera Aashirvad | ||

| Premium Amount | Child ULIPs | NA | 48,000 | 48,000 | NA | 48,000 | 48,000 | 48,000 | 48,000 | 48,000 | 48,000 | |

| Child Endowment Plan | 4,681 | NA | 13,593 | 8,956 | 7,805 | 6,085 | NA | NA | 6,984 | 6,000 | ||

| Sum Insured | Child ULIPs | NA | 480,000 | 480,000 | NA | 480,000 | 480,000 | 480,000 | 480,000 | 480,000 | 480,000 | |

| Child Endowment Plan | 100,000 | NA | 100,000 | 100,000 | 100,000 | 100,000 | NA | NA | 100,000 | 100,000 | ||

| Maturity Amount | Child ULIPs | NA | 2,106,545 | 1,688,839 | NA | 1,926,831 | 1,934,673 | 1,803,866 | 1,200,048 | 1,330,966 | 1,256,427 | |

| Child Endowment Plan | 208,000 | NA | 407,138 | 196,600 | 156,051 | 168,000 | NA | NA | 192,000 | 165,000 | ||

| IRR | Child ULIPs | NA | 7.00% | 5.12% | NA | 6.25% | 6.98% | 5.68% | 7.07% | 3.10% | 3.00% | |

| Child Endowment Plan | 7.00% | NA | 5.00% | 5.00% | 4.52% | 3.97% | NA | NA | 3.00% | 3.00% | ||

| Policy Term | Child ULIPs | NA | 20 | 20 | NA | 20 | 20 | 20 | 20 | 20 | 20 | |

| Child Endowment Plan | 24 | NA | 20 | 20 | 20 | 20 | NA | NA | 20 | 20 | ||

| Premium Payment Term | Child ULIPs | NA | 20 | 20 | NA | 20 | 17 | 20 | 8 | 20 | 20 | |

| Child Endowment Plan | NA | 15 | 10 | 10 | 17 | NA | NA | 20 | 20 | |||

| Insured Person (Parent/Child) | Child ULIPs | NA | Parent | Parent | NA | Parent | Parent | Parent | Parent | Parent | Parent | |

| Child Endowment Plan | Parent | NA | Parent | Parent | Parent | Parent | NA | NA | Parent | Parent | ||

| Riders & Benefits | Child ULIPs | NA | Accidental Benefit | Waiver of Premium | NA | No Riders offered by this company | Premium Payor Benefit Rider,Dual Protection, Accidental Benefit, Twin Benefit, Settlement Option, Maturity Benefit | No Riders; Death Benefit | NA | Term Life Insurance Rider Benefit, Major surgical benefit rider, family income benefit rider, accidental death, disability rider and critical condition benefit | Maturity Benefit, Life Cover | |

| Child Endowment Plan | NA | NA | Waiver of Premium | NA | No Riders offered by this company | Waiver of Premium | NA | NA | Guranteed Periodic Benefit, Tax Benefit, Maturity Benefit, Flexibilty, Protection for your family | Waiver of Premium, Guaranteed Life Cover, Guaranteed Tax Free Maturity Benefit, Flexibilty to receive periodic payout | ||

| Retirement | |||||||||||

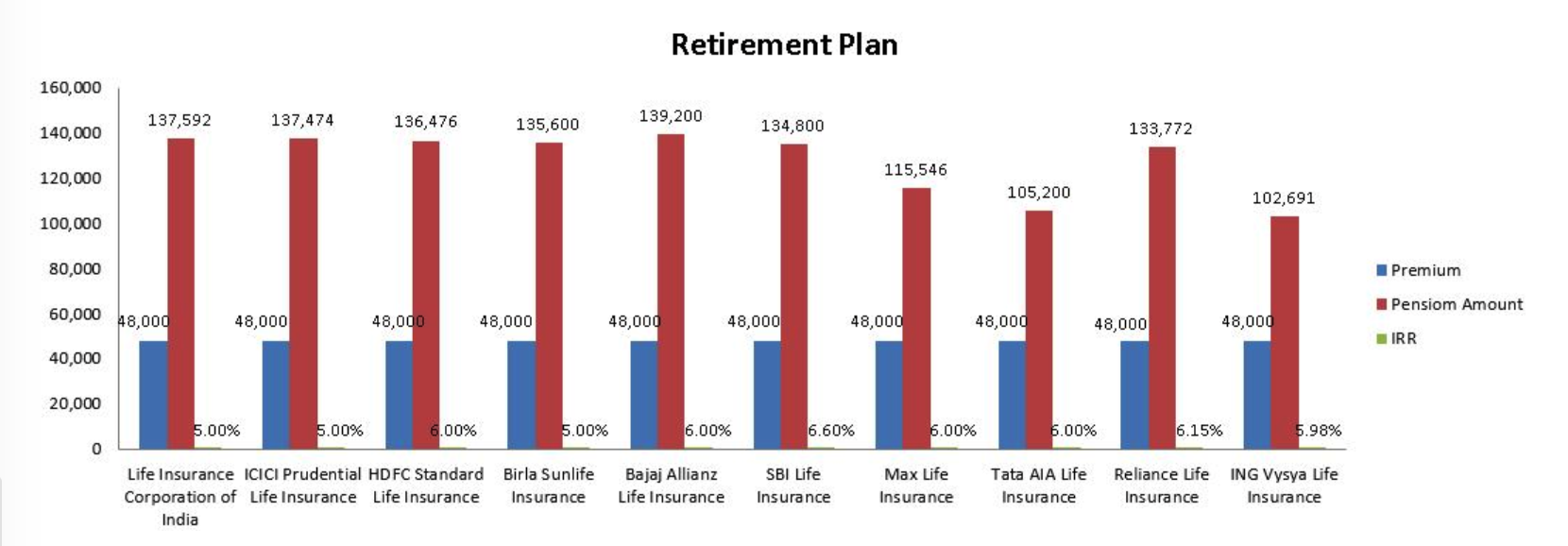

| Retirement Pension Plan – Insurance Company Analysis | |||||||||||

| PARAMETERS | Life Insurance Corporation of India | ICICI Prudential Life Insurance | HDFC Standard Life Insurance | Birla Sunlife Insurance | Bajaj Allianz Life Insurance | SBI Life Insurance | Max Life Insurance | Tata AIA Life Insurance | Reliance Life Insurance | ING Vysya Life Insurance | |

| Individual Retirement Account | Policy Name | Jeevan Anand | Easy Retirement | Pension Super Plus | Empower Pension Plan | Retire Rich | Saral Pension | Forever Young Pension Plan | Maha Life Gold | Reliance Smart Pension Plan | Exide Life Golden Years Retirement Plan |

| Policy Type | Traditional | ULIP | ULIP | ULIP | ULIP | Traditional | ULIP | Traditional | ULIP | ULIP | |

| Premium Amount | 48,000 | 48,000 | 48,000 | 48,000 | 48,000 | 48,000 | 48,000 | 48,000 | 48,000 | 48,000 | |

| Sum insured | 1,008,000 | 1,008,000 | 1,008,000 | 1,008,000 | 1,008,000 | 1,008,000 | 1,008,000 | 1,008,000 | 1,008,000 | 1,008,000 | |

| Pension Amount | 137,592 | 137,474 | 136,476 | 135,600 | 139,200 | 134,800 | 115,546 | 105,200 | 133,772 | 102,691 | |

| IRR | 5.00% | 5.00% | 6.00% | 5.00% | 6.00% | 6.60% | 6.00% | 6.00% | 6.15% | 5.98% | |

| Policy Term | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | |

| Commutation Option | No | Yes, 33.33% | Yes, 33.33% | Yes, 33.33% | No | Yes, 33.33% | Yes, 33.33% | No | No | No | |

| Tax Benefit | 150,000 | 150,000 | 150,000 | 150,000 | 150,000 | 150,000 | 150,000 | 150,000 | 150,000 | 150,000 | |

Assumptions

| Sr. No. | Assumption |

| 1 | Top 10 life Insurance Companies of India in 2015. |

| 2 | For child insurance- Age of Parent considered is 35 years and child’s age is 1 year. |

| 3 | For child insurance – Sum Insured is 10 times of Premium Amount. |

| 4 | For child insurance – Return assumption rate of 8% pre expenses is assumed |

| 5 | For retirement policy- Sum insured is 105% of total premium paid across the term. |

| 6 | For retirement policy- Pension amount and tax benefit is annual amount. |

| 7 | Pension is Taxable and only 1/3rd can be computed as tax free. |

Sources

Credits – Divya Agarwal

17 October, 2015