Decoding your Credit Card Bill.

Credit Cards offer one of the greatest conveniences by offering easy credit, in the need of the hour but on the contrary, they are notorious instruments known to make their owners spend beyond their means and fall into a debt trap. Well,sometimes! Credit Cards are a necessary evil in the financial world as no other instrument offers such convenience of easy accessibility of funds It depends on the user to extract the maximum benefit of the conveniences they offer and minimize the effects of high interest rates and other charges.

Credit cards are issued by almost all recognized banks with varying interest rates and payback options like free credit period, reward points etc. It is important to understand the terms and conditions of these features before getting enticed and making use of the privileges and easy credit options offered without reading the fine print. Credit Card billing and features are one of the most widely misunderstood terms, with penalties mentioned in fine print.

One of the most attractive marketing feature for the credit card, is the free credit period. The free credit period ranges anywhere between 50-58 days for cards of different features from various banks. However it is important to understand that the free credit period is not exactly like an interest free loan and it might not be applicable in all cases.

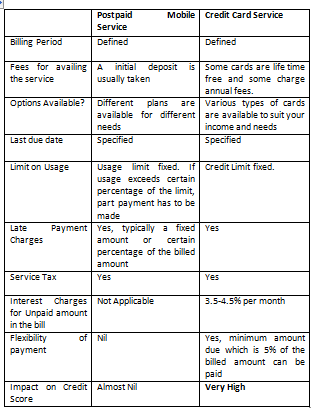

Credit card billing is similar to any other billing of utilities/services like mobile services, electricity etc. To understand how the credit card billing works, let us compare it to how billing of mobile service works.

Let us assume a person has subscribed to a postpaid cellular service whose billing period is from 1st of the month to 30th of the month. He also has a credit card which has the same billing period. Let us consider this example for the months of January and February.

Assuming the person utilizes the mobile services and also makes credit card transactions in January, the bill for both mobile service and Credit card will be generated on the 1st of February. The customer is given a time period of 15- 20 days to pay the bill. Let us assume the last day to pay the bill is 20th of February.

For both the services – the cost for any service utilized throughout the month of January has to be paid by 20th of February, be it borrowing money through a Credit Card or using mobile services.

So for a credit card, only the transactions made on 1st of January qualify for interest free period of 50 days. If any purchase is made on 31st January, it has to be paid back within 20 days. Also, the interest would not be levied only if there is no previous balance on the card. However for a mobile bill, if there is any previous balance a fixed amount of fine would be levied as late-payment charges.

The interest charges on Credit card varies as high as 3.5%-4.5% per month. This is because unlike mobile service where the services offered is calling, texting and data services, Credit card offers you free cash/cash transactions without any security. The chances of default, due to which the lending banks suffer severe losses are very high and can run to lakhs of rupees for anyone. A mobile service provider can just stop the service for the defaulter and the losses for him will be few thousands per person.

The credit card provides the flexibility of paying your bills in part. You can pay the minimum amount due every month and continue to enjoy the services till your credit limit is exhausted.

The above table is just to demonstrate the similarity in billing of the credit card and a postpaid mobile bill. It is important to understand this and use your credit card judiciously.

Let us understand the credit card interest and late payment charges levied for the earlier example.

Assume a person makes a cash transaction of Rs.20000 on his Credit Card on 15thJanuary. On 2ndFebruary his bill is generated. Last date of payment in 20th February. Assuming an interest rate of 3.5%, is billed for late payment. Case 1: No previous balance

Outstanding Balance – Rs.20000

Total Amount payable to the Card – Rs.20000 (without interest)

Minimum Amount Due – Rs.1000(Monthly interest will be levied on the remaining Rs.19000 till it is paid in full)

Case 2: Previous balance from earlier transactions is Rs.15000.

Outstanding Balance – Rs.35000

Total Amount payable to the Card – Rs.35962.5(Rs.20000 + 3.5%/2*20000+3.5%*15000+Rs.15000) + taxes applicable

Minimum amount due – Rs.1798 (Monthly interest will be levied on the remaining Rs.34164 till it is paid in full)

Case 3: Bill amount not paid on time previous month and outstanding previous balance of Rs.15000

Outstanding Balance – Rs.35000

Late Payment Fees – Rs.700

Total Amount payable to the Card – Rs.36662.5 (Rs.20000 + 3.5%/2*20000+3.5%*15000+Rs.15000+700) + taxes applicable

Minimum amount due – Rs.1833.5(Monthly interest will be levied on the remaining Rs.39814 till it is paid in full)

From the aboce example, in case 1 there is no interest charge if the entire outstanding is cleared on time. In case 2, because of previous outstanding balance the transaction of Rs.20000 in the middle of the month also is charged interest. In Case 3, late payment charges have been applied as the previous bill was not paid on time. The outstanding balance compounds every month as interest rate is applied monthly. In case only minimum amount due is paid every month, the interest charges are also added to the outstanding balance and subjected to further interest charges in the succeeding months.

Some tips to get the best out of your Credit Card:

- Always clear the Credit Card Debt in full. The debt on it should never exceed your bank balance.

-

Make high value transactions only in the beginning of the billing period. This way you can get interest free period of 50+ days, in case you don’t have any outstanding debt.

-

Choose the appropriate credit card for your needs and preferably go for a lesser credit limit. This will help in keeping unwanted expenses under control.

Akhila Muralidhar

Senior Para Planner- Dilzer Consultants Pvt Ltd