Mutual fund Basics

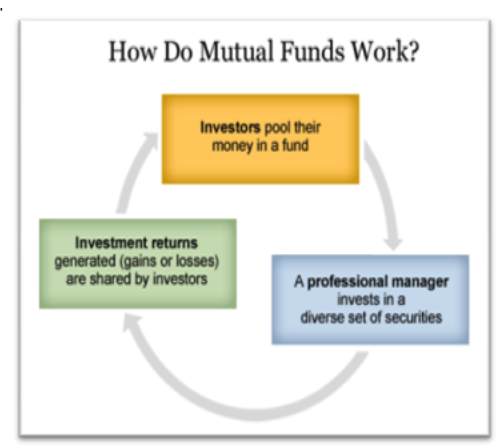

A mutual fund is not an investment by itself. Rather it is an investment vehicle wherein one can invest money in a professionally managed fund that has a portfolio of different underlying assets like stocks, bonds, cash, indexes

.Based on investment objective, fund manager philosophy and style, the fund manager’s responsibility is to ensure that returns are maximised and risks are minimized.

Why mutual funds do not guarantee returns?

The money that an investor puts in a mutual fund is invested by professional fund managers in line with the objective of the scheme.The performance of these investments impacts the returns generated by the mutual fund scheme. The underlying Securities in which a mutual fund is invested, is in itself not guareented. Therefore returns from a fund is not guareented.

The main three deciding factors of performance of the mutual fund investment are:

- The movement of the market in which the money is investedwhich is not within the control of the fund manager.

- The performance of individual securities heldwhich again cannot be controlled.

- The skills of the investment management team or the fund manager which can be improved upon or controlled.

Brief Explanation

A mutual fund scheme pools money from many investors and invests the corpus in equity and debt markets. However for both Equity and Debt Funds returns are not guaranteed.

Equity Funds do not give guarantee about the return.

Debt fundsalso do not assure returns even though they invest in fixed return instruments.This is because debt securities also have a listing price as they get listed on the debt markets and are thereafter traded in the debt market, which is subject to price differenciation because of demand and supply.. However the fixed returns lend stability to the debt fund and thus Debt funds give modest returns when compared to equity funds.

Regulatory ban on guarantees

The Securities and Exchange Board of India (Sebi) has banned all mutual funds from assuring any income- dividend and principal- to the investors. Even few years ago, some funds used to assure returns but manyof them could not fulfill their guarantees as they made losses due to market volatility. Hence, now there is a complete ban on assured returns.

SEBI directives also states that the name of the scheme cannot indicate any guaranteed returns as this might mislead the investors.

Capital protection-oriented funds

These funds too, only aim to protect and, do not guarantee a person money. They are closed ended and invest in a mix of equity and debt scrips in a way that one can get back the principal, with some gains. But factors like their poor track record, complicated structure and high distributor commissions are a few reasons to stay away from them.

Why Mutual Funds are still a good investment option and investors can consider mutual funds over others to achieve their investment goals even when the returns are not gurananteed?

Whether the objective is financial gains or convenience,mutual funds offer many benefits to its investors and hece is a good investment option.

The benefits are mentioned below :

Combating Inflation

Mutual Funds help investors generate better inflation-adjusted returns, without spending a lot of time and energy on it.Most people who prefer keeping their investments in savings banks do not consider the inflation factor while doing so.Mutual Funds provide an ideal investment option to place one’s savings for a long-term inflation adjusted growth, so that the purchasing power of the hard earned money does not plummet over the years.

Convenience

Mutual funds are an ideal investment option when one is looking at convenience and timesaving opportunity. With advantages like low investment amount alternatives, the ability to buy or sell them on any business day and a number of choices based on an individual’s goal and investment needs, investors need not spend time to research and find out avenues of investment.The same gets done by the fund managers.

Expert Managers

Backed by a dedicated research team, investors get the services of an experienced and expert fund manager who handles the financial decisions based on the performance and prospects available in the market on behalf of the investor to achieve the objectives of the mutual fund scheme.

Low Cost of Investment

Probably the biggest advantage for any investor is the low cost of investment that mutual funds offer, as compared to investing directly in capital markets. Most stock options require significant capital, which may not be possible for young investors who are just starting out and do not have enough capital.

Mutual funds, on the other hand, are relatively less expensive. The benefit of scale in brokerage and fees translates to lower costs for investors. One can start with as low as Rs. 500 and get the advantage of long term equity investment.

Diversification

Mutual funds help to mitigate risks to a large extent by distributing investment across a diverse range of assets. Mutual funds offer a great investment opportunity to investors who have a limited investment capital and cannot afford to take risks.

Scope of Higher Returns

Based on medium or long-term investment, mutual funds have the potential to generate a higher return, as onehas the option to invest in a variety of sectors and industries.

Liquidity

Investors have the advantage of getting their money back promptly, in case of open-ended schemes based on the Net Asset Value (NAV) at that time. If the investment is close-ended, it can be traded in the stock exchange, as offered by some schemes.

Safety &Transparency

Fund managers provide regular information about the current value of the investment, along with the strategy of investment and outlook, to give a clear picture of how the investments are doing. The portfolio is available at all times and the performance, charges are all transparent.

Moreover every mutual fund is regulated by SEBI. Henceone can be assured that the investments are managed in a disciplined , regulated and safe manner.

Conclusion

To conclude, though a mutual fund is not a guaranteed return product it is capable of producing good returns. The structure of mutual fund is such that it is just a pass-through vehicle which passes on the risk and return to the fund’s investors. It is but an effective and efficient way of managing money wherein a professional fund management team takes care of the investor’s money on behalf of the investor.

Happy Investing!!

Debalina Roy Chowdhury

Dilzer Consultants

Sources

http://fundsketch.com/mutual-fund-returns-are-not-guaranteed/

https://www.valueresearchonline.com/story/h2_storyView.asp?str=200320

15 Sep 2017