Types of tax benefits available for home loan purchase

A home is a ‘once-in-a-lifetime’ investment for many of us. It is natural that we want to make it as big and better as practically possible. But the shooting cost of property nowadays makes it difficult to acquire your desired property. No doubt, having the possibility of availing a home loan has improved affordability. It is difficult to buy a dream house entirely with our savings. Availing a home loan not only increases our affordability but also give us a huge savings in our tax liability too. The home loan is one of the most efficient tax saving instrument, which not only helps us to acquire an asset, but also gives the tax benefit on the principal as well as the interest amount we re-pay to the loan. There is no other loan like home loan which gives this much of tax befit to an individual, especially to the salaried class.

So, let’s look at what are the tax benefits an individual can enjoy by availing the home loan.

Tax Benefit on home loan

Our government has always shown a great inclination to encourage citizens to invest in house. Many schemes like Pradhan Mantri Awas Yojana are flashing green light on the Indian housing sector by striving to bring down the issues of affordability and accessibility. And when you buy a house on a home loan, it comes with multiple tax benefits too that significantly reduce your tax outgo since home loan is eligible for tax deduction under different sections of Income Tax Act (IT ACT). The tax benefit from a home loan can be availed in two ways:

- Tax benefit on the registration fee and principal repayment

- Tax benefit on the interest paid

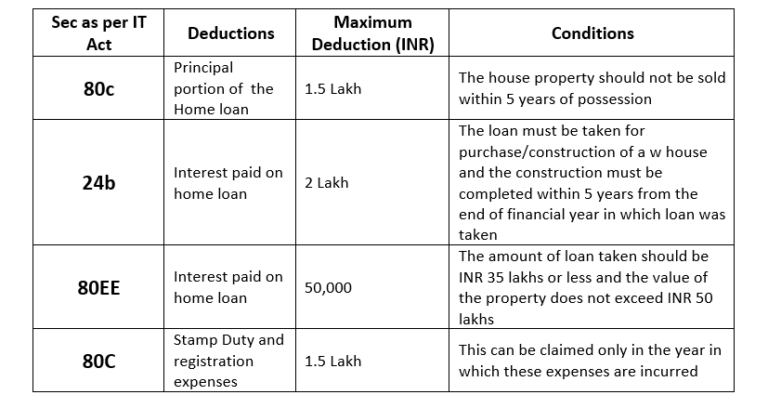

Tax benefit on registration and principal repayment. Under Sec (U/S) 80C

On the registration of the property: – Whenever you buy a property, it has to be registered in your name to transfer the rights of the property from the builder/seller to you. For registering a property in India, you have to pay a certain percentage of the value of the property to the government as the stamp duty and certain expenses in respect of the registration. Stamp duty & registration charges and other expenses which are directly related to the transfer are allowed as a deduction under Section 80C. The maximum deduction amount allowed under this section is capped at Rs.1,50,000. This deduction can only be claimed in the year the actual payment is made towards these expenses. If you buy the property on 15th Dec 2017, then you can claim this deduction U/S 80c only in the FY 2017-18.

The principal Repayment:- As a home loan buyer, Sec 80C can bring you relief as you are required to pay hefty Equated Monthly Instalments (EMI). The EMI paid by you every month has two components – principal and interest. The principal portion of the EMI paid for the year can be claimed as a deduction from gross total income under section 80C before calculating the net taxable income. The maximum amount that can be claimed is up to Rs 1.5 lakh. One can get a loan certificate from the lending bank’s branch or go online. The certificate will show how much of the total EMI paid in a year was repayment of the principal amount borrowed.

But Sec 80C (5) also states that in case the assesse transfers the house property, on which he has claimed tax deduction under Section 80C, before the expiry of 5 years from the end of the Financial Year in which the possession has been obtained by him, then no deduction and tax benefit on Home Loan shall be allowed under Section 80C.

Tax benefit on interest paid U/S 24 of IT Act

The interest payment towards the home loan usually arises in two situations

Pre-construction:- When you pay the interest only on the home loan when the property is under construction.

Post-construction:- When you pay the interest along with the regular EMI after the completion of the property.

Pre-construction (Under construction):- This is the time when your property is under construction and you pay only the interest for the portion of loan you have availed. This is otherwise called as Moratorium period in the loan terms. The interest paid during this period cannot be claimed for tax deduction on that Financial Year (FY). But, your eligibility to claim interest on the home loan as a deduction begins only upon completion of construction or immediately if you buy a fully constructed property. The income tax law provides deduction for such interest in five equal instalments starting from the year in which the property is acquired or construction is completed. The maximum eligibility remains capped at Rs.2 lakh per FY.

Post-construction:– The income tax act provides tax deduction on the interest portion of your EMI which you pay towards your home loan. The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs.2 lakh under Section 24. For Assessment Year 2018-19, maximum deduction for interest paid on Self Occupied house property is Rs.2 Lakh. In case of a let out property, there is no upper limit for claiming interest. For claiming this benefit, the loan must be taken for the purchase/construction of a house and the construction of the house must be completed within 5 years from the end of financial year in which loan was taken. You can claim this deduction for interest repayment on loans taken from anyone provided the purpose of the loan is purchase or construction of a property. You can also claim deduction for money borrowed from individuals for reconstruction and repairs of property. It does not have to be from a bank. “For tax purposes, the loan is not relevant, the usage is”. This Deduction can be claimed from the year in which construction of the house is completed.

Other Deductions

Further deduction on Home loan interest on Sec 80EE

The Section 8EE of the income tax provides the first time home buyers a further deduction of Rs.50000 in a FY over and above Sec 24 towards the interest payment on home loan EMI. The section also says that the deduction will be available only if the individual met the following conditions.

- This is the 1st house you have purchased

- Value of this house is Rs 50 lakhs or less

- Loan taken for this house is Rs 35 lakhs or less

- Loan has been sanctioned by a Financial Institution or a Housing Finance Company

- Loan has been sanctioned between 01.04.2016 to 31.03.2017

- As on the date of sanction of loan no other house is owned by you

Tax deduction on the home loan processing fee

As per the income tax law, the processing charges paid for the home loan are considered as interest and therefore deduction on the same can be claimed. “Under the Income Tax Act, Section 2(28a) defines the term interest as ‘interest payable in any manner in respect of any money borrowed or debt incurred (including a deposit, claim or other similar right or obligation)’. This includes any service fee or other charge in respect of the loan amount.

All deduction at a glance

Tax benefit on Home loan for joint owners

If you have purchased the property jointly, the co-owners can claim these expenses in their respective income tax returns based on their share in the property. Each of the loan holders can claim a deduction for home loan interest up to Rs.2 lakh each under sec24 and principal repayment under sec 80C up to Rs 1.5 lakh each in their individual tax returns. To claim this deduction, they should also be co-owners of the property taken on loan. So, loan taken jointly with your family can help you claim larger tax benefit.

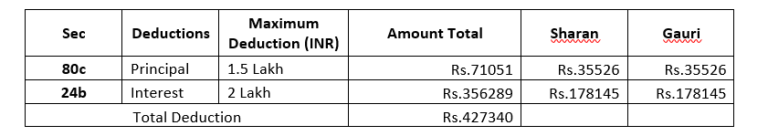

For Eg:-Mr. Sharan Shetty have taken a home loan of Rs. 35,70,000 along with his wife Gauri. When they generate the home loan statement for the FY2017-18, the total principal payment towards home loan amounted Rs.71051 and the interest amounted Rs.300724. For this financial year along with above they have a pre-construction interest of Rs. 55565 also. The property is owned jointly with 50% ownership each.

The following are the deductions available while computing the income tax.

The total deduction availed by both of them jointly is Rs. 427340. In the same case if Sharan was the only owner then the maximum deduction they can avail will be limited to Rs. 271051. So, it will be better if you can avail the home loan jointly and if the co-owner is a women you will get interest reduction also.

Conclusion

Once the loan is fully paid and the borrower gets the complete ownership, it becomes an asset that can help to guard from future troubles. So, now a days investors started seeing home loan not only as a loan but also as a great tool to create asset and save tax on his hard earned money.

Reference:-

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest-on-home-loan

https://cleartax.in/s/registration-charges-stamp-duty-exemption-on-property

Tax Benefit on Home Loan: Section 24, 80EE & 80C

https://www.moneycontrol.com/news/business/personal-finance/how-to-use-home-loans-effectively-for-tax-benefits-947539.html

https://www.livemint.com/Money/d5hbywRQQtbFGwHEbBZs9L/Claim-home-loan-interest-for-tax-deduction-from-rental-incom.html