What are the costs involved in various financial products

Financial products act as an investment avenue and provide the required financial security to the investors based on the risk-return profile of the financial products. Traditionally, in India there were financial products offered by Government like

- Bank deposits by Public sector banks.

- Insurance products by LIC.

- RD, NSC and KVP by postal department.

However with the liberalization of financial services industry, a variety of financial products have been introduced through participation of private and foreign entities in addition to the public sector enterprises. These include :

- Debit and credit cards by banks.

- Open end and closed end mutual fund schemes.

- Exchange traded funds (ETFs)

- Index funds

- Systematic Investment Plans (SIPs)

- Sector Funds etc.

- Life and Non-life Insurance schemes

- Unit Linked investment plans

- Pension plans

- Children’s education plans etc.

- Shares

- Debt Securities.

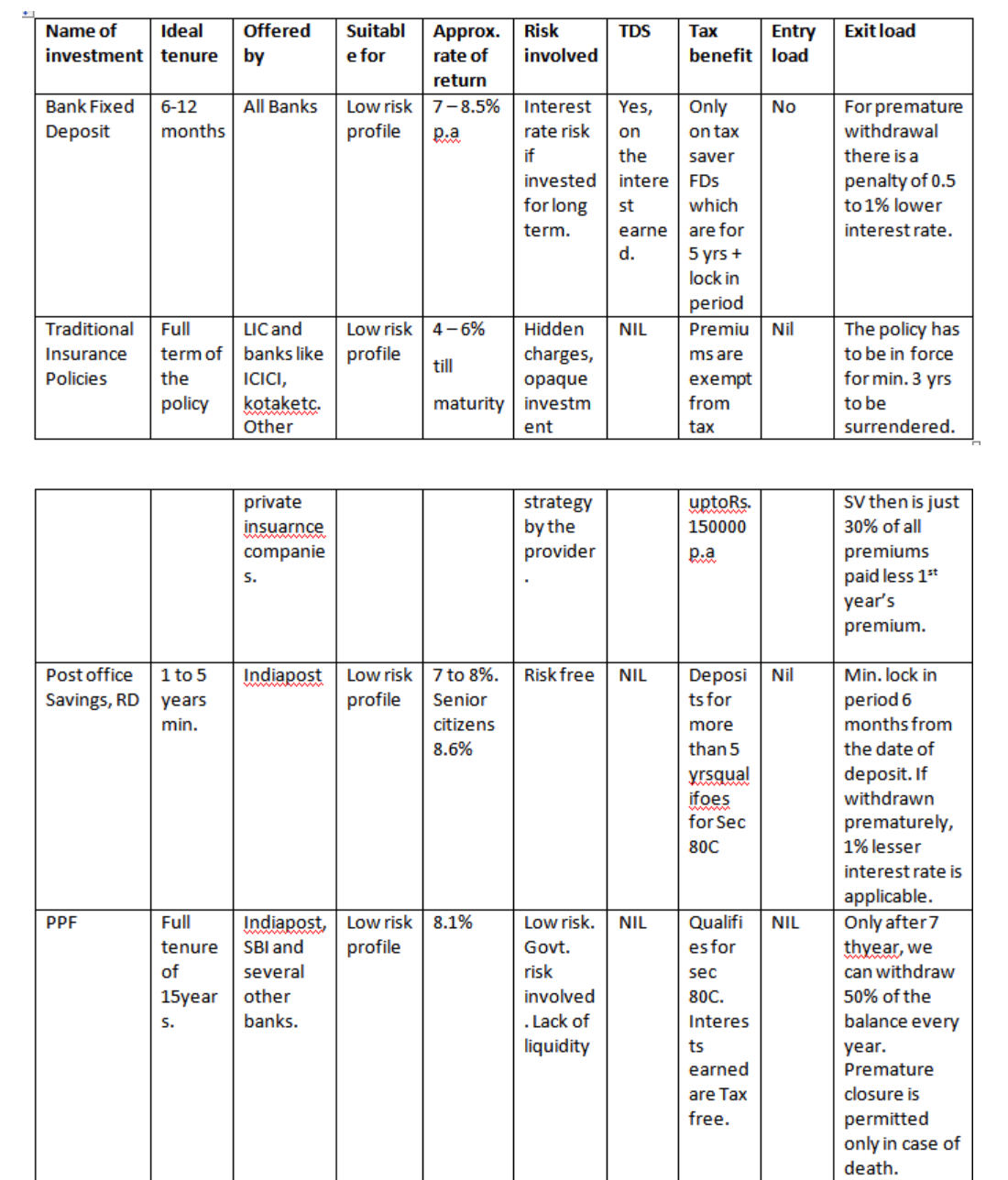

The costs involved in a few of the financial products is provided below

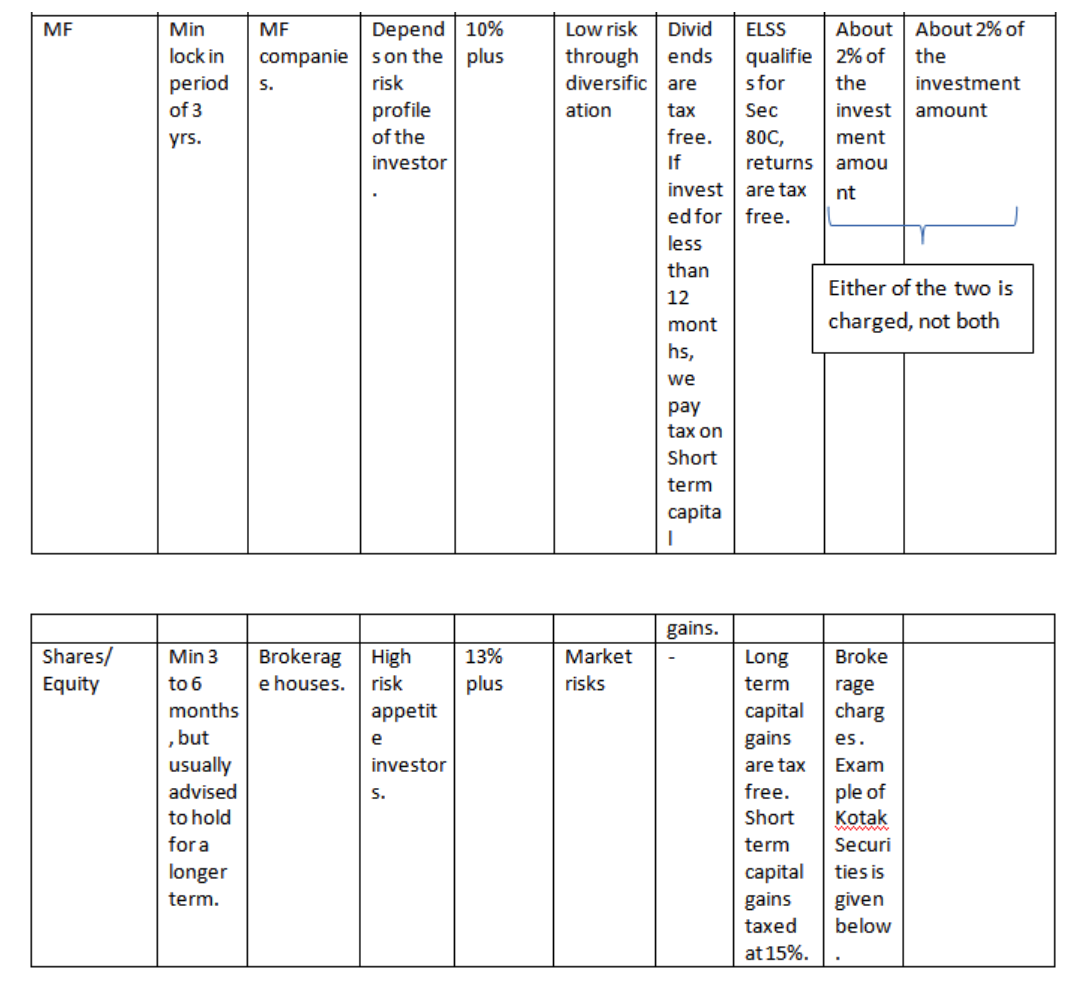

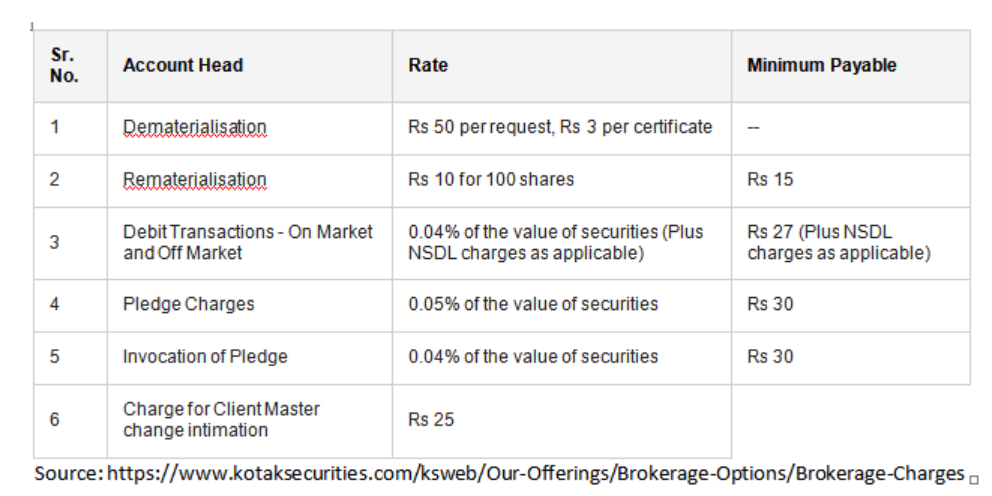

The brokerage charges as stated by Kotak Securities in their website is given below, to give an understanding on what basis and to which transactions the brokerages are charged and how much.

In the same context, in today’s world it becomes quite significant to also know about the PMS or Portfolio Management Services.

What is Portfolio Management Services or PMS?

Portfolio Management Services account is an investment portfolio in Stocks, Debt and fixed income products managed by a professional money manager, that can potentially be tailored to meet specific investment objectives.

PMS have equity and debt options. Earlier, they used to offer real estate, unlisted shares and structured products options as well, but now these come under the Alternative Investment Fund (AIF) category and are managed according to the market regulator’s separate regulations on AIF.

HOW IT WORKS?

The investor and the portfolio manager enter into an agreement detailing the investment strategy, goals and other details. The investor can offer either a sum of up to Rs 25 lakh or stocks worth this much.

There are broadly two types of PMS

- Discretionary PMS – Where the investment is at discretion of the fund managerand he has the power of attorney to manage the investor’s demat account. The client has no intervention in the investment process.

- Non-Discretionary PMS – Under this service, the portfolio manager only suggests the investment ideas. The choice as well as the timings of the investment decisions rest solely with the investor. However the execution of the trade is done by the portfolio manager.

Portfolio Management Services (PMS) Charges

The charges are decided at the time of investment and are vetted by the investor.

-

Entry Load –PMS schemes may have an entry load of 3%. It is charged at the time of buying the PMS only.

-

Management Charges– Every Portfolio Management Services scheme charges Fund Management charges. Fund Management Charges may vary from 1% to 3% depending upon the PMS provider. It is charged on a quarterly basis to the PMS account.

-

Profit Sharing– Some PMS schemes also have profit sharing arrangements (in addition to the fixed fees), wherein the provider charges a certain amount of fees/profit over the stipulated return generated in the fund.

**For Eg PMS X has fixed charges of 2% plus a charge of 20% of fees for return generated above 15% in the year. In this case if the return generated in the year by the scheme is 25%, the fees charged by the PMS will be 2% + {(25%-15%)*20%}.

The Fees charged is different for every Portfolio Management Services provider and for every scheme. It is advisable for the investor to check the charges of the scheme.

Apart from the charges mentioned above, the PMS also charges the investors on following counts as all the investments are done in the name of the investor:

- Custodian Fee

- Demat Account opening charges

- Audit charges

- Transaction brokerage

VarshaGaikwad.

Para Planner-Advisory Dilzer Consultants pvt Ltd.

Souces:

http://www.microsave.net

http://www.dnb.co.in

http://www.livemint.com

http://www.tflguide.com

http://www.businesstoday.in

http://finotax.com

22 April 2016