Exclusions on home insurance

Home insurance provides a person with a flexible and comprehensive cover that protects one’s home against all possible contingencies.

Apart from covering the structure itself, a good home insurance policy provides protection to the contents of the house. Most of the home insurance policies available in India offer cover against earthquake, floods, storm, and cyclone and also the cost of alternative accommodation, in case the home is damaged.

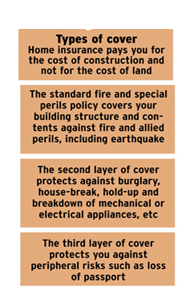

The Types of Covers which are available against the Insured Perilsunder a home insurance during the policy period are for:

Fire and Special Perils including earthquake (covering Building and Contents of the Building)

Burglary and House breaking including Larceny and Theft and Breakdown of appliances i.e. mechanical / electrical / electronic appliances

Robbery including waylaying and snatching away of valuables

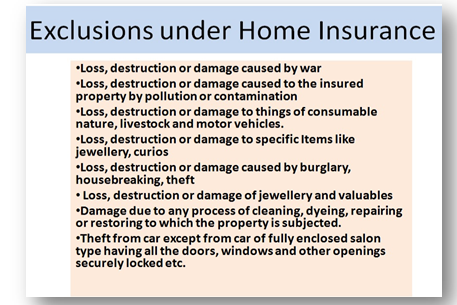

What is not covered by a home insurance policy?

When taking out Home Insurance, or any kind of insurance for that matter, it is important to check the finer details of the policy one buys. Exclusions, in relation to insurance policies, are clauses inserted into the terms of a policy which state what items, or events, are not included in the cover provided. It is thus always wise to go through the small print of a Home Insurance cover document as insurers differ in what they will and won’t cover.

Listed below are a number of exclusions under the types of cover of a Home Insurance policy.

1.Exclusions in respect of loss or damage due to Fire and Allied perils including earthquake:

The Fire and Special Perils Section does not cover the following:

- Loss, destruction or damage caused by war, invasion, act of foreign enemy, hostilities or war like operations ,civil war, mutiny or civil commotion assuming the proportions of or amounting to a popular rising, military rising, rebellion, revolution, insurrection or military or usurped power.

- Loss, destruction or damage caused to the property insured, directly or indirectly, by ionising, radiation or contamination by radioactivity from any nuclear fuel or from any nuclear waste from the combustion of nuclear fuel.

- radioactive toxic, explosives or other hazardous properties of any explosive nuclear assembly or nuclear component thereof.

3. Loss, destruction or damage caused to the insured property by pollution or contamination. This however excludes :

- pollution or contamination which results from a peril already insured against.

- any peril which has been insured against and which might have resulted from pollution or contamination.

4. Loss, destruction or damage to things of consumable nature, livestock and motor vehicles.

5. Loss, destruction or damage done to manuscripts, plans, drawings, securities, documents of any kind, stamps, coins, cash, paper money, deeds, ATM cards, credit cards, charge cards, bonds, bills of exchange, promissory notes, or any other negotiable instrument, books of accounts or any other business books, and explosives.

6. Loss, destruction or damage to specific Items like jewellery, curios, antiques, pictures and other works of art, guns, collection of stamps, coins and medals for an amount collectively in excess of Rs. 10,000 unless specifically stated to the contrary in the Schedule.

7. Loss, destruction or damage to any electrical machine, apparatus, fixture or fitting arising from or occasioned by over-running, excessive pressure, short circuiting, arcing, self heating or leakage of electricity from any cause (lightning included). 8. Loss, destruction or damage to the stocks in cold storage premises caused by change of temperature.

8. Expenses incurred on Architects, Surveyors and Consulting Engineer’s Fees and debris removal by the Insured following loss, destruction or damage to the property insured by any of the insured perils in excess of 3% and 1% of the claim amount respectively.

9. Loss of earnings, or other indirect loss or damage of any kind or description.

10. Loss by theft during or after the occurrence of any of the insured perils except as provided under riot, strike, and malicious damage cover.

11. Loss or damage due to volcanic eruption or other convulsions of nature.

12. Loss or damage to property insured if removed to any building or place other than in which it is originally stated to be insured, except machinery and equipment temporarily removed for repairs, cleaning, renovation or other similar purposes for a period not exceeding 60 days.

Terrorism Damage Exclusion Warranty

This insurance excludes loss, damage cost or expense of any nature directly or indirectly caused by any act of terrorism regardless of any other cause or event contributing to the loss. The warranty also excludes loss, damage, cost or expenses resulting from any action taken in controlling, preventing, suppressing of any act of terrorism.

Burglary and House breaking including Larceny and Theft and Breakdown of appliances i.e. mechanical / electrical / electronic appliances

Exclusions in respect of loss or damage due to Burglary and/or housebreaking

- Loss, destruction or damage caused by burglary, housebreaking, theft or larceny where any member of the Insured’s family is involved are not covered.

-

Damage to securities, documents of any kind, stamps, coins, cash/paper money, deeds, ATM cards, credit cards, charge cards, bonds, bills of exchange, promissory notes, or any other negotiable instrument, books of accounts or any other business books, and explosives are not covered.

- Damage to articles of consumable nature, livestock and motor vehicles does not come under coverage of home insurance policy.

-

Loss, destruction or damage to curios, antiques, pictures and other works of art, guns, collection of stamps, coins and medals for an amount collectively in excess of Rs. 10,000 unless specifically stated otherwise are also not covered.

-

Loss, destruction or damage of jewellery and valuables in excess of Rs. 10,000 per single article unless specifically stated otherwise.

Exclusions in respect of loss or damage due to mechanical / electrical breakdown of appliances

This Section does not cover:-

- Damage caused by any faults or defects existing at the time of taking the insurance whether known to the Insurance Company or not.

- Wilful act or negligence of the Insured person or his/her representative.

- Loss arising out of cessation of work whether total or partial.

- Derangement of the insured property not accompanied by damage covered under this Policy.

-

Loss of or damage to the property covered under this Policy falling under the terms of the Maintenance agreement. Such exclusions will also apply to parts exchanged in course of such maintenance operations.

-

Damage because of defects of design material or workmanship etc for which the manufacturer or supplier of the insured items is responsible either by law or under contract.

-

Damage due to or consequent upon wear and tear, gradual deterioration, atmospheric or climatic conditions, rust, corrosion, moth, vermin or insect.

- Loss due to mysterious disappearance and while left in unattended vehicles in respect of cellular phones, portable computers and other mobile equipment.

Exclusions in respect of loss or damage to valuables.

This Section does not cover:-

- Cracking, scratching or breakage of lens or glass whether part of any equipment or otherwise or to china, marble, gramophone records and other articles of brittle or fragile nature unless such loss of damage arises from accident to a railway train or ship or aircraft or vehicle by which such property is being conveyed.

- Damage due to any process of cleaning, dyeing, repairing or restoring to which the property is subjected.

- Mechanical derangement or over winding of watches and clocks.

- Theft from car except from car of fully enclosed salon type having all the doors, windows and other openings securely locked.

- Damage while being conveyed by any carrier under contract of affreightment.

Compare Home Insurance Quotes and get a policy

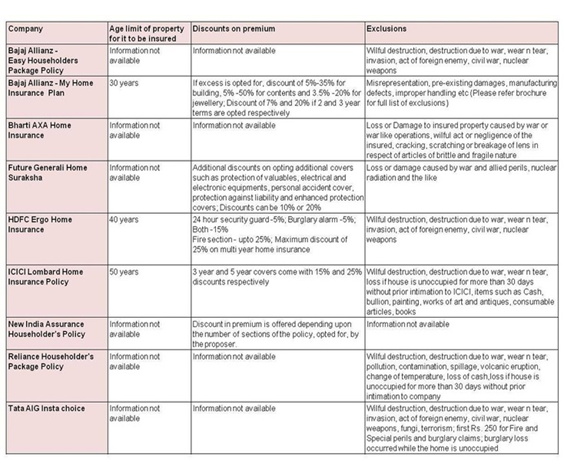

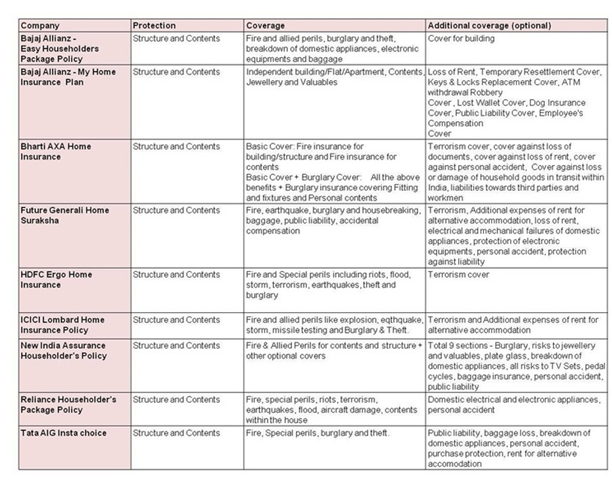

Before buying a comprehensive home insurance policy which is ideal for a person’s needs, it is very important that one compares all the available policies being offered by different insurance providers. This is extremely crucial to ensure the best deal.

Listed here are two tables which provide a general comparative analysis of few reputed home insurance plans. (http://www.gettingyourich.com/blog/how-you-can-protect-your-home-with-home-insurance )

Debalina Roy Chowdhury

Dilzer Consultants

Sources

https://www.bankbazaar.com/miscellaneous-insurance/homeowners-insurance.html

https://www.hdfcergo.com/documents/crosslink/Policy%20Wordings.pdf

https://www.policybazaar.com/home-insurance/

http://www.gettingyourich.com/blog/how-you-can-protect-your-home-with-home-insurance