We Promise to help you plan better.

Fill up this simple form to speak to a certified financial planner.

Simply put, Financial Planning is ‘planning for the future’. It is preparing oneself and one’s family for future events like their child’s education, retirement, child’s marriage, wealth creation, life security and other life goals.

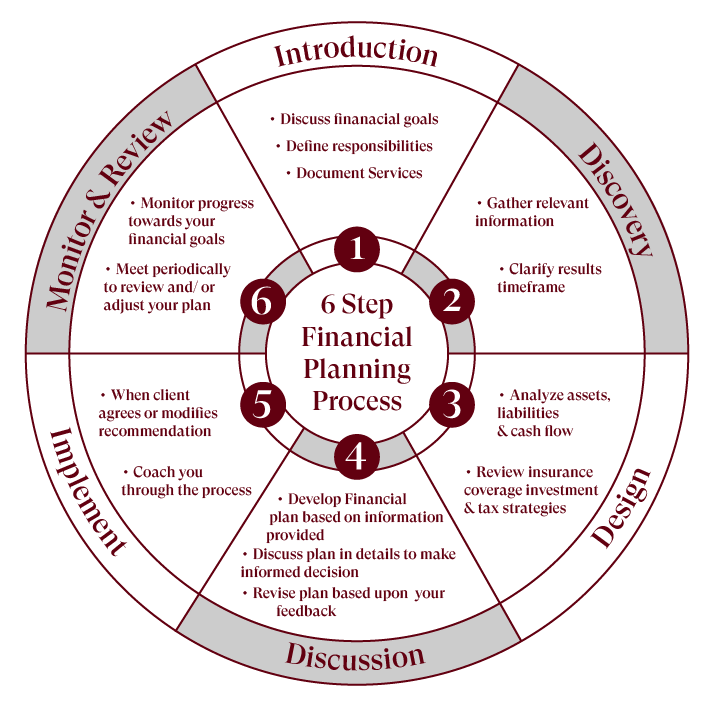

We believe in a Comprehensive Financial Planning process. We identify goals and gather and review financial data to design and implement a financial plan to help you reach your goals. It is a lifelong process. Once the plan is in place, it needs to be monitored, reviewed and updated to meet dynamic circumstances.

Goals need a plan and you have to track your goals to accomplish them. This will allow you to reflect and recalculate your next move. Without this, you will lose track of your progress and meeting your goals will become a challenge. To ensure that you don’t lose focus, you need to constantly review the process of achieving your goals.

In the Annual Goal Review Period, we analyse the growth and progress of each goal, investment asset, and how close you are to meeting your goals.

We prepare a customised and detailed year-wise breakdown adjusted for inflation and a comparative analysis of investment assets’ growth and contribution, net worth comparison and cashflow comparison specific to your situation and progression and plot them on a graph from base year to current year of evaluation.