Definition of NRI

1) Who is a NRI?

An NRI (Non-Resident Indian) is an individual of Indian nationality or origin who resides outside India for employment, business, or other purposes that indicate their intention to stay outside India for an uncertain period. The definition and tax implications for NRIs are governed by the Income Tax Act of India.

2) Who is considered to be a NRI?

Under the Income Tax Act, the residential status of an individual is determined based on their physical presence in India during a financial year (April 1 to March 31). An individual is considered an NRI if they meet the following criteria:

Non-Resident:

- Has been in India for less than 182 days during the financial year, or

- Has been in India for less than 60 days during the financial year and less than 365 days during the preceding four years.

NRI Taxable Income & Taxation

1) What are the incomes which is Taxable and Not Taxable in India for NRIs?

a) Income Taxable in India 500:

- Income Received in India: Any income received or deemed to be received in India is taxable.

- Income Accrued in India: Any income that accrues or arises or is deemed to accrue or arise in India is taxable.

b) Income Not Taxable in India:

- Foreign Income: Any income earned and received outside India is not taxable for NRIs.

2) What are different types of Income & their Tax implications for NRIs?

- Salary Income: Taxable if received in India or for services rendered in India.

- Rental Income: Taxable in India if the property is situated in India. Standard deductions and exemptions apply as for resident taxpayers.

- Interest Income:

o NRE Account: Interest earned on a Non-Resident External (NRE) account is tax-free.

o FCNR Account: Interest earned on Foreign Currency Non-Resident (FCNR) accounts is tax-free.

o NRO Account: Interest earned on a Non-Resident Ordinary (NRO) account is fully taxable.

- Capital Gains:

o Sale of Assets in India: Gains from the sale of assets such as property, shares, and securities in India are taxable.

o Short-Term Capital Gains: Taxable at applicable rates based on the type of asset.

o Long-Term Capital Gains: Taxable at 20% with indexation benefit for property and other assets, and at 10% without indexation for equity and equity mutual funds.

- Dividends: Dividends received from Indian companies are taxable in the hands of the NRI at the applicable slab rates. The company paying the dividend withholds tax at source.

- Special Provisions for Investment Income: Income from investments made in India in certain specified assets is taxed at 20%, and long-term capital gains on these assets are taxed at 10%.

3) What is DTAA?

India has entered into DTAA with various countries to avoid double taxation of income. NRIs can benefit from these treaties to reduce their tax liability in India and their country of residence. Provisions include:

- Tax Credit: Credit for taxes paid in one country against the tax liability in another.

- Exemptions and Lower Rates: Income may be exempt or taxed at a lower rate under the DTAA.

NRI Mutual Fund Related FAQs

1) Can NRIs invest in Mutual Funds (MFs)? Do they require any special permission from the RBI?

NRIs can invest in the Mutual Funds on repartiable as well as non – repartiable basis. They don’t require any special permission in this regard from RBI. RBI has vide Notification No. FEMA 20/2000 dated May 3, 2000 granted general permission to NRIs to purchase, on a repatriation as well as non repatriation basis the units of domestic mutual fund.

2) Are there any specific procedures to be followed for making the investment on a repartiable/non repartiable basis?

Investment on a repartiable basis

An NRI can invest in the domestic mutual funds on repartiable basis, provided the consideration is paid either by inward remittance through normal banking channels viz., Rupee drafts purchased abroad or out of funds held in his NRE/FCNR account.

In case of Indian Rupee drafts purchased aboard or if investment is made from funds in NRE/FCNR A/c a debit certificate from the issuing bank shall be required.

Investment on a Non - repartiable basis

An NRI can invest in the domestic mutual funds on Non- repartiable basis, provided the consideration is paid either by inward remittance through normal banking channels or out of funds held in his NRO/NRSR/NRNR account.

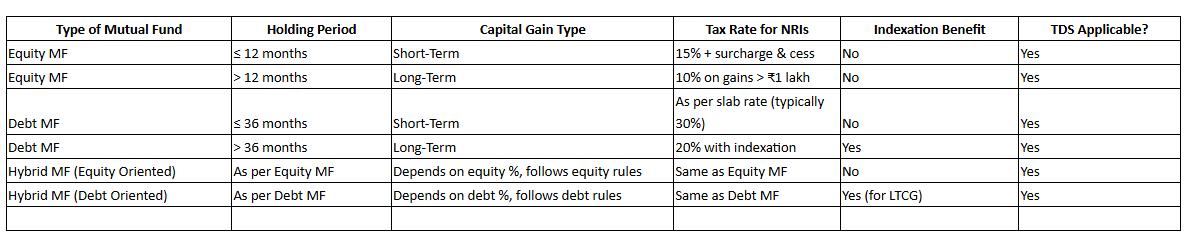

3) What is various Taxes for NRIs while investing into Mutual Funds?

Investing in mutual funds as an NRI (Non-Resident Indian) involves specific tax implications in India. The tax treatment depends on the type of mutual fund (equity or debt) and the holding period. The tax implications for NRIs investing in mutual funds in India are as follows:

Types of Mutual Funds

- Equity Mutual Funds: Funds that invest at least 65% of their corpus in equity and equity-related instruments.

- Debt Mutual Funds: Funds that invest primarily in fixed-income securities like bonds, government securities, and money market instruments.

- Hybrid Funds: Funds that invest in a mix of equity and debt instruments.

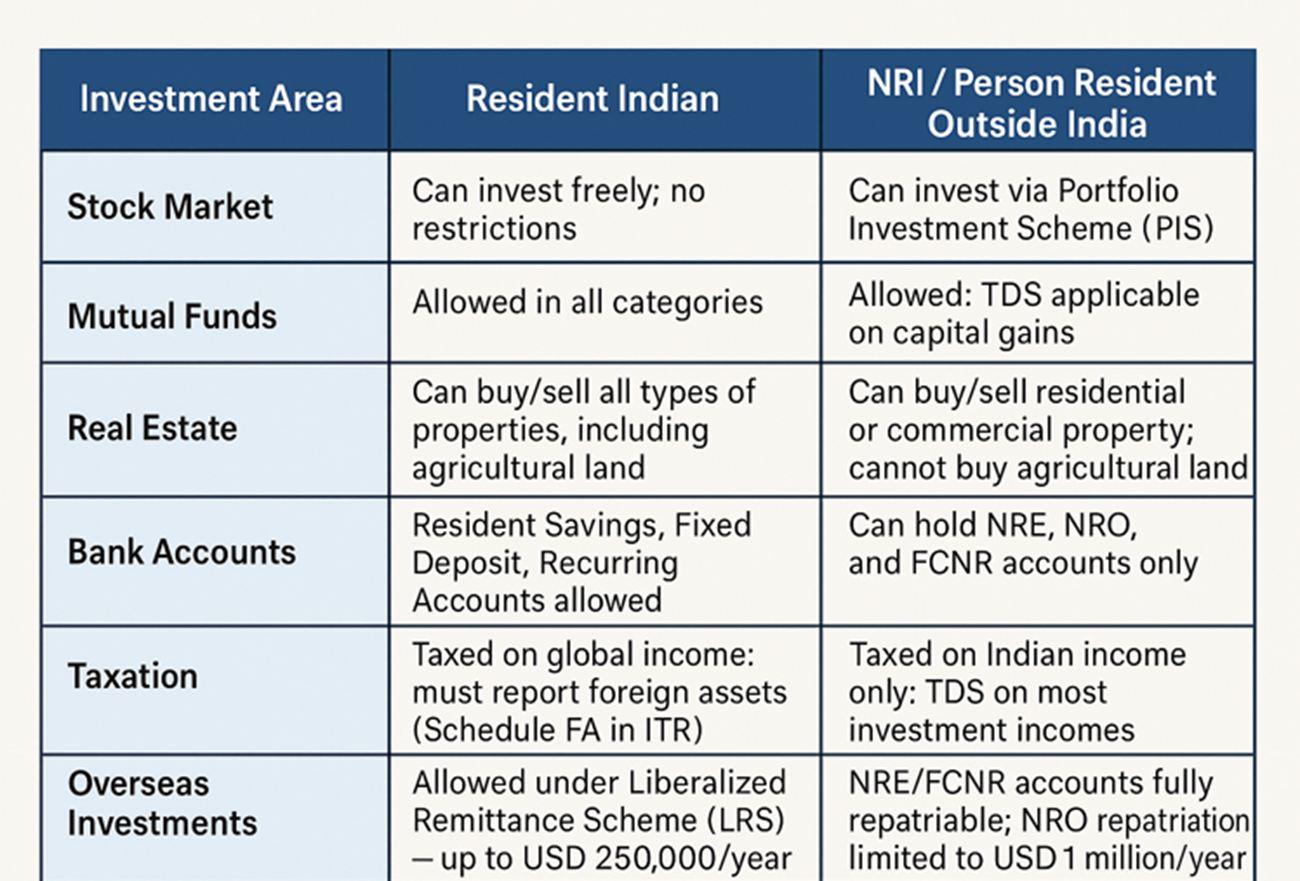

Investment options for NRIs

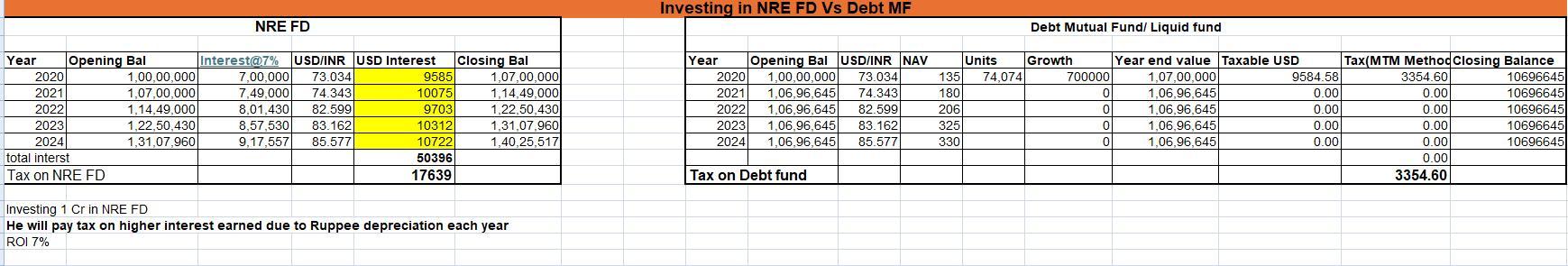

How are debt MFs better than NRE FDs for US NRIs

4) How can NRIs Repatriate their Mutual Funds from India?

NRIs can repatriate the redemption proceeds of mutual fund investments, subject to specific conditions:

- Investments from NRE/FCNR Accounts: Both principal and gains are fully repatriable.

- Investments from NRO Account: Only the capital gains (not the principal) are repatriable, subject to applicable limits and conditions set by the Reserve Bank of India (RBI).

Bank Account Types, Regulations & Requirements

1) What are various types of bank accounts offered for NRIs?

NRIs (Non-Resident Indians) have various options for maintaining bank accounts in India, each tailored to different needs, such as savings, investment, repatriation, and everyday transactions. Here are the primary types of bank accounts available for NRIs:

1. NRE (Non-Resident External) Account

Purpose: To park overseas earnings in India in Indian Rupees.

Features:

- Currency: Maintained in Indian Rupees (INR).

- Repatriability: Both principal and interest are fully repatriable to the NRI's country of residence without restrictions.

- Taxation: Interest earned is tax-free in India.

- Deposits: Can be made from foreign income or by transferring from another NRE/FCNR account.

- Withdrawals: Can be made freely in INR for local expenses.

- Types of Accounts: Savings, current, recurring deposit, and fixed deposit accounts.

2. NRO (Non-Resident Ordinary) Account

Purpose: To manage income earned in India, such as rent, dividends, pension, etc.

Features:

- Currency: Maintained in Indian Rupees (INR).

- Repatriability: Principal amount is not repatriable beyond a set limit (currently up to USD 1 million per financial year), while interest is fully repatriable.

- Taxation: Interest earned is subject to TDS (Tax Deducted at Source) as per applicable slab rates.

- Deposits: Can be made from income earned in India or by transferring from another NRO account.

- Withdrawals: Can be made freely in INR for local expenses.

- Types of Accounts: Savings, current, recurring deposit, and fixed deposit accounts.

3. FCNR (Foreign Currency Non-Resident) Account

Purpose: To maintain overseas earnings in foreign currency without converting to INR.

Features:

- Currency: Maintained in foreign currencies such as USD, GBP, EUR, JPY, AUD, CAD, etc.

- Repatriability: Both principal and interest are fully repatriable.

- Taxation: Interest earned is tax-free in India.

- Deposits: Can be made from overseas income or by transferring from another FCNR/NRE account.

- Withdrawals: Can be made in foreign currency.

- Types of Accounts: Fixed deposit accounts only (terms range 1-2 years).

2) What are the documents required to Open various NRI Bank accounts?

To open an NRE, NRO, or FCNR account, NRIs typically need to provide the following documents:

- Proof of NRI Status: Passport, visa, and/or residence permit.

- Proof of Overseas Address: Utility bills, rental agreement, or overseas bank statement.

- Proof of Identity and Address in India: Aadhar card, PAN card, or similar documents.

- Photographs: Recent passport-sized photographs.

3) What are the various Rules & Limits for Repatriation for NRIs?

NRIs (Non-Resident Indians) often need to transfer money between India and their country of residence. The rules and regulations governing the repatriation of funds from India are designed to facilitate these transfers while ensuring compliance with Indian laws.

Types of Accounts and Repatriation Rules

1. NRE (Non-Resident External) Account

Purpose: To park overseas earnings in India.

Repatriability:

- Both the principal and interest amounts are fully and freely repatriable.

- Funds in this account can be transferred to a foreign account without any restrictions.

Conditions:

- Deposits can be made from foreign earnings or by transferring from another NRE/FCNR account.

- There are no limits on the amount that can be repatriated.

2. NRO (Non-Resident Ordinary) Account

Purpose: To manage income earned in India, such as rent, dividends, pension, etc.

Repatriability:

- Interest earned is fully repatriable after paying applicable taxes.

- Principal repatriation is allowed up to USD 1 million per financial year (April to March), including all other eligible assets.

Conditions:

- The account holder must submit appropriate documents, including Form 15CA and Form 15CB (signed by a Chartered Accountant) to certify that taxes have been paid.

- Prior approval from the Reserve Bank of India (RBI) is not required within the repatriation limit.

3. FCNR (Foreign Currency Non-Resident) Account

Purpose: To maintain overseas earnings in foreign currency without converting to INR.

Repatriability:

- Both the principal and interest amounts are fully and freely repatriable.

- Funds can be transferred to a foreign account in the currency of the deposit.

Conditions:

- Deposits can be made from foreign earnings or by transferring from another FCNR/NRE account.

- There are no limits on the amount that can be repatriated.

4) What are the documents required for Repatriation?

Below are some of the key documents required for Repatriation:

- Form 15CA: A declaration of remittance submitted by the remitter.

- Form 15CB: A certificate from a Chartered Accountant confirming that applicable taxes have been paid or that the transaction is not taxable.

- Bank Forms: Specific forms provided by the bank for processing the repatriation request.

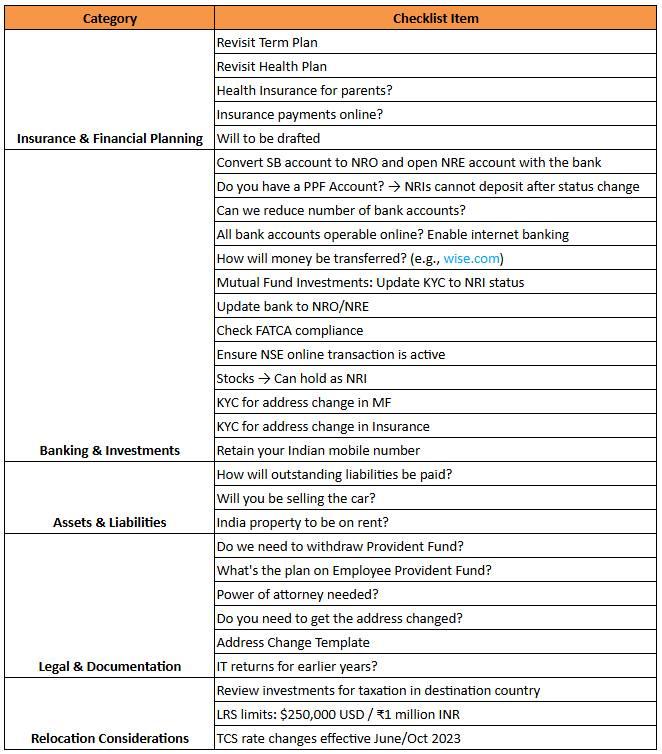

Checklist for Resident Indians (RIs) Moving Abroad and Becoming Non-Resident Indians (NRIs)

1. Banking & Financial Accounts

- Convert your resident savings accounts to Non-Resident External (NRE) or Non-Resident Ordinary (NRO) accounts.

- Consider opening a Foreign Currency Non-Resident (FCNR) deposit for foreign currency savings.

- Update KYC details with your bank, informing them of your NRI status.

- Close unnecessary resident savings accounts (NRIs cannot hold these).

2. Investments & Mutual Funds

- Update KYC status to NRI for all mutual fund holdings.

- Check with fund houses to see if they allow investments from your new country of residence. (Many AMCs restrict U.S. —and Canada-based NRIs.)

- Convert resident Demat & trading accounts to NRI Demat and Portfolio Investment Scheme (PIS) accounts if continuing to invest in Indian equities.

- Review tax implications on capital gains in both India and your new country of residence.

- Update bank mandate for dividend payouts to an NRO account.

3. Taxation & Compliance

- Check if you qualify as an NRI under the FEMA (staying abroad for more than 182 days) and Income Tax Act (considering previous financial years).

- File ITR as NRI from the next assessment year.

- Understand the Double Taxation Avoidance Agreement (DTAA) between India and your new country to avoid double taxation.

- If maintaining property in India, note TDS rules on rental income (30% TDS applicable).

- Ensure the correct Tax Residency Certificate (TRC) is obtained to claim DTAA benefits.

4. Property & Real Estate

- NRIs can continue to hold residential and commercial properties in India.

- If selling property, TDS deduction applies (20% on long-term capital gains for NRIs).

- Update property documents with your NRI status for smooth future transactions.

5. Insurance & Loans

- Convert life and health insurance policies to NRI status (check premium payment options).

- Review existing loans—NRI status can impact eligibility and terms of home loans, personal loans, etc.

- Check RBI regulations for repayment of loans as an NRI.

6. PAN & Aadhaar Updates

- Ensure your PAN is linked with Aadhaar (compulsory for tax filing).

- Update your address and contact details linked to PAN and Aadhaar.

- NRIs are not required to hold Aadhaar unless filing tax returns in India.

7. Remittances & Repatriation

- Use NRE accounts for easy repatriation of income earned abroad.

- Keep track of foreign remittance limits and reporting requirements under FEMA.

- Understand repatriation rules for sale proceeds of property, investments, and rental income.

- Under the Liberalized Remittance Scheme (LRS), resident Indians can remit up to USD 250,000 per financial year for permissible capital and current account transactions.

8. Estate & Will Planning

- Update nominee details for bank accounts, mutual funds, insurance, and Demat accounts.

- Consider making a Will to avoid complications in India regarding inheritance laws.

- If holding assets in India and abroad, consult a financial planner for estate planning.

9. Compliance for Returning NRIs (RNOR & Tax Status)

- If planning to return, understand Returning NRI (RNOR) status for tax exemptions.

- Plan for reinvestment of foreign income/assets upon return to India.

- Convert NRE/NRO accounts back to resident accounts when returning.

"If you're an NRI planning to return to India, timing your return smartly can help you qualify as RNOR and save taxes. Let's understand the key benefits of the RNOR status."

1. Extended RNOR Status with Smart Timing

RNOR status depends on when you return to India.

Example:

Return in July 2025 → RNOR for 2 years (FY 25–26 & 26–27).

Return in March 2026 → You are still NRI for FY 25–26, so you can claim RNOR for 3 years (FY 25–26, 26–27, 27–28).

2. Tax Advantage on Global Income

ROR (Resident & Ordinarily Resident): Taxed on worldwide income.

RNOR: Only Indian income is taxable.

This allows you to receive foreign income tax-free in India during RNOR years.

3. Lower Tax on Indian Investments

RNOR enjoys regular resident tax slabs, unlike NRIs who are often taxed at the highest rate on FD interest.

4. Wider Investment Options

RNORs can invest in:

· PPF (Public Provident Fund)

· Senior Citizen Savings Scheme

· Agricultural land (which NRIs cannot purchase)

5. RFC Account Benefits

RNORs can open and use RFC (Resident Foreign Currency) accounts.

Interest on RFC accounts is tax-free as long as you remain an RNOR.

NRI Sale of Property & Other Asset class Related FAQs

1) How do NRIs repatriate funds through Sale of Property?

Sale of Property:

- Residential Properties: NRIs can repatriate the sale proceeds of up to two residential properties.

- Commercial Properties: There are no specific limits, but repatriation is subject to overall repatriation limits and tax compliance.

- Conditions: Proceeds must be credited to an NRO account, and repatriation is subject to the USD 1 million limit per financial year. Taxes must be paid, and documentation (such as proof of purchase, sale, and tax payment) must be provided.

2) What are the issues with Real Estate for NRIs?

Buying multiple properties in India is not efficient from the taxation perspective. Only one property can be shown as self-occupied. The other has to be rented out, and rental income is taxable; if not rented out, it is considered deemed let-out, and the deemed rent is taxable. Investors not showing rental income from multiple properties becomes an issue with Indian tax compliance.

Tracking of properties held by Indian residents and NRIs is difficult and, hence, real estate investors have always been flying under the radar of tax authorities. NRIs/PIOs/OCIs are big investors in Indian real estate; they have to worry whether FATCA will apply to real estate holdings in future. The issue, again, is that income from real estate may not have been reported in the US tax returns and, hence, NRIs may not want to reveal that they did not report the Indian rental income in US tax returns. With fear of FATCA, NRIs are trying to come clean before they get caught.

Property Buying Fraught with Unclear Title Issues

Real estate has been a popular investment option for NRIs/PIOs/OCIs. They are allowed to invest in residential and commercial properties with NRO/NRE accounts to make payments but cannot invest in agricultural land, farmhouses, or plantations in India. NRIs can own such properties only if they have been inherited, but they can sell such properties only to a resident Indian.

With the real estate market in India going through a downturn, NRIs should be wary of buying property as an investment. Moreover, buying property in India can have issues of legalities and clear titles. Do check that the property has all the required approvals from civic authorities for construction. It is not easy for a novice to buy property without hassles. Having the ‘right’ intermediary can help to check the documentation and do proper title search and transfer; but agents are unregistered and, hence, service levels can vary. NRIs can avail home loan from Indian banks or financial institutions after satisfying the eligibility criteria. The loan amount and repayment transactions are in Indian rupees.

Property Selling Can Trouble You with Capital Gains Abroad

Property is an illiquid asset. It is not easy to sell in a down market without taking a beating. Selling property comes with some restrictions by FEMA (Foreign Exchange Management Act), especially for repatriation transactions. The property transaction can generate a high amount of capital gains which can create taxation issues especially for NRIs, depending on the country of residence.

Taxation on capital gains in India can be avoided by buying another property or investing in capital gains savings bonds from the Rural Electrification Corporation (REC) and the National Highways Authority of India (NHAI). But your country of residence may not accept such an arrangement. For example, a foreign resident may save taxes on property sold in India by re-investing in property or buying such bonds. But it may not be allowed under tax laws of the foreign country where the NRI resides. The capital gains made zero in India may mean that full capital gains will have to be paid in the foreign country.

Unlike India, the foreign country may not even allow the calculation of inflation-indexed purchase price to lower your capital gains. If such adjustment is not allowed, your capital gains abroad can be much higher than the capital gains calculated for Indian tax laws. It is crucial to consider if the income-tax liability in the country of residence on the capital gains will nullify the tax savings you made to satisfy the Indian tax laws. You will wonder whether claiming exemption under Sections 54/54F/54EC was really the correct decision.

If you end up saving taxes in India, but paying in your country of residence, your tax saving may not materialise. The NRI may be better off claiming only partial or no tax savings at all in India. Buying property in India may seem unattractive when you consider the tax angle in your country of residence. So, don’t jump into buying property without knowing the tax issues when you exit.

3) Property on Rent – Is Tax Deducted at Source?

Renting your property with a ‘leave and licence’ (L&L) agreement can be better than giving your property without any paperwork. Registering and paying stamp duty on the L&L agreement can ensure your right as the owner. The police can help you as the property owner if you have a registered L&L agreement. If you don’t have an agreement, it may be tougher to get justice.

Power of Attorney (PoA): When you are an NRI, you have the additional burden of giving a PoA to one of your family members to execute the L&L agreement, in your absence. You may not be able to personally meet the licensee to know him/her before renting It is a disadvantage. There is always fear of the licensee not vacating the place, despite signing an L&L agreement and registering it.

TDS on Rent: Under L&L agreement, a licensee is required to deduct tax at source at 30.9% under Section 195 before making the balance rental payment to the NRI owner. The licensee needs to pay the rent directly into the NRO account. The TDS by L&L licensee can be a turn-off for both parties, even though the owner is liable to be taxed on the rental income and can even get a refund if the income from Indian sources is below the minimum slab rate.

4) How do NRIs repatriate funds through Sale of Shares and Securities?

Sale of Shares and Securities:

- Repatriability: NRIs can repatriate sale proceeds after paying applicable taxes.

- Conditions: Investments must be made on a repatriable basis (through NRE/FCNR accounts). The transaction should be routed through a registered stockbroker.

Portfolio Investment Scheme (PIS)

1) What is PIS (Portfolio Investment Scheme)?

The Reserve Bank of India (RBI) allows NRIs and overseas citizens of India (OCI)/persons of Indian origin (PIOs) to invest in the Indian equity markets under PIS (portfolio investment scheme). PIS is a foreign investment route to simplify the process of registration and investment for all foreign investors. NRIs/OCIs/PIOs can purchase or sell the shares/NCDs (non-convertible debentures) of Indian companies on the stock exchange. This can be done by following these steps:

a. Bank Account: You need an NRE (non-resident external) or NRO (non-resident ordinary) account and obtain approval for stock trading under PIS.

b. Demat and Trading Account: You need a trading account (linked to the PIS account) with a broker and demat account by any service-provider.

Many banks have started offering all the above-mentioned services at a single point, which has made this process smooth. NRIs need to keep in mind the following:

- Only one PIS account can be opened for buying and selling of shares;

- Stock investment cannot exceed 10% of the paid-up capital of the company;

- Intraday trading not allowed. NRIs have to take delivery of shares purchased/sold;

- Short-selling not allowed;

- Can invest in only selected stocks as listed by RBI periodically;

- Investment can be done on repatriation as well as non-repatriation basis.

The following transactions do not need PIS account.

a. Sale of shares, which were not bought under PIS. For example, gifts, subscription to IPOs or shares bought as resident Indian, or received as bonus;

b. Fresh subscription for IPOs as an NRI;

c. Investment in MFs.

An NRI is eligible to subscribe toMutual Funds and Bonds in india. However, the issuer should specifically enable the ‘NRI Window’ in an offer. The bonds can be tax-free bonds or taxable. They can be subscribed on both repatriable and non-repatriable bases. NRIs can apply for these bonds through their NRE/NRO accounts. To apply on a repatriable basis, you need to fund it from an NRE account. For non-repatriable basis, apply from an NRO account.

Exchange Traded Funds (ETFs): Investment can also be done in ETFs available in India with your PIS account through your NRE/NRO bank account. However, investors from the US may want to avoid buying ETFs as they are considered PFIC (passive foreign investment companies), as discussed later in this article. Even investment in shares of companies considered as PFIC should be avoided by a US resident/person.

Direct vs Regular Mutual Funds

1) What is the impact on returns with respect to Direct & Regular Mutual Funds?

When investing in mutual funds, NRIs (Non-Resident Indians) and resident investors in India have the option to choose between direct plans and regular plans. The choice between these two types of plans can significantly impact the returns on investment.

Direct Plans

Definition: Direct plans are mutual fund schemes where investors can invest directly with the fund house without involving any intermediaries or brokers.

Key Features:

- No Distributor Commission.

- Lower Expense Ratio.

- Higher NAV (Net Asset Value).

Advantages:

- Higher Returns.

- Transparency.

Disadvantages:

- Do it yourself (DIY) Approach.

- No Advisory Services.

Regular Plans

Definition: Regular plans are mutual fund schemes where investors invest through intermediaries such as brokers, agents, or distributors.

Key Features:

- There will be Distributor Commission involved.

- Higher Expense Ratio.

- Lower NAV.

Advantages:

- Professional Advice.

- Convenience on documentation, paperwork, redemption etc.

Disadvantages:

- Lower Returns.

- Higher Costs.

Impact on Returns

The primary difference between direct and regular plans lies in the expense ratio, which directly impacts the returns. Here’s a simplified example to illustrate the impact:

- Assume: An investment of ₹1,00,000 in both direct and regular plans of the same mutual fund.

- Direct Plan Expense Ratio: 1.0%

- Regular Plan Expense Ratio: 1.5%

Returns After One Year(assuming a 10% gross return on investment):

1) Direct Plan:

- Gross Return: ₹1,00,000 x 10% = ₹10,000

- Expense Ratio Cost: ₹1,00,000 x 1.0% = ₹1,000

- Net Return: ₹10,000 - ₹1,000 = ₹9,000

- Ending Balance: ₹1,00,000 + ₹9,000 = ₹1,09,000

2) Regular Plan:

- Gross Return: ₹1,00,000 x 10% = ₹10,000

- Expense Ratio Cost: ₹1,00,000 x 1.75% = ₹1,750

- Net Return: ₹10,000 - ₹1,750 = ₹8,250

- Ending Balance: ₹1,00,000 + ₹8,250 = ₹1,08,250

Difference in Returns:

- Direct Plan Ending Balance: ₹1,09,000

- Regular Plan Ending Balance: ₹1,08,250

- Difference: ₹1,09,000 - ₹1,08,250 = ₹750

Over time, this difference compounds, leading to significantly higher returns in direct plans compared to regular plans.

Strategy used for Mutual Fund Investment & Return Expectations

Checklist for NRIs Returning to India

1. Banking & Financial Accounts

- Convert NRE/NRO accounts back to resident savings accounts.

- Close any unnecessary NRE/NRO accounts as per RBI guidelines.

- Consider opening anResident Foreign Currency (RFC) account to park foreign earnings in India.

- Update KYC details in all Indian bank accounts with a new residential status.

2. Investments & Mutual Funds

- Convert NRI Demat & trading accounts back to resident status.

- Update KYC details with mutual fund houses to reflect resident status.

- Reassess investments and modify portfolio allocation based on Indian tax laws.

- If applicable, check LTCG (Long Term Capital Gains) tax implications on overseas investments.

- NRIs returning to India can bring back proceeds from US investments subject to FEMA regulations. The annual exemption limit for repatriation varies based on tax treaties and reporting requirements.

- Under RBI's LRS (Liberalized Remittance Scheme), returning NRIs can remit up to USD 250,000 per financial year.

3. Taxation & Compliance

- Understand the Returning NRI (RNOR) status and tax benefits for the transition period.

- RNOR (Resident but Not Ordinarily Resident) status applies for up to two years post-return, offering tax exemptions on foreign income.

- Income earned outside India is not taxable in India during the RNOR period, except if received in India.

- RNORs are exempt from global income taxation but must comply with Indian tax laws after the RNOR period ends.

- Update PAN card details with the new residential status.

- File ITR as a resident Indian for the next assessment year.

- Declare all foreign assets and income in tax filings to comply with Indian tax laws.

- Check applicability of Double Taxation Avoidance Agreement (DTAA) for foreign income.

- Obtain a Tax Residency Certificate (TRC) if required to claim DTAA benefits.

4. Property & Real Estate

- Update home address in property documents, utility bills, and Aadhaar.

- Check capital gains tax liability if selling property abroad before moving back.

- If renting out property abroad, review taxation under Foreign Income Tax Act.

- Consider repatriating proceeds from property sales under FEMA guidelines.

5. Insurance & Loans

- Update life and health insurance policies with a new residential status.

- Convert existing international health insurance to an Indian equivalent if required.

- Reassess home loans, personal loans, and credit card payments in both countries.

- Check RBI regulations for foreign loans repayment and mortgage status.

6. PAN & Aadhaar Updates

- Ensure your PAN is linked with Aadhaar for tax compliance.

- Update address and contact details linked to PAN and Aadhaar.

- Apply for an Aadhaar card if not previously obtained, as it may be required for banking and taxation.

7. Foreign Assets & Repatriation

- Plan for repatriation of foreign earnings through legal channels.

- Understand FEMA limits for remittance and reporting requirements.

- If holding significant overseas assets, consult a financial planner for tax-efficient transfer.

- NRIs can repatriate investment proceeds from US stocks, mutual funds, and real estate, subject to IRS & FEMA rules. Ensure compliance with capital gains tax rules in both countries.

- Close unnecessary foreign bank accounts if no longer needed.

8. Estate & Will Planning

- Update nominee details for bank accounts, investments, and insurance policies.

- Modify or create a new Will reflecting your change in residency and asset locations.

- Ensure compliance with Indian succession laws for foreign assets.

9. Employment & Business Transition

- Inform employer and update tax withholding details if returning permanently.

- If self-employed or holding an overseas business, assess tax and legal implications.

- Transfer professional credentials/licenses to India if required for work.

10. Social Security & Retirement Planning

- Check eligibility for pension withdrawals or transfers from overseas funds.

- Understand Social Security benefits (like U.S. Social Security) and whether you can claim them in India.

- Plan for retirement savings in India by investing in suitable schemes like EPF, PPF, or NPS.

11. Family & Education Considerations

- If moving with children, review school/university admission procedures in India.

- Ensure all family members have updated documents (passports, Aadhaar, PAN, etc.).

- Plan for any dependent family members’ healthcare and insurance needs.

1) Which Mode of investing is suggested for NRIs either SIPs or STPs?

Systematic Transfer Plans (STPs) are investment strategies that allow investors to transfer a fixed amount of money at regular intervals from one mutual fund to another, typically from a debt fund to an equity fund. For NRIs (Non-Resident Indians), STPs can offer both strategic benefits and tax implications that need careful consideration.

Benefits of STPs for NRIs

- Rupee Cost Averaging: STPs help in averaging out the purchase cost by investing regularly in equity funds, reducing the impact of market volatility.

- Consistent Investment: Helps in maintaining discipline by ensuring regular investment without the need to time the market.

Considerations for NRIs Using STPs

1) Tax Deducted at Source (TDS):

- For NRIs, mutual fund houses in India deduct TDS on capital gains.

- Debt Funds: TDS at 30% on STCG and 20% on LTCG.

- Equity Funds: TDS at 15% on STCG and 10% on LTCG (on gains exceeding ₹1 lakh).

In case the client is not ready for the TDS deduction, which is on the capital gain part, then the same benefits can be availed while keeping the lumpsum in a savings bank account and doing a weekly SIP instead of STPs.The only disadvantage of doing this is that the investor won’t get higher returns, which most of the liquid or Arbitrage funds offer.The average return that a liquid or arbitrage funds offer is around 5% ~ 8%, p.a. whereas in a savings account, we can expect around 3% ~ 4% p.a.

2) What are the return expectations for various risk profiles?

Based on individual risk profile and risk taking ability, we can broadly classify the risk profiles as follows:

- Very Conservative Risk Profile (7% - 9%)

- Conservative Risk Profile (8% - 10%)

- Moderate/Balanced Risk Profile (9% - 12%)

- Aggressive (10% - 13%)

- Very Aggressive (14% - 18%)