Financial Independence

What is financial independence? While there are many opinions to this answer, basically, being debt free and creating a nest egg that will allow a person to live the rest of his/her life in comfort; forms the cornerstone of financial independence. Everyone would love to live a life where they do things that they enjoy without having to work at a job only for the financial security it provides. The ability to support oneself financially without relying on a job while maintaining the same lifestyle as in the past is the key.

This is easier said than done. With easy access to credit cards and personal loans and the comfort of purchasing expensive products on EMI, remaining debt-free is a challenging task. Yet, many people do manage to achieve financial freedom with savings and investments that exceed any liabilities. But is that enough? To maintain financial independence, a financial plan is essential.

A financial plan that preserves one’s wealth earned should always include a mix of equities, bonds, gold and real estate, but in a judicious mix that does not blind one to risks of any one asset class. Asset allocation also involves distributing assets taking into consideration not just the risk appetite, but also the overall financial goals. Age should also be a primary criterion while taking risky decisions since, the older one gets, the lesser the capacity to stomach a downturn. One other factor to keep in mind is the stability of income and its growth potential – a self-employed person needs to plough savings into less risky ventures since income levels may not be stable.

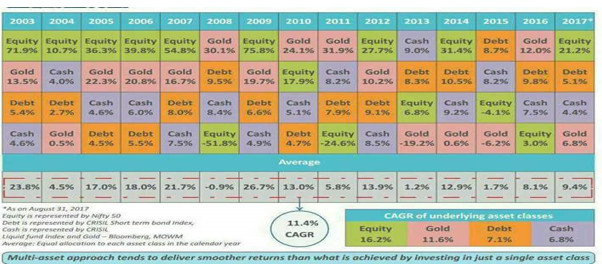

By ensuring not all wealth is in one asset class, we can hedge the risks of a class not providing adequate returns. In addition to risk being distributed, one also earn more if any one class performs superlatively. Asset allocation ensures the overall returns are superior than the rough ups-and-downs of investing in only one asset class.

In India, many people may start investing in equities, but invariably turn to the ‘safety’ of fixed deposits, gold or real estate to preserve wealth as they get older. However, these options may not be as safe as assumed. FD returns cannot match inflation growth and are taxed heavily, so real returns are low. Real estate rental yields are generally minimal, so it cannot be a source of wealth creation. . While a house is essential for security, keeping a majority of assets in an illiquid investment like real estate that cannot be divested very easily is not advised. Gold is another safe investment option for Indians but it is at best a wealth preserver and also a hedge against falling markets. Money invested in gold does not rise in value like equity, and a rise in gold value is always driven by a fear that other investments will fall Asset allocation should therefore also include a healthy mixture of equities since they are the best means to increase one’s wealth.

From the above table, we can see that equities have provided the best return in 2017, far above most other assets. In the long term, equity returns have averaged around 16% over the past 15 years exceeding other asset classes’ returns.

Our in house calculation of Returns from various asset classes and their co-relation over a 20-year period provides an in-depth analysis on performance of various asset classes. More Information here

What happens after the financial goals are achieved? What are the steps people take for preserving their hard-earned wealth? These are the questions that invariably follow.

The rich in India have three main goals in mind; to safeguard, preserve and grow wealth. While preservation happens through investing in debt instruments, the growth ensues through investing in businesses.

Creating a financial plan that allows people to prioritize wealth preservation should be the next action. To safeguard the estate and ensure that the wealth accumulated is passed on to the next generation wisely is the idea that most wealthy people work toward.

Traditionally, people used to ”WILL” assets to the next generation, however, nowadays, wills are often contested by family members unhappy with the distribution of the assets. So, the wishes of the Testator are often ignored and family disputes become messy leading to legal cases.

One method to avoid this situation, is the creation of family trusts.. Family trusts help wealthy families ring fence their assets from future liabilities – by creating strict conditions under which assets are transferred and insulating them against legislations and taxation changes. A trust can protect assets from nasty divorce proceedings, bankruptcy filings or family disputes by allowing the settlor (or creator of the trust’s assets) to exercise control on how the assets are to be distributed. When should one set up a Trust – More Here

Once assets are in the hands of the inheritors, often the sudden influx of wealth leads to impulsive and rash financial decisions. If the capital inherited needs to be grown and nurtured to generate a steady income, then alternative investments are vital. These go beyond the usual equity and debt options to invest in other assets such as commodities, collectibles including works of art, vintage cars, or even race horses and sports teams. Other alternative investments can include close ended funds where the pooled resources are invested in startups, infrastructure or social ventures.

Family offices is another major trend. These are private wealth management arms of the wealthy, that deal with investments, succession planning, taxes and philanthropy. They invest a portion of the assets in alternative ventures like those mentioned above. In addition, assets may also be put into small, early-stage investments in start-up firms, or larger stakes in recognised businesses that are fast growing. Thus, wealth is not just preserved, but also increased.Family office is also involved with social investments such as charity which is often the next goal of the very wealthy after succession planning.

Philanthropy is a complex process as evidenced by the myriad efforts of Bill Gates. Wealthy people have plenty of options to help, but in India, this has been quite minimal due to a belief that the entire wealth has to be left for the next generation. Although this mindset has begun changing, philanthropy in India is mainly about opening educational or medical institutions than actually attempting to make a difference in specific areas. Still people like Azim Premji have begun making an attempt to shed these ideas and focus attention on philanthropy as the biggest goal.

Researched by

Neena Shastry

Dilzer Consultants Pvt Ltd