Impact of long-term diseases and treatment on your goals-How to prepare for it?

Cancer, AIDS, Cardiovascular diseases are some of the life-threatening ailments that have seen a growth in past years. In fact, the news reported by Times of India says – “Annually, nearly 500,000 people die of cancer in India. The WHO said this number is expected to rise to 700,000 by 2015”. On the other hand, Indian Express stated – 1.96 lakh new HIV infections were reported last year!

Do you think you need extra cover to help you financially in case you/your family member is diagnosed with such a condition? Or you feel a group cover by your employer is self-sufficient? Let’s check to find out –

Impact of Chronic diseases on healthcare costs

Let’s try to come to a figure on how much a chronic disease could cost –

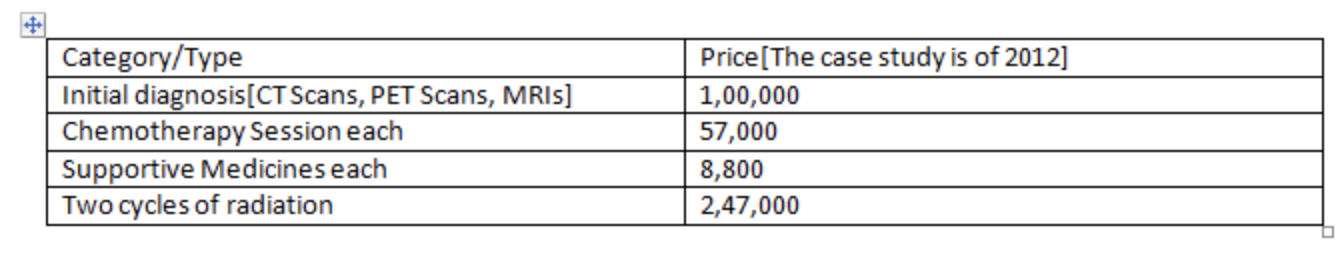

We are picking an example of a male patient who is 65 years old and is diagnosed with lung cancer

So if a doctor prescribes a treatment of 4 chemotherapy followed by supportive medicines and radiations for 20 days, the total cost would be = 5,10,200 INR

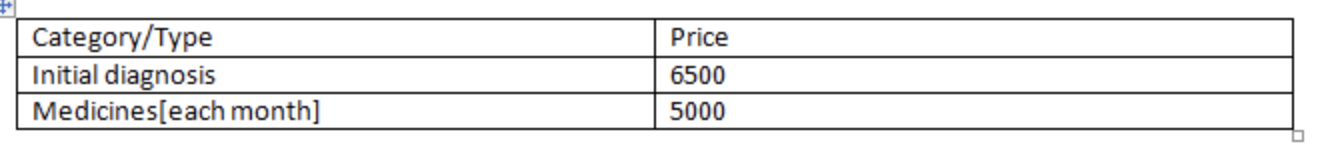

Let’s take another case study of a patient diagnosed with AIDS

One of the misconception people have, is that once an individual is diagnosed with AIDS, he would die soon. On the contrary people with proper medicines he or she could even live up to 20-25 years. So if an individual who is 35 years old is looking for AIDS treatment that would cost him for 25 years = 15,00,000 INR

So we just saw, how huge is the expense!

How To Prepare For It – Critical Illness Cover!

We do not have a specific path through which one can guarantee that he/she may not suffer from any of the diseases. So if your family has a history of such ailments, it’s best to prepare for them.

The best way to protect yourself against the long-term diseases is by buying the critical illness Cover!

What is Critical Illness Cover

The cover provides an individual with a lump-sum amount in case the individual is diagnosed with any of the critical illness, that are covered by the policy during the coverage time. The amount paid could be less/equal to the sum assured under the policy.

This amount received by the claimant helps as a financial security in case of temporrary job loss and also helps fund the treatment required during diagnosis of the critical illeness.

Features of Critical Illness Cover

The critical illness benefit covers

1. Illnesses that are on a pre-determined list of the policy offered by an insurer.

2. Will not cover any pre-existing critical illness or congenital conditions.

3. There would be a waiting period for making a claim – a claim can only be made if a critical illness is diagnosed after the waiting period is over.

4. Also, comes with a survival clause. The benefit is payable only if the life assured survives a certain period after being diagnosed with the critical illness. If death occurs before the pre-defined period after diagnosis, the benefit will not be payable

Best way to opt for a critical illness cover is a stand alone one which is not dependent on the cause of any other event for one to utilize the benefit.

Does it make sense to buy a Critical Illness Cover if there is no history of Critical Illness in my family?

Critical illness cover is like a financial lifeline to an individual, and with a steep rise in these diseases, coupled with disproportionate rise in medical treatment costs, experts recommend covering yourself and family against such illness.

You could use the money to clear your debts, or pay medical bills or even to adapt your home to your particular needs.

So it makes sense to buy a critical illness cover even if you do not have a history of illness in your family.

We hope we have answered your queries on what’s the impact of long-term diseases on financial goals.If you still have any unanswered questions or need help, feel free to contact us here.

We would be glad to help you with your planning and investment related decisions.

Samiksha Seth

Content Strategist – Dilzer Consultants Pvt Ltd.

Sources

http://spicyip.com/2012/06/dealing-with-cost-of-cancer-treatment.html

http://www.businesstoday.in/moneytoday/insurance/how-to-choose-the-best-critical-illness-insurance-plan/story/188491.html

http://timesofindia.indiatimes.com/city/kanpur/AIDS-treatment-cheaper-in-India/articleshow/17446361.cms

http://articles.economictimes.indiatimes.com/2011-09-14/news/30154290_1_critical-illness-base-policy-lump-sum-benefit

23 September 2016