Investing only to save on tax? Think again

Saving only for tax is not prudent and is not sufficient to accumulate corpus

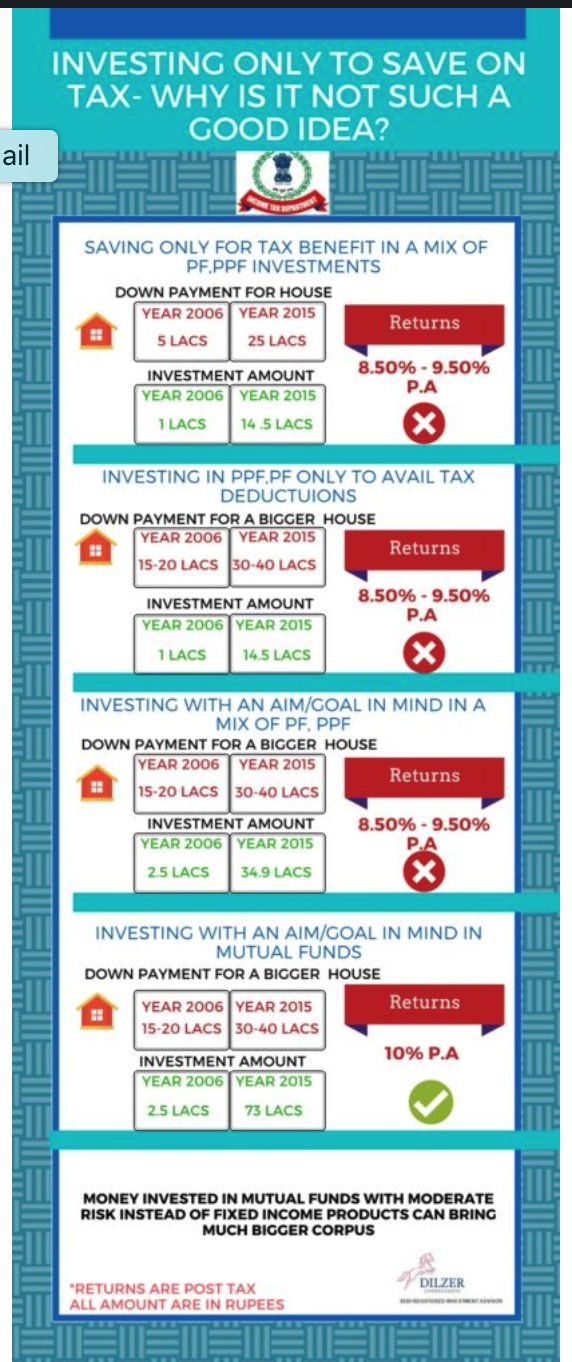

Primarily a person should not invest only for the sake of saving taxes. Tax planning is but a small component of a person’s investment portfolio. One should invest keeping in mind his/her larger financial needs and goals and should think about and investigate the pros and cons of products before taking the final investment decision towards accumulating his corpus needed.

One needs to choose the investment schemes and products that align with the overall financial objectives,in addition to fulfilling the goal of tax savings. Saving only for availing tax deductions may not always help to accumulate the required corpus for achieving a particular goal, as over a given period of time inflation increases the corpus amount considerably. It is always prudent to consider the future costs of goals and save money accordingly in order to comfortably achieve goals,instead of saving just about enough to avail tax deductions.The same is evident from the following illustration.

ILLUSTRATION 1 (Saving only for tax benefit is not sufficient for corpus accumulation)

Assumptions- Saving for Down-Payment of house

Approximate Down payment

2006 to 2015

500000 to 2500000

Investing only for availing Tax deductions

| Year | 80 C Limit | Invest in a mix of PF,PPF | Investment Amount at the end of the year | |||||

| Investment Amount | ||||||||

| Average Post-tax Return | ||||||||

| 2006-07 | 100000 | 100000 | 8.50% | 108500 | ||||

| 2007-08 | 100000 | 100000 | 8.50% | 2,26,223 | ||||

| 2008-09 | 100000 | 100000 | 8.50% | 3,53,951 | ||||

| 2009-10 | 100000 | 100000 | 8.50% | 4,92,537 | ||||

| 2010-11 | 100000 | 100000 | 9.50% | 6,48,828 | ||||

| 2011-12 | 100000 | 100000 | 8.43% | 8,11,955 | ||||

| 2012-13 | 100000 | 100000 | 8.65% | 9,90,839 | ||||

| 2013-14 | 100000 | 100000 | 8.73% | 11,86,069 | ||||

| 2014-15 | 150000 | 150000 | 8.73% | 14,52,708 | ||||

As seen above the investments have been done to avail tax deductions which are not sufficient enough to achieve the corpus of Down payment of house of amount Rs 2500000 in 2015.

-

How Investment Portfolio Mix Affects Corpus Required for a goal

The overall investment portfolio should have the right mix of equity and debt investment funds to achieve the corpus .One can opt for tax-saving mutual funds with exposure to equities or stock market and also invest in debt funds with endowment plans, PPF, etc. The proper way should be to allocate funds and invest in effective tax-saving schemes after considering one’s financial goals, risk appetite, age, number of family members towards building right portfolio. An illustration is sited here under which explains how the investment portfolio can affect the corpus required.

ILLUSTRATION 2 (How Investment Portfolio Mix Affects Corpus Required)

Assumptions- Saving for Down-Payment of a bigger house

Approximate Down Payment

2006 to 2015

15-20 lacs and 30-40 lacs

| Investing only to avail Tax Deductions | ||||

| Year | 80 C Limit | Investment Amount | Invest in a mix of PF,PPF | Investment Amount at the end of the year |

| Average Post-tax Return | ||||

| 2006-07 | 100000 | 100000 | 8.50% | 108500 |

| 2007-08 | 100000 | 100000 | 8.50% | 2,26,223 |

| 2008-09 | 100000 | 100000 | 8.50% | 3,53,951 |

| 2009-10 | 100000 | 100000 | 8.50% | 4,92,537 |

| 2010-11 | 100000 | 100000 | 9.50% | 6,48,828 |

| 2011-12 | 100000 | 100000 | 8.43% | 8,11,955 |

| 2012-13 | 100000 | 100000 | 8.65% | 9,90,839 |

| 2013-14 | 100000 | 100000 | 8.73% | 11,86,069 |

| 2014-15 | 150000 | 150000 | 8.73% | 14,52,708 |

| Investing with an Aim/Goal in mind in a mix of PF, PPF | |||

| Year | Investment Amount | Invest in a mix of PF,PPF | Investment Amount at the end of the year |

| Average Post-tax Return | |||

| 2006-07 | 250000 | 8.50% | 271250 |

| 2007-08 | 250000 | 8.50% | 5,65,556 |

| 2008-09 | 250000 | 8.50% | 8,84,879 |

| 2009-10 | 250000 | 8.50% | 12,31,343 |

| 2010-11 | 250000 | 9.50% | 16,22,071 |

| 2011-12 | 250000 | 8.43% | 20,29,886 |

| 2012-13 | 250000 | 8.65% | 24,77,097 |

| 2013-14 | 250000 | 8.73% | 29,65,172 |

| 2014-15 | 250000 | 8.73% | 34,95,857 |

| Investing with an Aim/Goal in mind in Mutual Funds | |||

| Year | Investment Amount | Invest in Mutual Funds | Investment Amount at the end of the year |

| Average Post-tax Return | |||

| 2006-07 | 250000 | 10.00% | 275000 |

| 2007-08 | 250000 | 10.00% | 5,77,500 |

| 2008-09 | 250000 | 10.00% | 9,10,250 |

| 2009-10 | 250000 | 10.00% | 12,76,275 |

| 2010-11 | 250000 | 10.00% | 16,78,903 |

| 2011-12 | 250000 | 10.00% | 21,21,793 |

| 2012-13 | 250000 | 10.00% | 26,08,972 |

| 2013-14 | 250000 | 10.00% | 31,44,869 |

| 2014-15 | 250000 | 10.00% | 73,04,798 |

As can be seen from the above illustration, saving only for availing tax deductions will not help to accumulate the required corpus needed for achieving a goal, as over a period of time inflation will increase the corpus amount considerably.

As against, if money is invested, keeping a goal in mind one is able to accumulate corpus sufficient enough to achieve the goal.

Again, if the same money is invested in Mutual Funds with moderate risk instead of Fixed Income products, much bigger corpus can be accumulated and that exceeds the amount required.

Tax savings investments under 80C/Tax Deductions which fall Under Section 80C of Income Tax Act:

Under section 80, a tax paying person is eligible for tax deductions of up to Rs. 1,50,000. Many people ending up spending more amount than actually required to invest in tax saving schemes without actually being aware whether they are properly utilising the limit of Section 80C.

Tax savings investments for senior citizens which takes care of their investment needs

For retirees, the retirement corpus should be such that their tax liability is taken care of along with the need of a regular flow of income which is enough to meet their expenses post retirement. And the income inflow should be enough as to accommodate their remaining life after retirement. A person generally retires at 58 or 60, while the average life expectancy could be 80.

The ideal for a retired person should be to build a retiree portfolio with a mix of fixed income and market-linked investments. Here are few investment options for the retired to provide for their monthly household expenses and also takes care of the tax part.

More on Post retirement investment strategies is available here https://dilzer.net/2016/07/29/post-retirement-investment-strategies/

How to utilise SWP option for effective and tax efficient retirement corpus distribution can be read https://dilzer.net/2012/05/16/systematic-withdrawal-option-a-tax-efficient-way-of-earning-retirement-inflow-benefits/

One should never invest in something which is not needed:

People have the general tendency to buy lots of unnecessary life insurance products just because the premiums payments give tax benefits. What they forget is to find out whether those policies serve their actual insurance needs or not.Investing a big amount of the hard-earned money on Endowment plans alone may not get onegood returns. Many taxpayers make the mistake of investing their entire eligible amount of Section 80 C in endowment plans and fully ignore other effective tax-saving schemes. People can invest in term plans too, which also qualify for tax deduction under Section 80 C if taking care of insurance needs is a criterion.

Checking the eligibility for Tax Exemption is a must:

Whether or not a person is eligible for tax exemption for a product is an important thing to find out before deciding on the product. For example, under Rajiv Gandhi Equity Savings Scheme tax benefits are available only for a first time equity investor.

The product features should be checked to find out whether it is at all eligible for tax deduction or not. For example, not all the mutual funds are eligible for tax deductions as per section 80C of Income Tax Act. One can claim tax benefits only on Equity –Linked Savings Scheme (ELSS).

Mode of payment while doing investment

Special attention with regard to mode of payment should be taken because in some cases, cash mode of payment are not considered for tax deduction. For example cash payment of health insurance premium is not acceptable for tax deduction. Donations where payment is made in cash and is in excess of Rs 10,000 is not allowed for tax deduction.

Debalina Roy Chowdhury

Dilzer Consultants

References

https://www.policybazaar.com/income-tax/section-80c-deductions/

https://www.policybazaar.com/income-tax/common-tax-saving-mistakes/

3 March 2017