Should you upgrade your house with increased income?

These days we have more money at our disposal. “How best can we utilize/invest this hard earned money?”. And one such dilemma could be deciding whether to upgrade our house? Will it prove to be a good option to use this extra money? Is it a good decision at this point of time? If yes, then shall we go for a high end villa or a 3BHK or 4BHK.? Or shall we invest in something else? It IS an adventure for sure. Because one wrong move can cost a lifetime.

Why do you want to make the move to a larger home?

If your family is starting to outgrow your current home, or if you believe that you would enjoy a better quality of life in a nicer home, then it might be worth considering making the move.

Most of the times the need for a larger home comes with an addition to the family, A BABY. The arrival of the new member surely needs more space – to play, walk, run around, creative activities and the list goes on. On the other hand the other reasons could be –

- Affordability: because with increase in income you feel you can afford a bigger and better home.

-

Luxury: Being in a good working position makes you feel that you should live lavishly. In a villa or luxurious apartment. A better quality of life and an experience in itself.

-

Parents decide to move in with you.

- You are getting married and you expect guests visiting you more often. Etc.

Are you ready to upgrade your house?

A bigger house or better neighborhood usually means more money.

People may be comfortable with their current mortgage payment, but can they handle a larger one? Also, a bigger home means more floors, rooms and outside areas to clean and maintain. There are costs associated with moving, and you may need to buy more furniture, How will that affect one’s budget? Will you have to give up certain expenses or cut back on certain “luxuries” like vacations or going out?

A look into whether one’s finances are in good shape, gives a better understanding of the affordability to go for a bigger house.

- Ideally debt-to-income ratio should not exceed beyond 36% of gross monthly income. At the max, as per financial advisers it can go upto 40%.

- Credit score (CIBIL):

Lenders will closely review your income, debts, assets and liabilities, to make sure you don’t exceed the maximum debt-to-income ratio. Keeping your credit score undamaged is a plus to change your dream into reality.

Considering your household income, debt sustainability and ability to handle the future expenses coming with a bigger home, it becomes clear whether a person is ready to make the move.

Buy first and then sell or sell first, then buy?

This is chicken – or – egg dilemma.

If you own your current home outright (meaning you don’t have a mortgage or any lien) or you have enough cash to cover the purchase of a new home without depending on the profit from selling your current home, then good for you.

But if you’re in a situation where you need to sell before you buy — unless you’re prepared to carry two mortgages. Hopefully you’ll make a sizable profit from the sale and can use it to cover the upfront expenses on your new home, including the closing costs, down payment and moving expenses. Let us now look at the different scenarios under this option:

Sell first, and then buy

This is perhaps the safest plan, but it calls for multiple moves. In this scenario,

- One needs to sell his/her existing home and complete the transaction before purchasing another home.

- After selling the home, the bulk of seller’s belongings are put in storage and they live in a temporary rental or,

- if possible, enter into a rent-back deal with home’s new owner(buyer).

The advantage of this method is that

- we know exactly how much you have in hand to spend on a new home,

- we don’t have to worry about temporary financing.

- Also, since there is no commitment waiting, we’ll be less tempted to drop the price or to take the first offer that is below the asking price.

The disadvantage is that it is a disruptive experience, and one could be displaced for a while if s/he is home-shopping for a long time.

Buy first, and then sell

This strategy minimizes disruption. This scenario works best if your first home is already paid off. You can move into your new place at your leisure and then take time to prepare your old home for sale.

But if the mortgage on the old home is still pending, there could be a major disadvantage. Depending on how fast your old home sells, you could be shouldering the burden of two mortgages for some time. You are also responsible for maintenance and security on the vacant home.

However, a variation of this plan is to buy a new home with the plan to rent out the old one for a year. This buys you some time with money coming in. You may also need to repair or renovate the home after it has served as a rental.

Buy and sell simultaneously

The trickiest bit in this scenario can be timing the financial burden (to arrange for a 20% or more down payment money for the new one).

- One option is bridge financing: Short-term(usually 12 months) loan advanced to cover the period between the termination of one loan and the start of another. It is arranged generally to complete a purchase (such as a new house) before the borrower receives payment from a sale (of the old house). Also called bridge finance, bridging loan, or gap financing. The existing home, in this case, is considered the collateral for the bridge loan, meaning that the loan amount is decided based on its sale value.

- The other options of raising funds can be to borrow from family and friends.

-

Or a short-term loan from a bank or other lending institution to span the time period between when you close on your new home and sell your old one. In actual sense it is called as a short-term home-equity loan, also known as a HELOC, a Home Equity Line of Credit, on your present house and using it as a down payment on your new house. You then repay the loan when you sell your first home.

{What is HELOC? : Home equity line of credit is more like a credit card. It facilitates the borrower to borrow in installments. Here the borrower is issued a cheque book or a credit card by the bank which s/he can use against her/his home’s equity to make purchases. S/he can borrow only a certain amount of loan money which s/he needs instead of borrowing and keeping the total lump sum amount. The interest rate in this type of loan starts building only when the person actually makes a purchase.}

Once you know you want to buy a bigger house, the question is “how big a house should you buy?”

Use this ready reckoner by Sanket Dhanorkar, ET Bureau.

With a considerable increase in your stream of income, how best can you choose to invest? What to choose – normal apartment, luxury apartment, high end apartment, villa, high end villa or plot?

This depends on what is the motive behind your investment. If you are looking to earn rental income, then villas and apartments should be your ideal choice. Investment in plots is a long term one. This asset appreciates many years down the line. So if you are willing to wait out the gestation period, then you can find a lot of plots in your preferred city and its suburbs. If you want to invest in apartments and villas then city localities should be preferred for luxury and mid-segment homes.

High end premium properties may it be apartment, penthouse or villa is a matter of pure luxury. Increasing number of ultra high net worth individuals means more demand for super luxury homes, which include penthouses and sprawling apartments.

The luxury homes segment is surpassing all expectations even though the Indian real estate market is not showing the expected growth.. As most Indians travel abroad regularly, they are exposed to a higher standard of living. Consequently, their expectations now extend beyond just a fancy address.

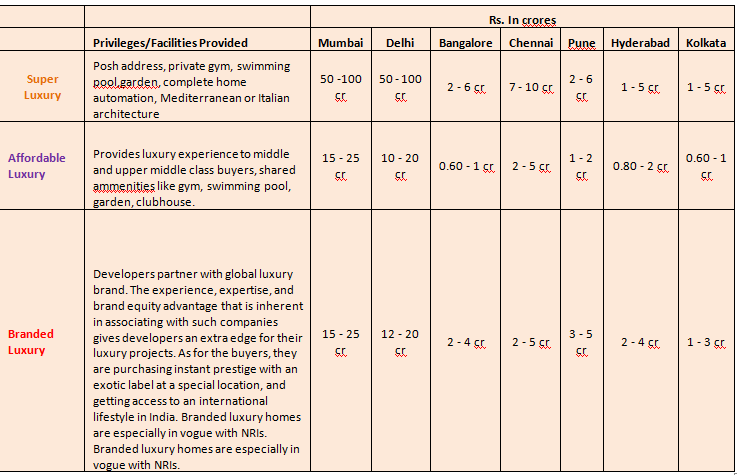

Here’s a ready chart showing the prices offered at different cities in India for different types of luxury homes.

Varsha Gaikwad

Content writer – Dilzer Consultants Pvt Ltd.

Sources:

http://articles.economictimes.indiatimes.com/2014-12-08/news/56839443_1_emi-home-loan-ready-reckoner