Transition To A Smooth Retirement

We all dream of a happy retirement phase when we can call it a day from our work and enjoy the sunrise with meditation or the sunset with a drink without a care in the world about money, etc. How many of us will actually be able to live the dream? India has a growing number of wealthy people. Many Indians also have wealth management strategies in place. But as per a report by Standard Chartered, only 32% of them feel that they will achieve more than half of their wealth goals. About 68% of people expect not to achieve even half of their wealth aspirations.

Retirement looms ahead for each of us. Financial planning is imperative to ensure that we do not outlive our finances. Yes, there can be unexpected situations but a good financial plan will support us to minimize the adverse effects of emergencies or financial mishaps.

How can we transition to a smooth retirement?

Understand your financial needs and your earning potential

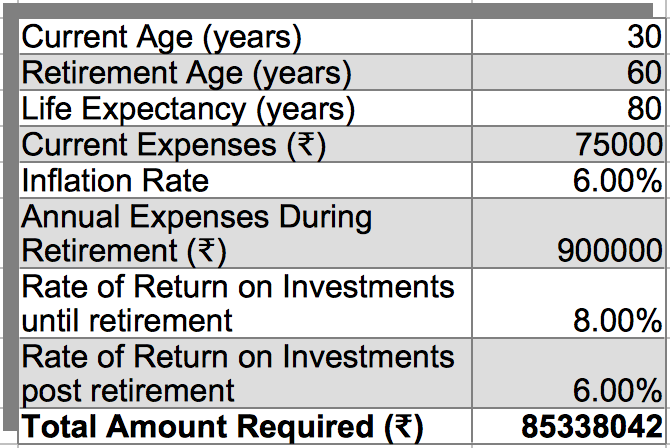

Estimate your financial needs for the retirement phase. Consider your current living expenses and retirement goals. Some people might want to go on luxury cruises and others might want to live in a palatial house in their hometown. Your living expenses will remain more or less similar to now. But you may not have a regular source of income. Here is an example of an estimate of financial needs for retirement -

Consider your current earnings, potential rise in income in the future, and assess realistically if your retirement goals are achievable. There has to be a parity between income, financial responsibilities, and dreams.

Earn and Save

Earn and Save

When you are working, you have to earn to your maximum potential possible. Do not squander your money on frivolous purchases. Set up a monthly savings target and ensure that you hit the bullseye on it. Experts consider a saving rate of 15% per year as ideal. But it varies from person to person depending on income, obligations, expenses, and dependents.

The earlier you save the better as the magic of compounding will work on your investments and both your returns and investments will earn money.

Build a Well-diversified Investment Portfolio

Invest your money in assets that can offer you the most optimum returns. Invest in a variety of assets that are of high-quality so that you diversify your risk and have the potential to earn the highest returns. Talk to your financial advisor to build an ideal investment portfolio that will cater to your investment ability, risk profile, and retirement goals.

Buy Adequate Insurance

Elderly people do not get health insurance easily or even if they get, it is not as comprehensive and the premium is higher. Purchase health insurance when you are young. If you have a family history of critical diseases, insure yourself against them. Unexpected medical emergencies can get covered by it, and your retirement kitty is not adversely affected.

Think Beyond Money

Retirement is not easy. Many get bored and others get depressed, Some people lose a sense of purpose. Do think of how you want to spend your retired days. Plan ahead in terms of activities and hobbies. It can be reviving an old hobby, volunteering for social service organizations, or spending time with your grandchildren. You can also work on a part-time basis or provide consulting services in your area of expertise. It will supplement your retirement fund.