Why are Insurance products inefficient investment options?

Indian Investors are not very clear about what insurance is, how is it different from investment and how they should best go about insuring themselves. We will discuss what insurance is and how it should be bought and then compare this to investment for better understanding.

The basic purpose of insurance is to cover the financial aspect of risk. The only logical kind of life insurance that makes sense is term insurance. In term insurance you are being insured against a risk that is insurable at a low cost and in case of a grievance the family receives the sum insured amount

Any other kind of insurance other than term insurance is actually an investment that is disguised as insurance and investment.

The basic problems associated with buying insurance other than term insurance are listed below:

Illiquid: Investments should always be liquid so that when you really need it, it is readily available to you.

However, the investment part of the life insurance policy

- Is locked in for a long duration of time.

- In addition, the investment part of insurance offers moderate returns, namely the cash value of the policy.

Investments like public provident fund and other tax-saving investments offer a far better deal in some other way, either in the form of tax exemptions, or in sovereign guarantees or in the relatively short period of lock-in and better returns and often a combination of these.

Lack of transparency:

Transparency should be followed in every kind of financial service, most of all in life insurance on which majority of people depend as their investment. Inefficiency, non performance in any kind of financial services are almost always due to lack of transparency.

However, in an attempt to increase transparency, IRDA introduced a guideline. Insurance products now need to offer customized illustration of non-guaranteed and guaranteed benefits that provide gross investment returns of 8% and 4%, respectively in the illustration shown to cliens. The benefits illustration should be part of the policy contract between policyholder and the agent. Prior to these guidelines, this was mandatory only for ULIPs. In addition, to improve transparency of corporate governance, all insurance companies are required to set up a “With Profit Committee” at their board level. The committee will be responsible for approving the asset mix, as well as the expense allocation and investment income for the fund.

Cost in form of commission:

The commissions received by insurance agents are more compared to the commissions received by agents dealing with mutual funds, Reserve Bank of India and other bonds and Post Office deposits get. They are generally around 15 per cent of first year premiums and 7.5 per cent in the second and 5 per cent from the third year onwards. In case of ULIP products the commission rates are disclosed as the last column of a benefits illustration. ULIPs usually charge expense ratio of between 15-25% in the first year, 7.5-10% in the second year and 1-2% third year to maturity. In addition there are policy administrative charges , mortality charges and Fund Management Charges. These expenses are probably the strongest argument against investing with an insurance company.

Why ULIP is not the best insurance product

When markets were in a downturn, many policyholders lost the market value and further costs reduced returns to the investor.IRDA made changes in the product proposition. It capped charges on them since September 2010. Even the fund management expenses had a fee cap. This was done to make the product more appealing.

The new ULIP guidelines that were made by the IRDA are:

- Lock in for Five Years and Premium Payment Term

- Increase in Minimum Sum Assured: The minimum sum assured multiple has been increased to 10 times for age at entry below 45 years and 7 times for age at entry above 45 years. At no time can the sum assured be less than 105 per cent of total premium paid including top ups. All top ups also must have life insurance cover built into them.

- Net Reduction in Yield for Every Year from Year 5

- Cap on Discontinuance Charge: IRDA has introduced a cap on surrender charge, now termed as policy discontinuance charge This allows life insurers to charge only a small penalty on early surrender of policy.

- Modifications in Unit Linked Pension Products : Partial withdrawals in Unit Linked Pension products will not be allowed. On maturity, one third of the corpus could be taken as lump sum and rest must be used for buying annuities. IRDA has also made it mandatory that all unit linked pension products must offer minimum guaranteed return which would be specified by IRDA from time to time.

Investors failed to understand the nature of the product. For instance, the premium one pays includes mortality charges for providing protection. The balance is invested in stock markets. This not only raised ambiguity around the product but also led to a fall in fund value when stock markets fell. Apart from Mortality charges, a few other charges which are included in the premium are :

- Policy administration charges for servicing of the policy

- Fund management charges which depend on the funds chosen by you.

- Premium allocation charges which are deducted upfront from your premium.

When investors saw their fund value declining in an insurance plan, they redeemed in fear as they were unaware of such eventuality. High charges further erased their capital.

With charges now being regulated, investors can draw some respite though. The bottom line is that both insurance and investment needs are separate. These needs depend upon individual client circumstances.

Why Whole Life Insurance should be avoided

Whole life insurance is often recommended, particularly to high income earners, as a guaranteed investment with some tax benefits. However it’s disadvantages are too many compared to its advantages. They are:

1) The insurance costs more.

2) The commission percentage for the first year’s premiums for agents are too high.

3) One can invest in bonds directly at a lesser cost instead of doing it through a middleman (insurance company)

4) Complexity favours the issuer . Whole life insurance products are sometimes so complex that only the actuaries are able to figure them out! This makes whole life insurance the worse deal ever for you.

5) Even when it works out fine, it takes a long time to give returns.

7) You are not adequately paid for the loss of liquidity.

Stocks, bonds, and mutual funds can generally be cashed out any day the market is open. You can change investments or use the money for living expenses without much problem. There are only two ways to get money out of a whole life insurance policy. The first is to surrender the policy and second by making the policy paid up. In either case, you lose out some money.

The ideal way to go about insurance is to calculate how much cover you need and then find a good, low-cost, term insurance which is just suitable for your life insurance needs.

Investment and insurance should not be mixed up!!

Illustration – Should insurance plans be invested for goal realisation?

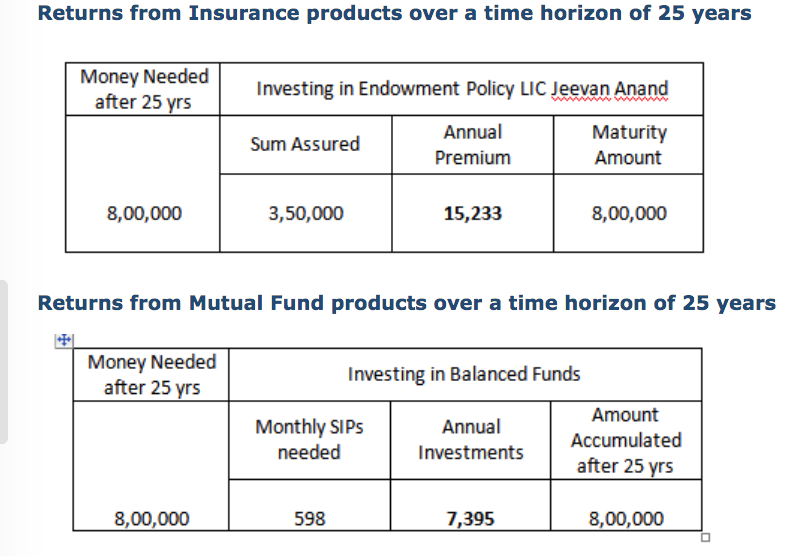

(Returns from Insurance products versus Mutual Fund products over a time horizon of 25 years)

Deduction from the above tables:

- If investing in Life Insurance product you are required to invest INR 15,233

- In fact , you actually are required to save less annually , around INR 7,395 if you are investing in Mutual Fund products.

- If we compare both the tables we can conclude that Additional Investments needed to be made every year if investing in Insurance products is INR 7,838.

Assumptions Note for both the tables:

Annual Return Assumed for Balanced Funds is 10% p.a.

The SIPs are calculated for a period of 25 yrs similar to that of Jeevan Anand policy.

Debalina Roy Chowdhury

Para Planner – Dilzer Consultants

Sources

https://www.valueresearchonline.com/story/h2_storyView.asp?str=23061

https://epolicy.sbilife.co.in/FAQ/e-Shield_faqs/Life_Insurance_India.html

http://www.lifeinscouncil.org/faqs/new-ulip-guidelines

28 October 2016