Why is planning for child education so important- What about inflation?

Child Education Planning ensures comprehensive financial planning for a child’s education and development needs by way of paying regular premiums or a lumpsum amount. At key education milestones of the child one can use this money partly or completely .

Why is planning for child education so important?

Parents nowadays are spending huge amount of money on the up-bringing of their child by opting for costly international schools, private engineering colleges, up-market dance academies, drawing institutes and a host of extracurricular activities. However in this process of upbringing the child the parents forget to plan and save for the child’s higher education goal.

Mentioned below are a few points as to why it is important to plan and save for a child’s higher education goals:

1. Education costs are increasing rapidly

The cost of education in India is increasing at a fast pace. Be it primary, secondary or higher education, parents are finding it increasingly difficult to cope up with the growing fee structure and other costs associated with education.

Education costs are inflating at an above-normal rate, and hence the returns on the child education fund need to outpace and take into account this inflation cost. Also, education fees tend to increase by more than the general rate of inflation and therefore, any effective plan needs to be give returns that exceed inflation.

According to rough estimates, on an annual basis the education inflation is about 10-12 percent. To cite an example of education inflation, the tuition fee for B. Tech Program in IIT is Rs 2 lakh per annum. If this is the amount of tuition fees, the total cost will be much higher. At an average inflation rate of 10%, a four-year engineering course that costs Rs 8 lakh today will cost around Rs 17 lakhs in another eight years’ time. By 2030, the same would cost more than Rs 30 lakhs.

The above is just an example of how the fees of undergraduate courses have increased. If we consider Post Graduate Management programmes, IIM Ahmedabad has increased the fees of its two-year post-graduate programmes, including food and agri-business management, for the batch of 2017-19 to Rs 21 lakhs. This is a 7.7% increase over last year’s fee which was Rs 19.5 lakhs. Such an increase marks back-to-back fee increases on the part of IIM Ahmedabad — it had hiked fees by 5.4% in the last year as well.

Thus it is evident that higher education costs have the highest inflation rates in India. Education is an expensive affair and if one did not plan well in advance, a person can fall short of the required corpus when the child is ready for college.

2. Education Loan is not a good option for a child’s future

While education loan can be a source for funding a child’s education, it is not really a sound option for the following reasons:

- If education loan is availed for graduation, the child may be forced to take up a job to pay up the loan even if he/she may want to go for higher studies (in case the parent is unable to pay the same).

- Availability of the loan is not uniform and depends on the institution, type of course the child chooses etc. Hence, loan may not be a very stable source of funding.

- Education loan is not a good loan. The rate of interestoffered by most of the banks is not cheap.

Given that loan is not a good funding option it is evident that one should plan well in advance for the child education goal rather than going for loans.

Taking bank loans for child education purpose should be but the last resort, and should be availed only if the plan was started late and investments were insufficient. The lesser time one has towards the goal, the costlier it can get.

3. Rise in foreign education options

The number of Indian students going abroad has been growing at a faster pace than before. With an annual growth rate of 17%, more and more Indian students are opting for the universities of developed counties like USA, Canada, Australia, Singapore, Europe etc.

Education cost in developed countries has also increased and there is an increased rhetoric to cut subsidies for foreign students too.

More so, if one is planning for overseas education then the expense also involves factors like the length of study, stay and the choice of country and university (A well known, top rated university usually will cost more). Added to this are expenses with regard to extracurricular activities, electronic gadgets and other related expenses.

Since the amount that a person has to accumulate for studies abroad is a large amount, there is a need for a proper education savings plan in place, and the earlier one starts the better.

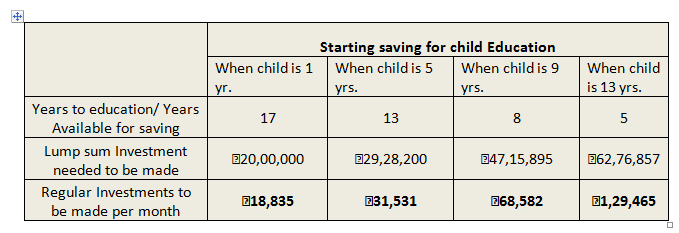

Start saving early for the Child’s education

| Assumptions in the analysis | |

| Yrs. Of education | 4 |

| Present Cost p.a. | ₹5,00,000 |

| Total Cost of Education | ₹20,00,000 |

| Inflation in Education | |

| Costs | 10% |

| Future costs | ₹1,01,08,941 |

| Investment Returns | 10% |

It is obvious from the above example that sooner a person starts saving for a child’s education, the less stressful it will be for one as the education year draws closer.

Conclusion

The above discussion makes it evident that starting early and planning well are important aspects of a child’s higher education plan. Enough research should be done to assign a fair value to this goal, before one begins to put aside the money.

Debalina Roy Chowdhury

Dilzer Consultants

Sources:

http://www.jagoinvestor.com/2011/02/financial-planning-child-education.html

http://www.finatoz.com/blog/2017/03/28/start-saving-early-your-childs-education/

http://www.livemint.com/Money/Y4yKUAoz95RFBwQeK4qLpJ/How-to-plan-for-your-childs-education.html